The market had a fairly positive session after two consecutive deep declines, the liquidity decreased compared to the previous session but still remained at a good level, showing that money is still making efforts to support the market and has a waiting-buying strategy at good price levels. The index closed at 1,270 points on March 13, up 22.5 points (equivalent to 2.05%), the trading volume on HOSE exceeded 23,500 billion VND.

The outlook for the market in the coming sessions of securities companies is that the market can continue its upward trend to approach the 1,300-point level.

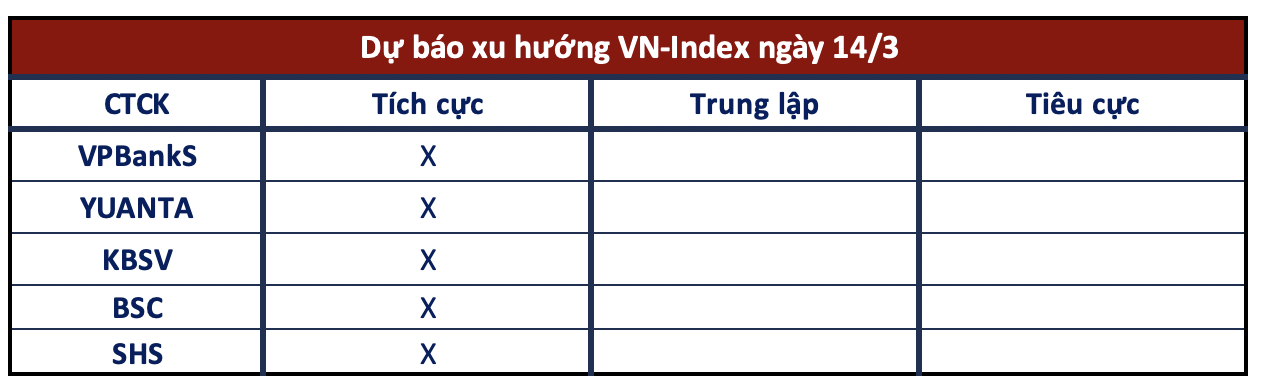

Continuation of the upward trend

VPBankS Securities

The current recovery signal is helping the market stabilize and create expectations for further gains. However, temporarily, the market will be in a tug-of-war state and testing in the range of around 1,230 – 1,250 points. The supply-demand signal in this testing range will greatly affect the market’s subsequent developments.

Yuanta Securities

The market may continue to rise in the next session, but the VN-Index may retest the level of 1,268 points. At the same time, the market may continue to differentiate in this period as large-cap stocks may experience further adjustments in the next session, while small and mid-cap stocks are entering a strong volatile phase in a positive direction. In addition, the strong return of short-term psychological indicators indicates that investors are becoming optimistic again.

Possibility of short-term breakthrough

KBSV Securities

The formation of the “Marubozu” candlestick pattern with increasing trading volume and widespread effects in all sectors shows the dominance and dominance of buyers. This development continues to confirm the upward trend for VN-Index with a high possibility of a short-term breakthrough. However, the market sentiment in recent rebounds is concentrating more on mid-cap and small-cap stocks or “lagging” stocks in the previous uptrend; this reflects the attractiveness of capital flows of leading stocks has somewhat decreased.

Therefore, KBSV warns that the risk index will soon encounter a correction at the beginning after breaking through the old short-term resistance level. Investors are advised to avoid chasing buying in the rebound phases, can gradually take profit and reduce the proportion of trading positions when the index approaches the next resistance zone around 1,300 (+-10).

Aiming for 1,300 points

BSC Securities

In the upcoming trading sessions, the market may continue its upward momentum to the range of 1,280 – 1,300.

SHS Securities

From a short-term perspective, a strong rebound session and return to the short-term peak after 2 strong corrections open up the possibility that VN-Index may continue to increase in the next sessions towards the strong resistance level of 1,300 points. However, after the end of the euphoric phase, VN-Index will retrace within the price range of 1,150 points – 1,250 points as the accumulation base is the foundation for the uptrend that has not formed enough reliability.