“In my opinion, the presence of any foreign F&B brand in Vietnam, regardless of financial strength and operational capacity, will to some extent have an impact on domestic brands, whether directly or indirectly,” said expert Brian Dang – Founder of the F&B training and consulting center – commenting on the presence of Cotti Coffee in Vietnam.

Although it just opened its first store in October 2022, by the end of 2023, Cotti Coffee already had over 6,000 stores in China and is the fourth largest coffee chain in the world. The two Founders of Cotti Coffee are also part of the founding team of Luckin Coffee – the largest coffee chain in China with over 13,000 locations.

Highlands Coffee, The Coffee House, Phuc Long… should they be worried?

After succeeding domestically, in August 2023, Cotti Coffee announced its global expansion strategy and opened its first overseas store in Gangnam, Seoul. To date, this Chinese brand has a presence in many places such as Korea, Japan, Canada, Indonesia, Malaysia, Thailand, and Vietnam.

According to the forecast by Momentum Works, 2024 will be a year of continued expansion of Chinese F&B brands in Southeast Asia. The presence of Cotti Coffee in Vietnam is part of this trend. In December 2023, Cotti Coffee “made its debut” with 3 consecutive stores in Ho Chi Minh City. Shortly after, 2 branches were opened in Hanoi.

Expert Brian Dang points out that the target customer base that Cotti Coffee is aiming for is young people, with the aim of building a new coffee product range for this group.

“Iced coffee, milk coffee, and coffee with condensed milk will still remain popular over the years, but there will be updates with products that contain less coffee, such as fruit-flavored coffee, coffee-based drinks, lattes… This is seen as a future trend among Vietnamese youth,” the analyst said.

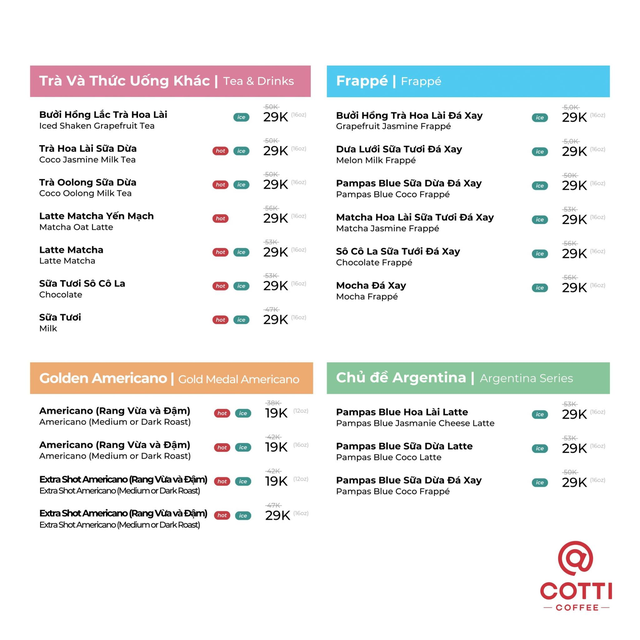

Looking at Cotti Coffee’s menu, this strategy is evident. Alongside familiar coffee types, there are also variations, including tea and coffee products with many flavors that young people love. During the opening period, Cotti Coffee approached customers by offering discounted prices for the entire menu: coffee starts at 19,000 VND, and milk tea starts at 29,000 VND. The most expensive item is only 41,000 VND.

Discounted menu during Cotti Coffee’s opening period.

Regarding the youthful and innovative direction of Cotti Coffee, Brian Dang believes this is a challenge for Chinese brands, but if successful, it has the potential to hinder the development of existing major chains. The reason is that the target customer base of coffee brands is also becoming younger, in order to adapt to the shift in the main consumer generation.

However, for strong Vietnamese chains such as Highlands Coffee, The Coffee House, and Phuc Long, the expert believes there is no need to be wary of Cotti Coffee.

“Instead, they may study the product range of Cotti Coffee and monitor the brand’s development in the Vietnamese market to make appropriate and timely preparations for the future,” Brian shared.

The key point that makes Cotti Coffee less likely to grow as fast as Mixue

The presence of Cotti Coffee in Vietnam brings to mind Mixue – a brand also from China that specializes in ice cream and milk tea products.

After opening tens of thousands of stores in its home country, Mixue made its international debut in Hanoi in 2018. By mid-April 2023, the “king” of affordable ice cream and milk tea announced reaching the milestone of 1,000 stores in Vietnam. The white snowman logo on a red background becomes familiar not only in big cities but also in many other locations.

It is easy to see the similarities between the strategies of Mixue and Cotti Coffee. Thanks to the support of large corporations with strong supply chains, good operational processes, and stable product and service experiences, both brands have expanded rapidly through the franchise model.

“However, coffee is more challenging than milk tea in terms of market penetration for brand explosion. Therefore, the development speed of Cotti Coffee will not be as fast as that of Mixue in Vietnam”, the expert commented.

This viewpoint is similar to the perspective of Vũ Trường Giang, Founder of Ka Coffee – a brand established in 2020 with 5 stores in Hanoi and Ho Chi Minh City.

“I think Mixue’s model will still perform well in 2024, and limitations such as stores being too close together can be gradually adjusted. However, in the coffee industry, I don’t think applying that model is as easy as with milk tea

In terms of coffee, Vietnamese people have higher standards. The demand for going to a coffee shop is more about the experience rather than just buying a drink to take home. Looking at online sales, if there are 10 orders, milk tea may account for 7 orders, and coffee may only make up 2-3 orders,” analysis by the owner of Ka Coffee in the special episode of the Chapter 0 podcast produced by Rising Vietnam.

Summing up, Brian believes that Chinese F&B brands operate systematically and have clear product strategies, so their entry into the Southeast Asian market will threaten domestic brands. Not to mention the impact of the economic downturn, the wave of investment shifting from other industries to F&B has made the market more challenging than before.

“Therefore, not only because of the presence of Chinese brands, Vietnamese shop owners have already had to upgrade and prepare better to increase competitiveness. Specifically, they need to focus more on the service aspect (customer care) and product development (R&D). In addition, those planning to open new shops in the period from 2023 need to build a clear development strategy for products, concepts, marketing, and “rigid” operations in order to be competitive in the current context,” Brian concluded.