Many Positive Signs for the Banking Industry in 2024

After a challenging year in 2023, the favorable macroeconomic foundation is expected to be a launching pad for the recovery of the banking industry in 2024. Speaking at the C2C conference with the theme “Prospects for the Banking Industry in 2024 from the Perspective of Techcombank” organized by Ho Chi Minh Securities Corporation (HSC), Ms. Pham Lien Ha – Director of Financial Services Research assessed that the banking industry in 2024 has many favorable factors but short-term risks are still inherent.

The positive factors come from the system liquidity maintaining stability with low-interest rates, economic recovery from the 4th quarter of 2023, and GDP in 2024 expected to maintain positive growth of over 6%. On the other hand, the conditions to maintain the looser monetary policy are more favorable, in the context of inflation being under control and pressure on the VND exchange rate decreasing, and some supportive policies such as Circular 02 on maintaining the debt structure group can be extended, and Circular 16 on trading TPDN of commercial banks will be amended.

From the above favorable factors, HSC experts expect credit demand to recover, helping credit growth to perform better in 2024. The growth momentum in the first half of the year may come from public investment, import-export activities, or FDI customer groups. Although somewhat slower, individual customer demand for consumption and investment will recover strongly in the second half of the year.

Regarding the Net Interest Margin (NIM) ratio, after a decrease of an average of 50 basis points in 2023, the expert expects a slight recovery of about 20-30 basis points. For fee-based activities, there will also be certain growth compared to last year, with a recovery in the bancassurance segment.

Although asset quality improved in the 4th quarter with a reduction in bad debt, HSC experts note that this is still a concern. The reason is that the entire system’s bad debt at the end of 2023 is still at a high level of about 4.8-4.9%, although more than half of it comes from SCB Bank, it can still be a bottleneck of the economy if not handled. On the other hand, bad debt of the top 14 banks, including debts being restructured according to Circular 02, is currently at a relatively high level.

“However, with supportive policies continuing to be maintained in 2024 and the recovery and growth of the economy as well as credit growth, the relative scale of bad debt as well as provisioning pressure remains under the control of banks and is likely to show slight improvement,” Ms. Ha commented.

With the above views and forecasts, the expert estimates that the profit growth of the top 14 banks in the industry will reach 20-21% in 2024, higher than the 5.5% profit growth in 2023.

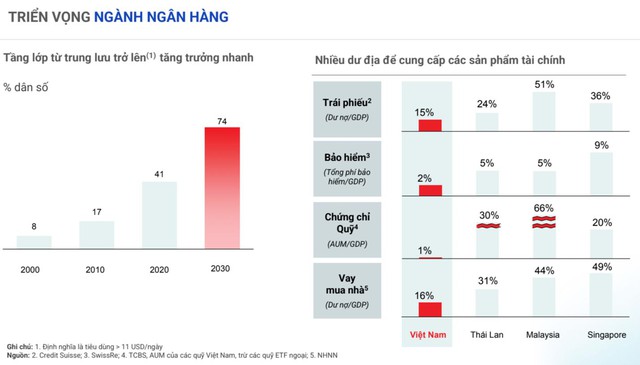

Similarly, Mr. Phung Quang Hung – Deputy General Director of the Corporate and Institutional Banking Division of Techcombank also provided a positive outlook for the banking industry in 2024. The proportion of the population belonging to the middle class and above is increasing rapidly and may continue to increase significantly in the coming years. This shows that there is still considerable potential to provide financial products, thereby expecting a continuous growth in total financial demand in 2024.

With great potential while still being attractively valued, the banking stock group is expected to attract strong capital inflows in 2024. With a fairly strong price increase in the first 2 months of the year, Ms. Pham Lien Ha believes that the recovery prospects of the banking industry have been partially reflected in the valuation. Currently, the projected P/B ratio for the top 14 banks is at 1.25 times, higher than the 1.05 times at the end of 2023 but still lower than the long-term average.

To choose banking stocks, HSC experts believe that several factors need to be considered such as industry prospects, fundamental platform, position, and the unique story of each bank, as well as the overall valuation of the industry and that bank. A typical example among the banks analyzed by HSC is the Vietnam Technological and Commercial Joint Stock Bank (TCB) with an attractive long-term story and strong recovery in 2024.

Four Special Advantages of Techcombank

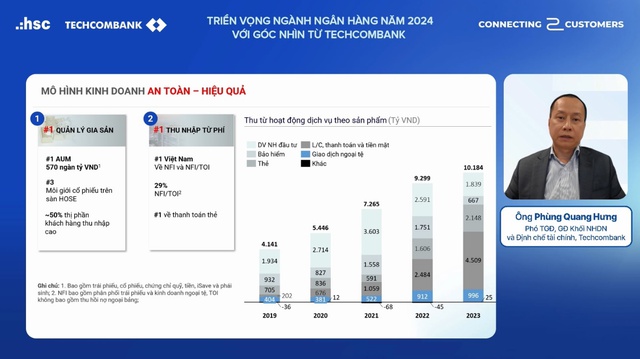

The prospects of Techcombank were emphasized by Mr. Phung Quang Hung, Deputy General Director of Techcombank through the following 4 special advantages:

Firstly, coordinating with Ky Thuong Securities Joint Stock Company (TCBS) forerunner in the wealth management segment. In this segment, Techcombank is a leading bank with the value of managed assets nearly VND 600 trillion, ranking first in the bond issuance and distribution segment, ranking 3rd in the stock brokerage market share on HOSE. With the forecast that the proportion of the population with high income will continue to increase, the bank will continue to offer new products to develop this area.

Secondly, Techcombank also has the advantage of owning diverse sources of income. Techcombank is the leading bank in terms of the ratio of fee income to total income. For the individual customer segment, Techcombank leads in market share of card payment. In 2023, despite many key markets slowing down, the bank’s fee income still grew. With the recovery of import-export activities, infrastructure construction, the fee income products of corporate customers will continue to grow and this will be an important driving force for Techcombank.

Thirdly, developing value chains is also a special advantage of Techcombank. In the real estate and construction sector, TCB has successfully deployed an efficient value chain from input to output for many large companies. This strategy ensures sustainable growth, developing many new customers with low costs, and good risk management.

Fourthly, Techcombank continues to diversify and develop new customer segments. Utilizing the high-end customer base along with superior data and technology capabilities, the bank will continue to expand its target customer base to lower segments while maintaining profit margins.

“This is the strengths that we will continue to promote to create growth momentum for Techcombank in 2024 and in the long term,” the bank representative said.

Answering investors’ concerns about issues related to the corporate bond market, investment in corporate bonds by Techcombank, Mr. Nguyen Xuan Minh – Director of Techcombank’s Investment Banking Division, Chairman of the Board of Directors of TCBS, said that the recovery of the bond business for Techcombank and TCBS is taking place very strongly, with even more impressive timing than the liquidity crisis that occurred in 2022.

“Currently, the average purchase demand for TCBS bonds is VND 250-300 billion/day, which is the record high of TCBS in 8 years. This is a welcome signal and TCBS expects the recovery to be even stronger in 2024,” Mr. Nguyen Xuan Minh said.

Growth Drivers for Techcombank in 2024

Sharing about business prospects in 2024, Mr. Phung Quang Hung expects total operating income and pre-tax profit of Techcombank to grow well thanks to several factors.

Regarding capital sources, the CASA ratio will continue to recover, thereby affecting the cost of capital mobilization and NIM can recover to about 4% – 4.5% after going down to a low level in 2023. Especially, interest income continues to grow with the expansion of customers, importantly is the fee income – the main focus of Techcombank will continue to grow.

In addition to a stable business platform, Techcombank also has sound asset quality. The bad debt ratio at the end of 2023 of the bank is 1.19%, the bad debt ratio of real estate businesses is 0%, and the bad debt ratio for home loans is 1.5%, these are healthy bad debt levels for the banking industry under the difficulties like last year.

Regarding credit growth, representatives from Techcombank said that the bank will use up the credit growth rate approved by the SBV. Techcombank’s credit growth rate after the first two months increased by about 3-4%, especially the corporate customer segment has recovered strongly by nearly 7% thanks to the rebound in exports.

In conclusion, the banking industry, as the backbone of the economy, has positive signals thanks to the improved macroeconomic foundation and the recovery of credit demand. With many favorable factors for the banking industry as well as unique strengths in each area, Techcombank expects to have a remarkable breakthrough in 2024.