Illustration photo

According to preliminary statistics from the General Department of Customs, in January 2024, our country exported 180,221 tons of fertilizer and earned over 72 million USD, up 41.7% in volume and 14% in value compared to the same period in 2023. The average export price reached 404 USD/ton, a decrease of 14.5% compared to January 2023.

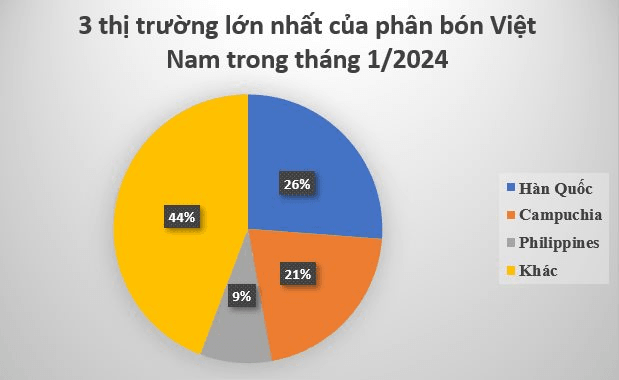

In recent years, Cambodia has always been the largest customer of Vietnamese fertilizer. At the end of 2023, the neighboring market spent over 246 million USD to import Vietnamese fertilizer, accounting for 38% of the total. However, in January of this year, South Korea unexpectedly became the largest customer of Vietnamese fertilizer.

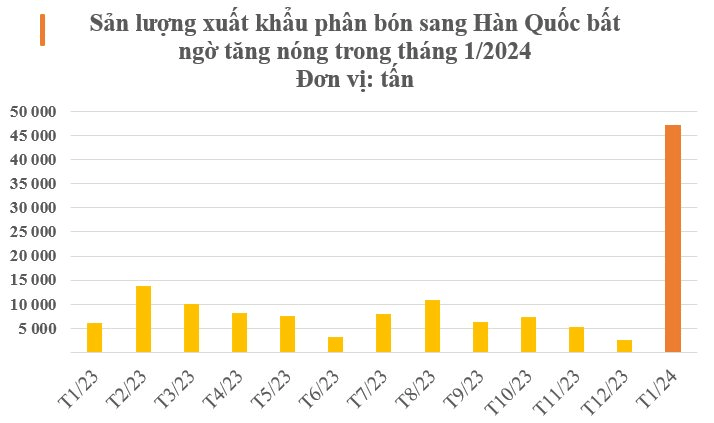

Specifically, in the first month, our country exported 47,206 tons of fertilizer to South Korea, equivalent to a value of over 19.3 million USD, an increase of 984% in volume and 1,074% in value compared to January 2023. Compared to the previous month, the output and value also increased significantly with an increase in volume of 63% and an increase in value of 61%. In the whole year 2023, our country exported 89,190 tons of fertilizer to South Korea with a value of over 65.4 million USD, so the output in January has exceeded half of the total output of 2023.

The average export price of fertilizer to South Korea reached 410 USD/ton, an increase of 8% compared to the same period last year.

Cambodia became the second largest customer of Vietnamese fertilizer with 37,782 tons, worth over 16 million USD, an increase of 13.6% in output but a decrease of 2% in value compared to the same period last year. The average export price reached 425 USD/ton, a sharp decrease of 57.8% in volume and 58.2% in value compared to December 2023.

The Philippine market ranks third with 15,558 tons, equivalent to 7.2 million USD, an increase of 293.3% in volume and 256.9% in value but a decrease of 9.3% in price compared to December 2023.

Ammonium phosphate is the most important fertilizer product in the world, accounting for 56% of global consumption from 2015 to 2022. Nitrogen and potassium fertilizers account for 24% and 19% respectively of total fertilizer consumption during the same period. According to IFA’s forecast, global nitrogen fertilizer production capacity will grow by 9%, from 156.9 million tons in 2022 to 170.7 million tons in 2027.

However, in 2024, experts predict that fertilizer supply sources will become increasingly scarce as the world’s two major suppliers, China and Russia, restrict exports. This could lead to a slight increase in fertilizer prices in 2024 compared to previous years.

Specifically, Russia has extended its policy of limiting fertilizer exports until May to protect the domestic market, while China continues to restrict urea exports to ensure domestic supply and stabilize prices. These are two important countries for the global fertilizer industry, with Russia accounting for 15% of production and China accounting for 1/3 of global nitrogen fertilizer supply. Therefore, any significant reduction in export volume from China threatens to strain supply and push up global fertilizer prices.

In the domestic market, experts forecast that fertilizer consumption in 2024 will increase slowly compared to 2023. In addition, the shortage of supply and the increasing global fertilizer prices could directly affect the domestic market and production activities as the fertilizer used in our country is mainly imported from abroad.