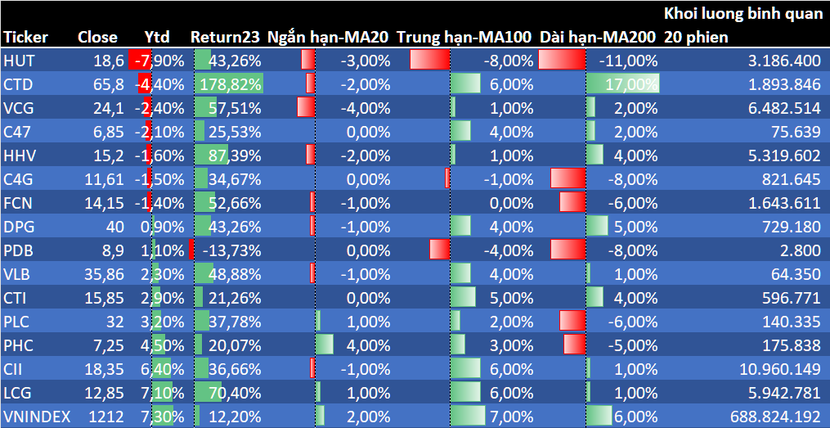

According to the record after the trading session on February 23, VN-Index “dropped” 15.31 points, equivalent to a 1.25% decrease. However, many stocks in the Construction Investment group such as LCG (-4.8%), CTD (-4.5%), CII (-4.4%), FCN (-3.7%) recorded deeper declines than the index.

If we look further from the beginning of 2024 until the end of the February 23 session, the performance of Construction or Building Materials stocks mostly still lags behind the VN-Index.

The best-performing stock in the group is LCG (+7.1%), but its performance since the beginning of 2024 is weaker than the VN-Index.

In fact, the business results of Construction companies have not provided encouragement to investors who are waiting for the wave of Infrastructure Investment stocks.

In particular, only HHV stands out by exceeding both revenue and profit targets. HHV’s consolidated revenue exceeded the plan by 8%, reaching VND 2,686 billion. Profit exceeded the plan by 7%, reaching VND 362 billion.

Meanwhile, many companies have not been able to achieve their profit targets. Specifically, LCG achieved 80% of the profit plan, DPG achieved 73%, CTD achieved 69%, C4G achieved 46%, VCG achieved 40%, FCN achieved 7.9%.

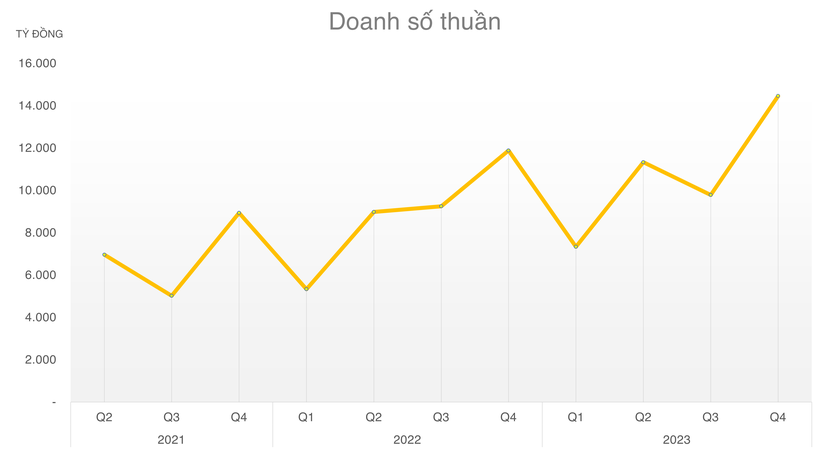

However, it is necessary to acknowledge the efforts of the Government in disbursing funds in late 2023, as well as the urgency for companies to increase their workload as much as possible to achieve financial targets for the year.

According to the consolidated data from 7 companies (C4G, CTD, DPG, FCN, HHV, LCG, VCG), the total net revenue in Q4/2023 reached over VND 14,450 billion, the highest level in many quarters.

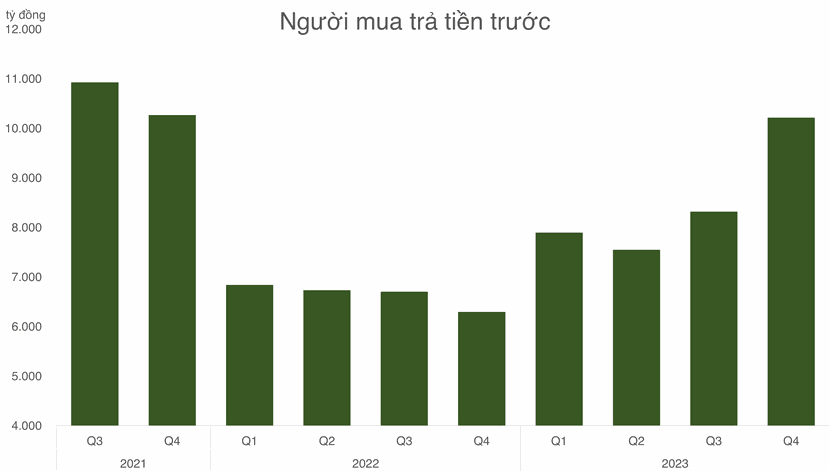

In addition to payments, many companies have received significant advances from buyers in Q4/2023. These include FCN (+VND 920 billion), LCG and VCG both received more than VND 700 billion, and DPG received more than VND 200 billion in the past quarter.

According to statistics, the total value of prepayments at 7 construction companies reached VND 10,220 billion, the highest level in 8 quarters.

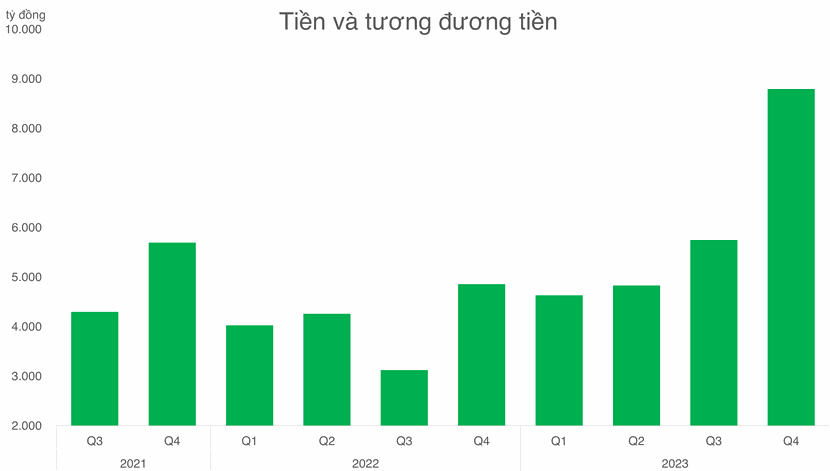

The total cash balance of the 7 companies also increased sharply to nearly VND 8,800 billion. LCG recorded a sharp increase in cash to VND 670 billion, 8.5 times higher than in Q3/2023.

Meanwhile, CTD holds the highest cash and cash equivalents (over VND 2,800 billion). Next is VCG with cash of VND 2,282 billion, an increase of nearly 80% compared to Q3/2023.

This will be a very important counterpart capital source to help companies have additional financial capacity and accelerate the construction progress in the coming time.

According to the statistics of Mirae Asset Vietnam, listed companies have won more projects in the second half of 2023. VCG (VND 68 trillion) and C4G (VND 24 trillion) top the total value of winning bids in 2023.

2024 will still be a year when the Government strongly disburses investment in infrastructure, so companies will receive new contracts. In the spring meeting of the Year of the Tiger, Prime Minister Pham Minh Chinh set a target for the country to allocate VND 657,000 billion for investment, mainly in transportation infrastructure, and strive for the disbursement rate to reach at least 95%.