On March 28, FPT Securities Joint Stock Company (FPTS, code FTS) is expected to hold its 2024 Annual General Meeting in Hanoi. The company has released meeting documents with many noteworthy information.

Profit Plan Decreases by 18%

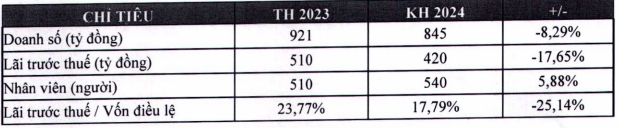

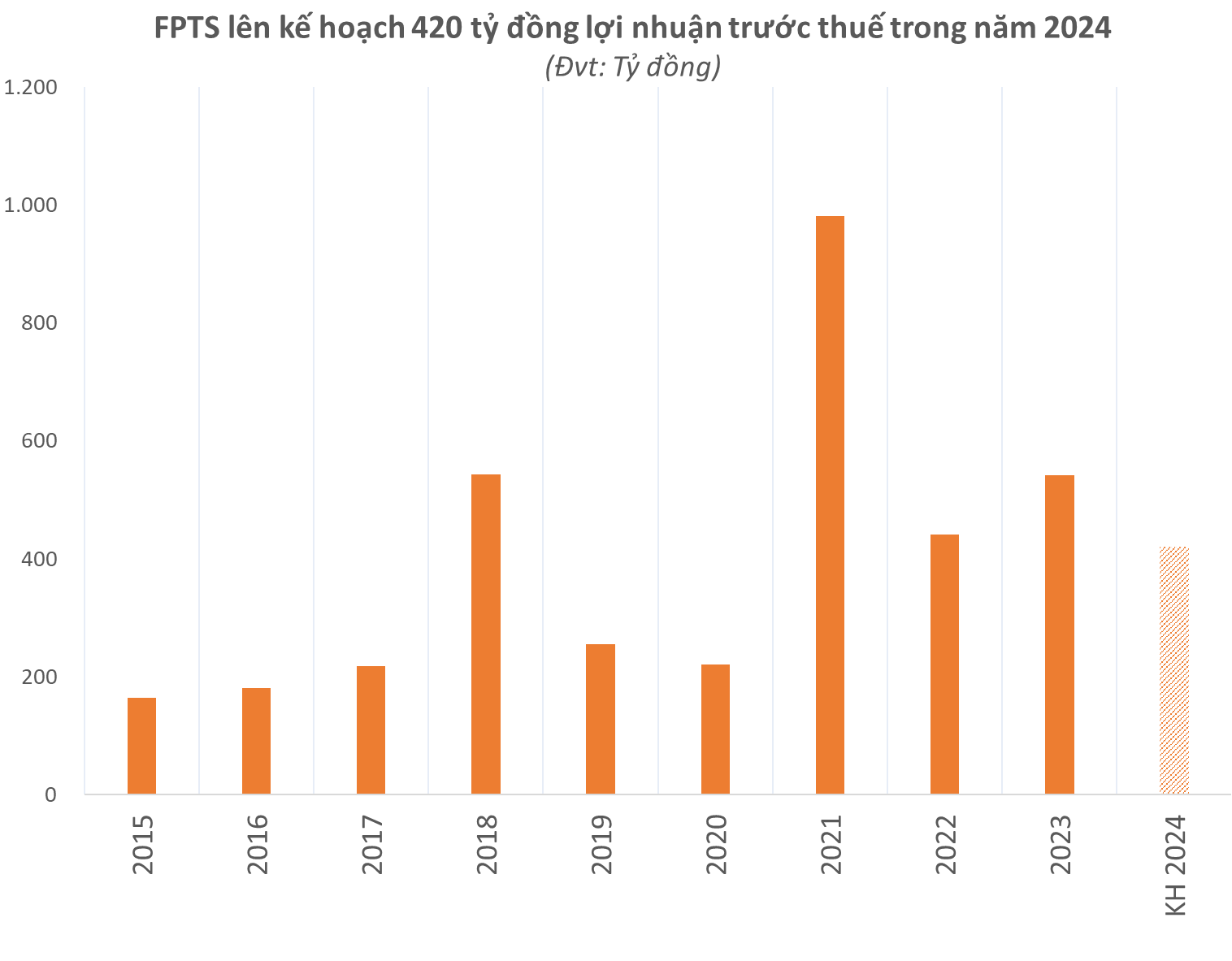

Regarding the targets in 2024, FPTS plans to achieve revenue and pre-tax profit of VND 845 billion and VND 420 billion, respectively, a decrease of nearly 8% and 18% compared to the previous year. The pre-tax profit/equity ratio fell to nearly 18% from 24% the previous year. In the context of the backward plan, FPTS expects to increase its personnel by 30 people to a total of 540 employees.

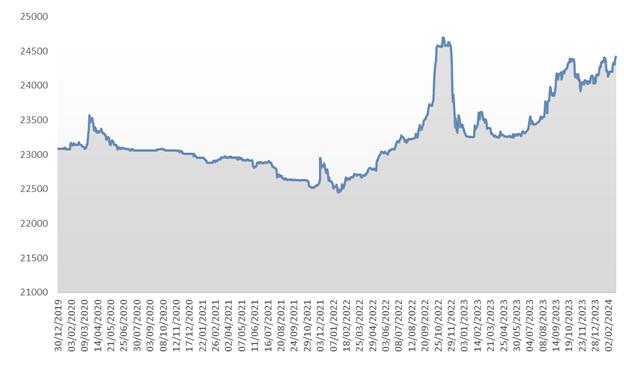

According to the securities company, 2024 could be a brighter year for the economy but still poses many difficulties and challenges for Vietnamese businesses. As for the stock market, the liquidity and point score in 2024 are expected to be supported by low interest rates and the government’s focus on growth-stimulating policies. However, concerns about strong exchange rate fluctuations will negatively affect the market.

FPTS also expects the new KRX system to be officially operational. However, there will be no new products, and there won’t be many new stocks listed/traded on the market. The company also predicts increased competition in transaction fees and margin interest rates among securities companies.

Previously, in the whole year of 2023, pre-tax profit reached nearly VND 542 billion, an increase of 23% and exceeding the profit plan for the whole year of 2023 (VND 420 billion).

Based on the above results, FPTS plans to present shareholders with a plan to distribute profits for the year 2023 with a cash dividend rate of 5%, equivalent to VND 500 per share. Thus, FPTS will spend more than VND 107 billion, expected to be implemented in the second quarter of 2024. In previous years, FPTS’ cash dividend rate was always 5%.

Joining the Race to Increase Capital, Expect to Issue Over 91 Million New Shares

One notable content is FPTS’ capital increase proposals. The total number of newly issued shares is expected to be over 91 million shares. If completed, the company’s charter capital will increase from over VND 2,145 billion to VND 3,059 billion.

Firstly, FPTS plans to issue nearly 86 million bonus shares to increase its charter capital from equity for existing shareholders. The issuance ratio is 10:4 (for every 100 shares that a shareholder owns, they will receive an additional 40 new shares).

The capital source comes from undistributed after-tax profit at December 31, 2023. The new shares issued are not restricted from being transferred, except for cases where rights to receive shares for capital increase from equity arise from the number of shares issued under the employee stock ownership plan (ESOP) for 2022 that are currently subject to transfer restrictions. These shares will also be restricted from transfer according to the corresponding ratio and time limit specified for the ESOP shares that are currently subject to transfer restrictions.

Secondly, FPTS plans to issue over 5.5 million ESOP shares for management officials at a preferential price equal to par value of VND 10,000/share.

ESOP shares issued will be restricted from transfer for 2 years, and will be gradually unlocked as follows: 50% of the shares will be freely transferable after 1 year from the end of the issuance period, and the remaining 50% after 2 years from the issuance date. The capital raised of over VND 55 billion will be used by FPTS to supplement capital for margin trading activities.

Both options are expected to be implemented in the second or third quarter of 2024 after getting approval from the State Securities Commission.

Further, according to the general meeting’s program, FPTS will propose to dismiss Mr. Taro Ueno from the Board of Directors for the 2023-2028 term and nominate Mr. Kenji Nakanishi as a new member.

According to the introduction, Mr. Kenji Nakanishi (Japanese, born in 1966) previously worked at Daiwa Securities Group from April 1992 to November 2021. He was the Overseas Business Administration Manager at SBI Holding Inc. from July 2022 to April 2023. Since May 2023, he has been the CEO at SBI Royal Securities Plc (Cambodia) under SBI Holding Inc.

In the market, the FTS stock closed at VND 60,300 per share on March 6.