According to statistics from the General Department of Customs, Vietnam’s wood and wood product exports in January 2024 reached nearly 1.47 billion USD, a 9.7% increase compared to the previous month and a 2% increase compared to December 2022. Compared to the same period in 2023, exports increased by 83.1%. This is the only item in the agricultural, forestry and fishery sector with exports exceeding 1 billion USD in the first month of 2024, accounting for 29% of the total agricultural exports.

Of which, the export value of wood products reached over 1 billion USD, an increase of 107.5% compared to January 2023.

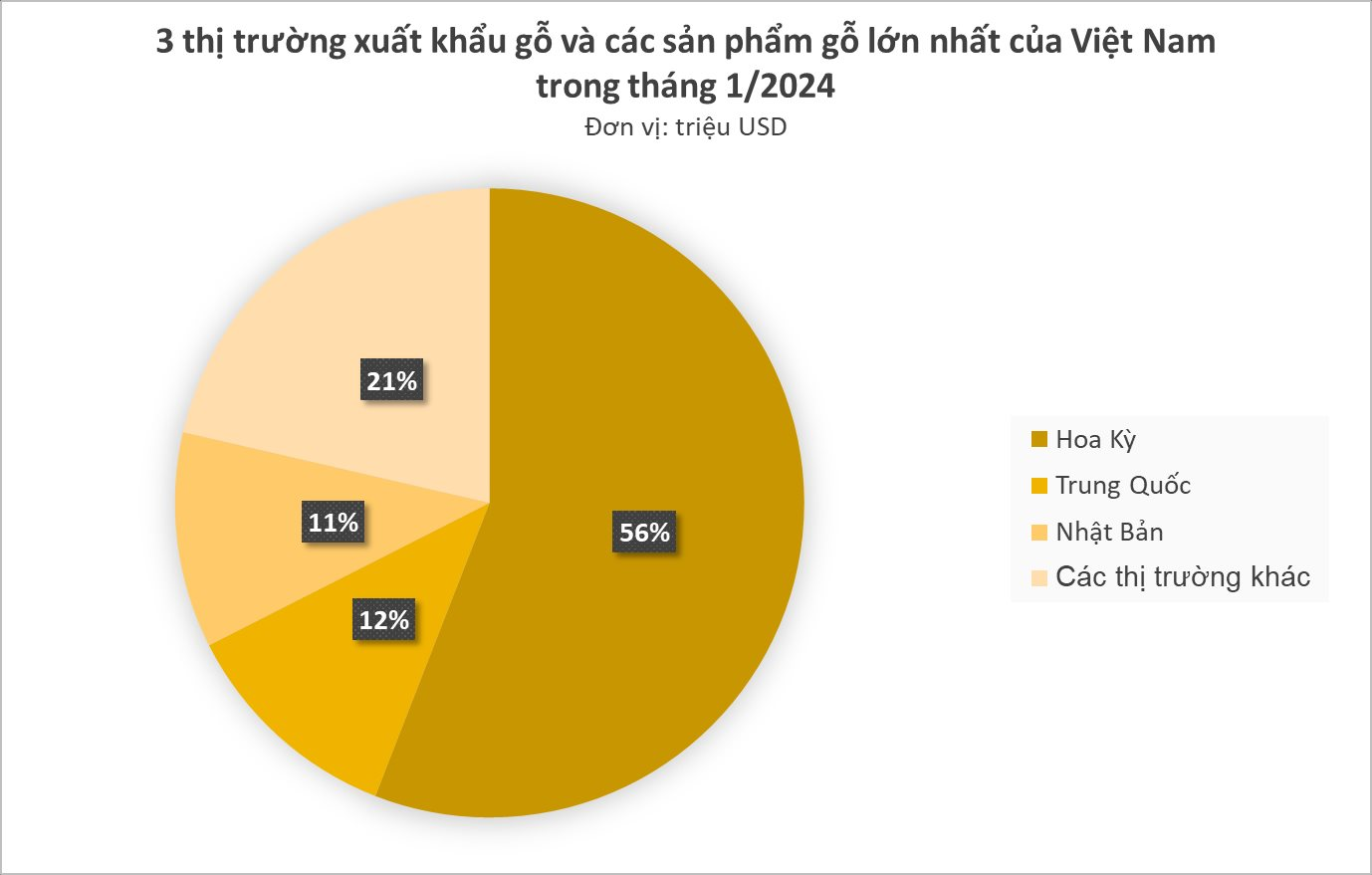

The United States, China, Japan and South Korea are the 4 main export markets for Vietnam’s wood and wood product industry. In 2023, these markets accounted for 85% of the total export turnover of the entire wood and wood product industry of Vietnam.

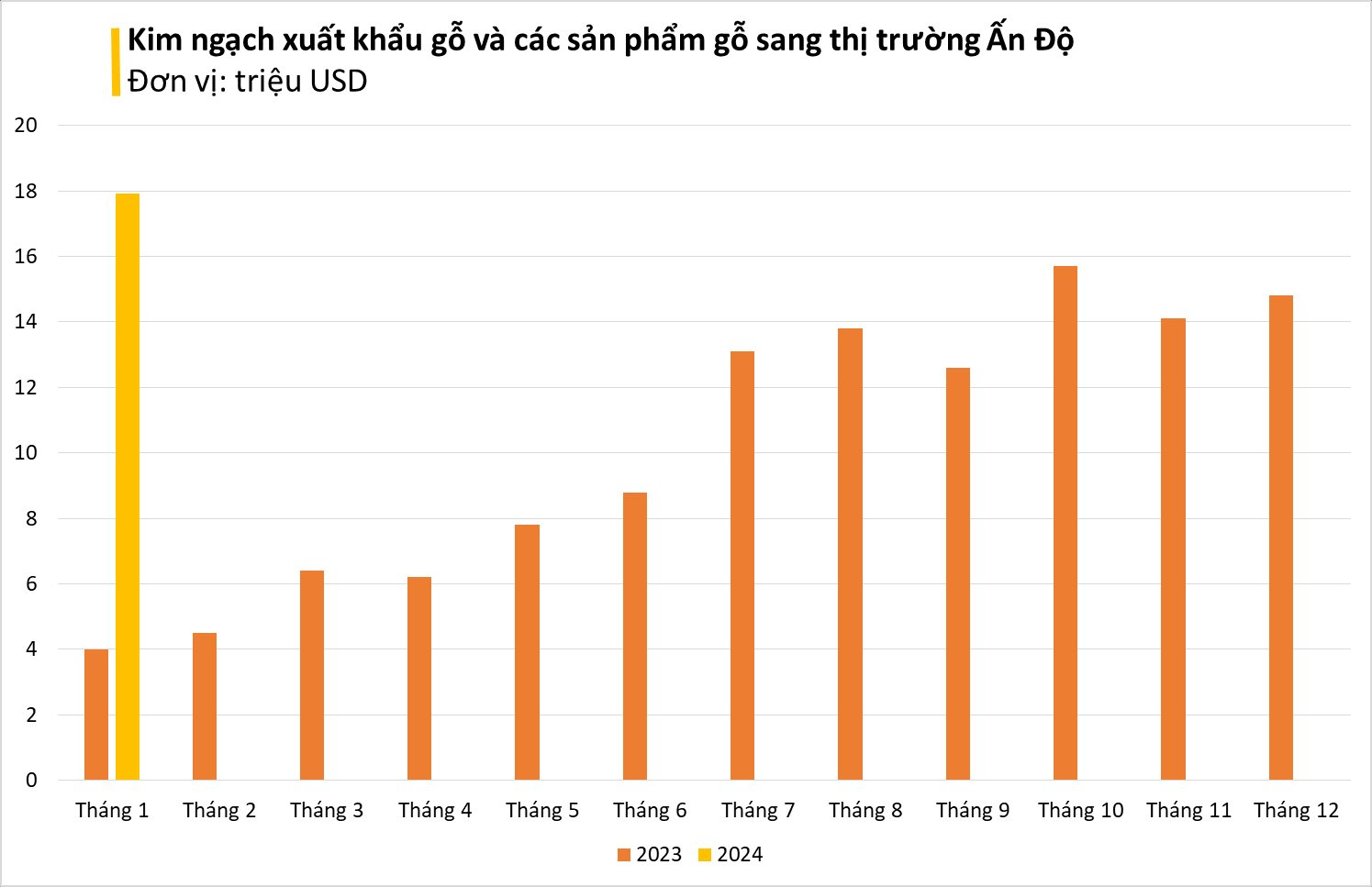

Notably, India is the fastest growing import market.

In particular, in January 2024, wood and wood product exports to this market reached over 17.9 million USD, an increase of 21.2% compared to the previous month, an impressive increase of 347% compared to the same period in 2023, accounting for 1.22% of the total export turnover.

With a population of over 1.4 billion people, India’s interior and design industry is booming due to a developing real estate market, increasing population, rising income and ongoing urbanization.

With a total market size of 41 billion USD, India is the fourth largest consumer of furniture in the world. Home sales in India in the 2022-2023 fiscal year were 36% higher than the previous fiscal year.

Meanwhile, the hotel industry is also experiencing strong growth, with an expected addition of 12,000 rooms next year and attracting about 2.3 billion USD in investment by 2028.

Although earning nearly 1.5 billion USD in the first month of 2024, Vietnam’s wood industry is also facing some issues that directly affect its sustainability. These include risks regarding imported wood materials, EU forest protection regulations, and low-carbon emission requirements for wood products. In addition, the Red Sea conflict has led some shipping companies to announce the suspension of transportation or changes in schedules, increasing transportation costs.

Currently, freight rates to the 2 largest markets for wood exports, the US and Europe, are disrupted, making it difficult to meet orders in a timely manner. Disrupted transportation has led to increased freight rates, particularly to the US where freight rates are over 4,000 USD/container, causing difficulties and cost pressures for wood exporters.

In 2024, the forestry sector aims to achieve wood and wood product exports of 17.5 billion USD. If successful, this would be a 21% increase compared to 2023.