Screenshot

|

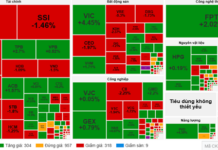

The expert from HSC states that the Vietnamese stock market has many participants, but it shares similarities with emerging and frontier markets, with 80-90% of individual investors.

The VN-Index has had a less positive performance in 2023 compared to the explosive growth in 2020-2021 and the strong influx of money.

“The current liquidity level is around 13,000 billion and has started to show signs of recovery. In recent sessions, it has reached around 20,000 billion. There has been improvement, but it still remains relatively weak compared to the period of 2020 and 2021,” he said.

According to Mr. Quy, individual investors play a significant role in determining whether the market will have opportunities to rise in the future, as this group is the main driving force behind the market’s support.

The expert also noted that individual investors have the characteristics of being psychologically vulnerable and speculative. Some investors have switched to safer investment channels such as banks, indicating that individual investors still lack confidence in the securities market. However, he sees this as an opportunity for the market.

“If in the coming period there is support from interest rate policies, positive changes in the economy, and especially foreign investors returning to net buying, that will still be the driving force for the market,” he said.

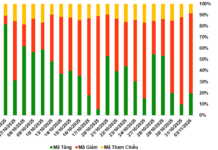

Mr. Quy also assessed that the potential for money flow in 2024 still exists, through analyzing the market sentiment indicators, especially considering the number of stock groups that have surpassed the 50 to 200-day moving averages. The indicator reflects the correlation between the strength of the money flow and the breadth of the market, to see the expectations of investors in the medium and long term.

Screenshot

|

He pointed out that from July to September 2023, the peak of the green line on the chart reached 70-80%, meaning that the number of listed stocks on the market accounted for 90% above the MA200 line, indicating a very strong amount of money, large enough to create breadth with a very strong increase of the VN-Index, marking the highest wave in 2023, reaching 1,250 points.

“However, at the moment, the green line is low, maintaining around 50-60%, showing that the current amount of money is at the market’s equivalent level and there are signs of cooling down, which is suitable for the current situation of the market,” he analyzed.

The expert also observed that the recent situation of the Vietnamese market did not see many new stocks, especially those with large market caps to attract large money flows, especially foreign investors.

In addition, when there are signs of a big wave starting, the banking sector usually appears, followed by a gradual shift to the Mid Cap group.

The HSC analyst also noted that in the past year and recently, no significant money flow has been seen into the real estate group, accounting for about 30-40% of the market’s capitalization. “If there is a supplement of money flow here, it will expand the market and increase its height in 2024,” he said.

According to Mr. Quy, the level of margin utilization in the market is also an indicator of the money flow in the stock market. He has noticed a coincidence when the VN-Index reaches its peak, it falls into periods where margin in the market is tight, or the margin lending capacity of brokerage firms on the market reaches its limit.

Screenshot

|

The current money flow is still weak, while individual investors account for a high proportion of the market’s trading value. When there is a shortage of funds, combined with tight margin conditions, the buying pressure gradually weakens and the probability of forming a peak is very high.

Currently, the margin utilization level of investors trading on the market is at a high level, equivalent to the peak of the index (VN-Index reached 1,500 points), while the index is only at 1,200 points. The reason is that during the 2020-2021 period, brokerage firms were determined in capital raising activities, thanks to this margin issuance, the main group of investors (individuals) received support in terms of money flow, so although the margin is high (equivalent to the period when the VN-Index was at 1,500 points), the margin lending capacity is still large. Therefore, the risk factor of margin has also decreased.

Based on the analysis of these factors, the HSC expert concluded, “There is still a lot of potential for money flow growth in 2024.”

Kha Nguyen