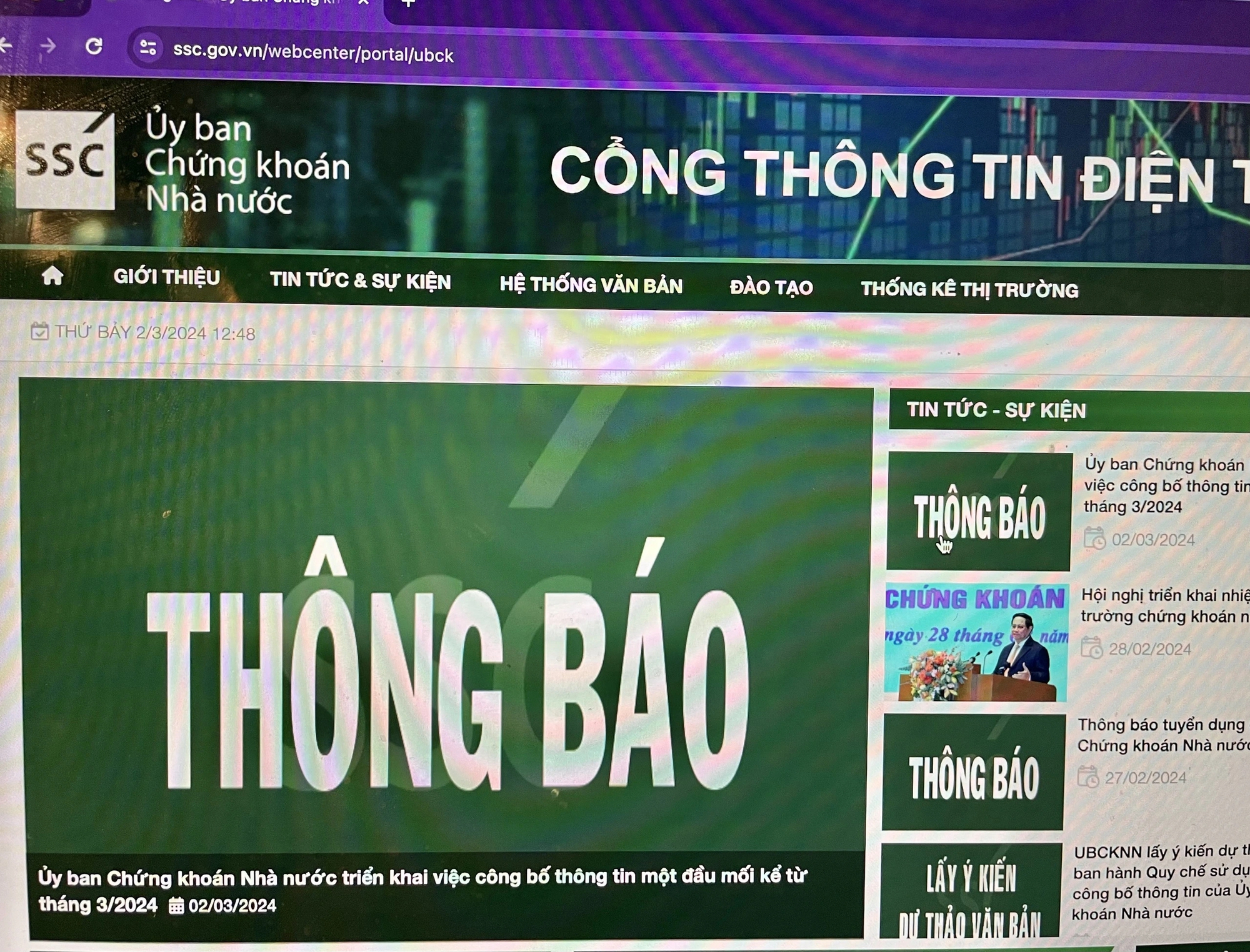

The State Securities Commission (SSC) announces that from March 8, this agency will officially operate the information disclosure system through a centralized point of contact for listed organizations and trading registration on the stock exchange.

Initially, it will be applied to listed organizations and trading registration on the Hanoi Stock Exchange (HNX).

Explaining the new regulation, the SSC stated that currently, listed organizations and trading registration on stock exchanges fulfill the disclosure obligations on the SSC system as specified in Circular No. 96/2020/TT-BTC dated November 16, 2020 of the Ministry of Finance, and at the same time, they must submit reports to the stock exchange where the company’s shares are listed and traded.

Therefore, to reduce the reporting burden, the SSC has implemented technological solutions to unify a reporting point for listed organizations and trading registration on stock exchanges.

Information disclosed on the website of the SSC

Until now, the reporting and disclosure system through HNX’s central point of contact is ready to be put into operation and will be applied first to 321 listed companies and 869 registered companies

After the implementation process at HNX, the SSC will continue to implement the centralized information disclosure for listed companies on the Ho Chi Minh City Stock Exchange (HoSE).

The operation of the reporting and disclosure system through a centralized point of contact is one of the SSC’s solutions to reduce administrative procedures, reduce costs for businesses, increase the effectiveness and timeliness of information disclosure, and create favorable conditions and support for listed organizations and trading registration on stock exchanges in fulfilling their reporting obligations in the securities market.