In reality, this is not difficult to understand as the financial and real estate sectors often need to constantly increase their capital capacity to support their business operations. Stock splits and capital increases are common activities that often prevent stock prices from maintaining high levels. Furthermore, the financial sector is also cyclical in nature, and sustaining continuous growth over a long period of time is not simple.

The real estate sector has only one representative, which is Nam Tan Uyen Industrial Park (KCN Nam Tan Uyen).

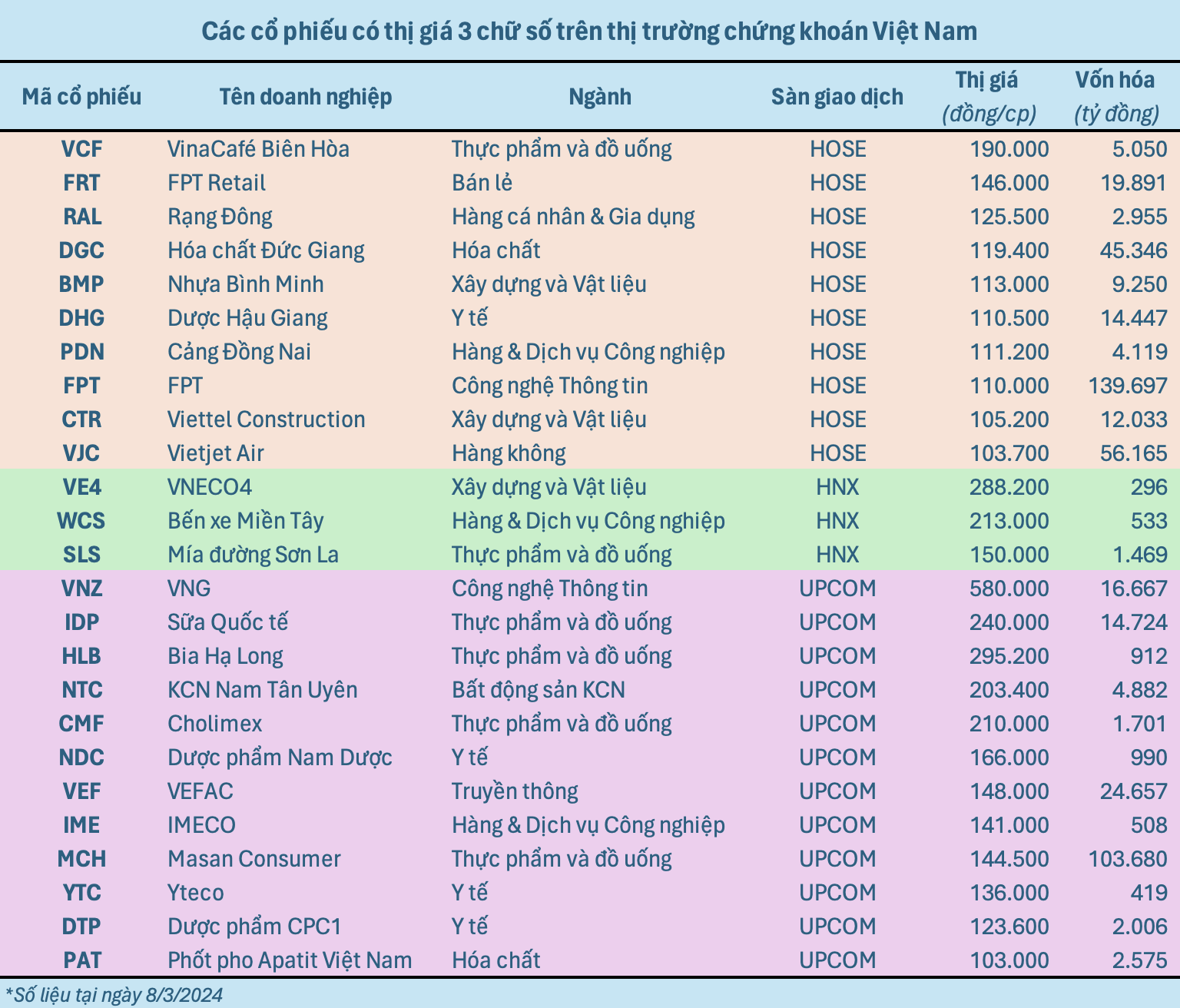

The majority of the three-digit share price companies belong to less cyclical industries such as technology, healthcare, retail, food and beverage, and industrial services. Many companies like FPT, Dược Hậu Giang, Masan Consumer, Viettel Construction, Rạng Đông, Cảng Đồng Nai, Cholimex, have maintained stable growth over a long period of time. Consistent profit growth is one of the important factors that drive stock prices upward.

On the basis of high profit growth, many stocks in the three-digit share price list have increased by tens of percent since the beginning of 2024. Some stocks are even at historical highs, such as FPT, BMP, CTR, WCS, HLB, MCH… These stocks have high prices, but they continue to attract strong and continuous capital inflows. It is not an exaggeration to say that these are “expensive” stocks on the Vietnamese stock market.

Furthermore, companies in the three-digit share price group rarely dilute their shares. Stable profits and consistent cash flows accumulated over many years help strengthen the financial strength of these companies. Therefore, these companies rarely need to mobilize capital from shareholders or external entities to support their business operations. Instead, the majority of the money is used to distribute dividends to shareholders.

High dividend payout tradition

Many stocks in the three-digit share price group have a tradition of paying high dividends in cash, especially stocks like Nhựa Bình Minh, Sữa Quốc tế, Phốt pho Apatit Việt Nam, Bến xe Miền Tây, Mía đường Sơn La… Shareholders of these companies tend to hold their shares in the long term to enjoy dividends instead of trading for price differences. This is also a reason why the liquidity of these stocks is often not high.

One of the most prominent examples is Phốt pho Apatit Việt Nam, which continuously pays generous dividends since its listing in mid-2022. Last year, the company even made an interim dividend payment for 2023 at a rate of 90% in cash. Prior to that, the shareholders of this chemical company also received cash dividends at a rate of up to 306% for the year 2022.

“Bé hạt tiêu” Bến xe Miền Tây is also preparing an interim dividend payment for 2023 at a rate of 144% in cash. The last registration date is March 15th, and the expected payment date is March 28th. At the end of 2023, Mía đường Sơn La distributed dividends for the 2022-2023 period at a rate of 150% in cash for shareholders. Sữa Quốc tế and Nhựa Bình Minh also both paid dividends for 2023 at high rates, 85% and 65% respectively.

In general, stocks in the three-digit share price group are more suitable for long-term investment strategies. The wide variety of stocks across all three exchanges (from market capitalization of hundreds of billions to billions of dollars) allows investors to choose comfortably. With this investment approach, cash dividends are an almost indispensable factor.

Essentially, cash dividends at high rates and consistent payment partially reflect the financial health of companies. Maintaining a consistent dividend policy based on sustainable business operations is an important driving factor for stock prices. Therefore, long-term investors can “relax” and enjoy double profits by holding stocks with annual dividends.