In the summer of 2021, when the world’s largest cryptocurrency fell to $31,500 USD, Đăng Khoa from Ho Chi Minh City poured in more than 20 million VND to “try out” Bitcoin. After a week, Bitcoin rose nearly 13%, and Khoa sold it for a profit of over 2 million VND. From then on, he became interested in this new type of asset. He decided to spend time learning about trading techniques and studying various indicators such as RSI to detect overbought or oversold conditions, SMA to determine price trends, and Bollinger Bands to measure market volatility…

By the end of July 2021, the price of Bitcoin dropped below $30,000 USD. It was also the time when Khoa re-entered the market with a capital of over 100 million VND. During that time, Bitcoin could fluctuate more than 10% in a single day. Although not every trade was successful, he still made several million VND profit in a single day.

“I called it the ‘get rich overnight’ phase, and I was enticed by Bitcoin’s high volatility,” Khoa recalled.

Later, this young investor withdrew all his cryptocurrency to limit debt when he bought an apartment in early September 2021. Staying out of the cryptocurrency market during the “crypto winter,” Khoa returned in 2023 but gradually became disillusioned because, in his opinion, the “enticing factor” of Bitcoin (i.e., high volatility) was no longer present.

He realized that Bitcoin had “matured.” Despite its upward trend, the phenomenon of “getting rich overnight” was almost non-existent. Even the continuous waves that occurred from the beginning of the year until now, which caused Bitcoin to increase by more than 60%, did not excite Khoa and the investors he knew.

They were allocating funds to invest in other cryptocurrencies. In the first half of the year, Khoa mainly traded Cosmos and Optimism. For example, with Optimism, Khoa made a profit of over 4-5 million VND overnight when he invested 40 million VND on the evening of March 2 and quickly sold it the next morning when the price reached nearly $4.3 per unit. In addition, with hopes of similar ETF funds for Ether being approved, Khoa also allocated about 30% of his capital to hold a larger investment in the second-largest cryptocurrency.

Not only Khoa, but many other investors are also shifting their money from Bitcoin to other asset classes. Data from FxEmpire analyzing capital flows in the derivatives market in the last 10 trading days of February showed that money was flowing out of the world’s largest cryptocurrency and into alternative coins (altcoins), with Ether being the standout.

“Investors are leaving the Bitcoin market to reinvest their profits in Ether,” the platform noted.

A recent report from market analysis company Glassnode examined a lot of data on liquidity, capital flows, and various metrics, indicating that the recent uptrend has created a shift in capital towards altcoins. The altcoin index from this company shows better growth and more sustainable signs, mainly focusing on assets with high market capitalization.

Bitcoin is famous for its high volatility. For many years, investors viewed it as a feature rather than a flaw because it could generate significant and immediate profits. However, recently, according to Business Insider, the volatility of cryptocurrency has become more similar to that of traditional assets and is “much more boring.”

According to data from market analysis platform DataTrek Research, Bitcoin’s long-term volatility used to be three times higher than the S&P 500 index, which typically fluctuates around 1% daily in both directions. Since September 2022, Bitcoin’s volatility has been below average. Even the recent launch of ETF funds did not lead to a significant price increase.

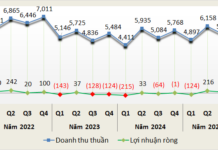

The chart below displays the 100-day rolling standard deviation of Bitcoin returns from 2015 to the present. The rolling standard deviation indicates the level of market price dispersion relative to the average price. A higher standard deviation indicates greater price volatility, and vice versa.

Bitcoin is currently experiencing lower than average volatility since late 2022. Source: DataTrek Research |

One noticeable point is that in the past, Bitcoin tended to reach new highs and lows during periods of above-average volatility. For example, from December 2017 to March 2019, the asset reached a record high of $19,000 USD and dropped to $8,000 USD. Other events in the past few years also had similar fluctuations. On the other hand, stocks tend to reach new lows during periods of below-average volatility but reach new highs during low volatility periods.

Data from DataTrek Research shows that Bitcoin has been more stable than usual over the past 18 months, although it still fluctuates twice as much as large-cap U.S. stocks. “The increased interest from institutions may reduce the daily price volatility of Bitcoin. In simple terms, this cryptocurrency will eventually mature,” the DataTrek Research team commented.

The stability of Bitcoin is also reflected in the recent uptrend, which reached a record high of $69,200 USD. The price was considered “feverish” from early February until now, but the daily price range was only around $1,000-$2,000 USD. In many sessions, the price chart was almost flat, with only a few hundred dollars difference between the highest and lowest price of the day.

The most volatile period in the market occurred from the evening of March 5 to the early morning of March 6, when Bitcoin’s price dropped more than 14% in just a few hours. On social media platforms discussing cryptocurrency, many investors complained that Bitcoin’s price increase was slow but its decline was too fast.

Meanwhile, during the late 2021 uptrend, Bitcoin fluctuated by $3,000-$4,000 USD per day for two months from October to November 2021. There were sessions with a difference of nearly $6,000 USD between the highest and lowest price of the day. After reaching a near $68,800 USD peak, Bitcoin also experienced a drop of only 5.5%.

Hồ Quốc Tuấn, a Senior Lecturer at the University of Bristol (UK), believes that Bitcoin’s recent volatility made many people think that the cryptocurrency was skyrocketing. However, in reality, Bitcoin has become much more stable.

“It is becoming increasingly difficult for investors to get rich and expect prices to surge from $3,000 USD – the time some Bitcoin funds currently open like Grayscale – to $60,000 USD as before,” Tuấn said.

On the other hand, the new characteristics of Bitcoin attract funds from investors who prefer stability. As a consequence, this cryptocurrency becomes less volatile, and price fluctuations occur more sequentially.

“Sooner or later, hot money will flow into other channels, but what it will be is still uncertain,” this expert expressed his opinion.

Tiểu Gu