The stock of VRC of VRC Real Estate and Investment Joint Stock Company closed the session on March 13, up 6.7% to VND 12,000 per share. This marked the 6th consecutive ceiling increase for this stock, with a 50% price increase in just over a week of trading.

With 50 million shares in circulation, VRC’s market capitalization increased by VND 197 billion, currently reaching VND 600 billion. However, compared to the historical peak price of VND 38,800 per share set in late February 2022, VRC’s price is still more than 69% lower.

The liquidity of this stock has also shown significant improvement, with trading volume from a few thousand units per session to hundreds of thousand units, with billions of dong in trading value.

Amid the soaring stock performance, the Ho Chi Minh City Stock Exchange (HoSE) has requested VRC Real Estate and Investment to explain the five consecutive ceiling increases from March 6th to March 12th.

This request is based on the regulations on information disclosure in the securities market: “Public companies must disclose abnormal information within 24 hours, from the time one of the following events occurs: When the company becomes aware of an event or information that affects the stock price of the company itself, the company must confirm or adjust that event or information”.

At the same time, based on the letter from the State Securities Commission on HoSE’s request for listed organizations to report, disclose information related to the company that has a significant impact on the stock price within 24 hours from the time the stock price reaches the ceiling or drops for five consecutive sessions or more.

Struggling business situation, insignificant profit of a few hundred million VND per year

According to research, VRC Real Estate and Investment, formerly a Special Construction Zone Vung Tau – Con Dao, was established in August 1980, one of the earliest construction companies in Ba Ria – Vung Tau province. In June 2018, the company moved its headquarters to Ho Chi Minh City.

The company was listed in July 2010 and underwent comprehensive restructuring in 2017, officially changing its name to VRC Real Estate and Investment Joint Stock Company with a charter capital of VND 500 billion as it is today.

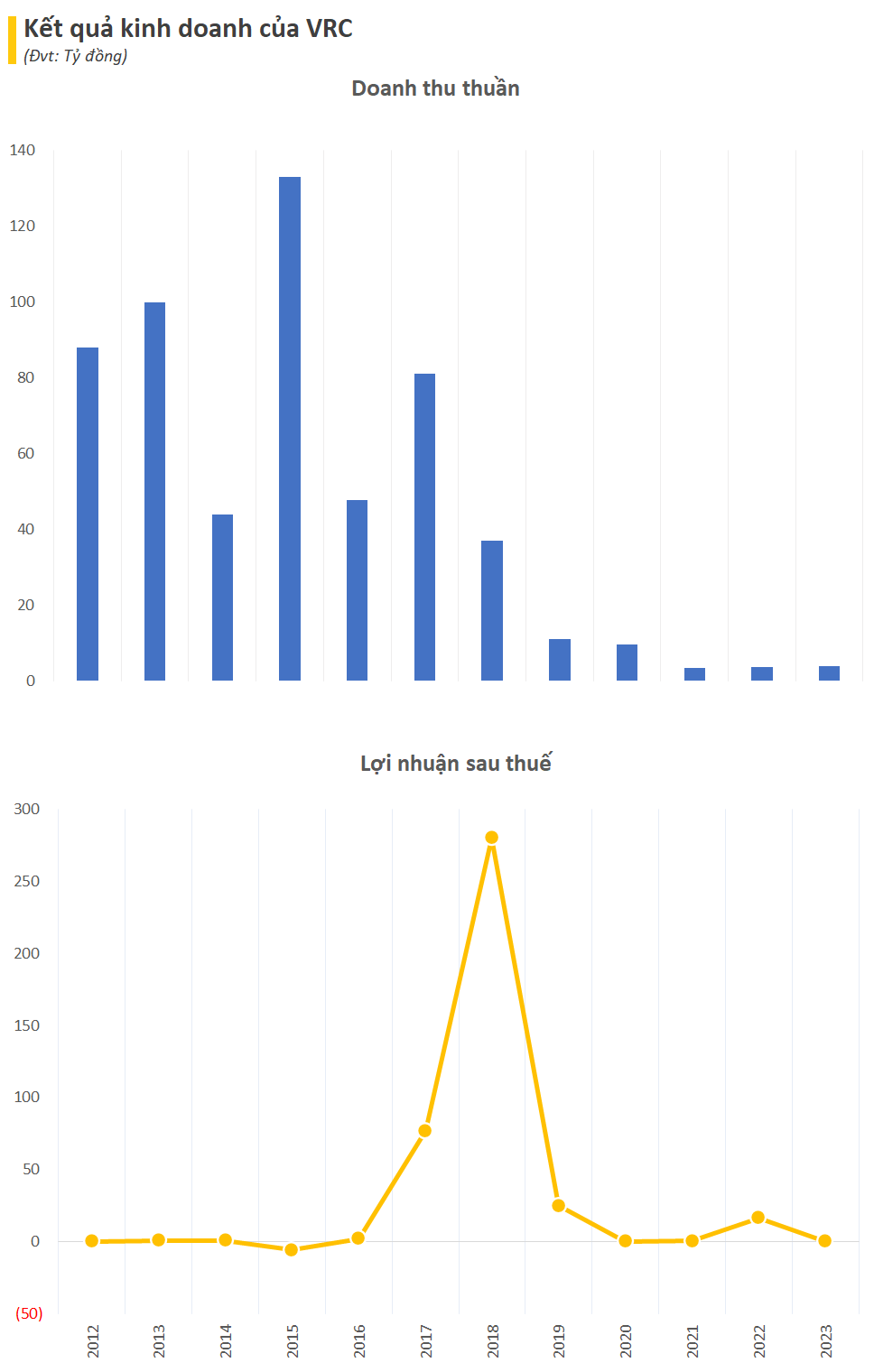

Although the stock has shown strong growth, VRC’s business results in recent years have not been optimistic. For four consecutive years from 2020 to 2024, the revenue is less than VND 10 billion.>

Also, 3/4 of the years during that period, VRC reported a slim profit less than VND 500 million per year. In 2022, the company’s net profit was approximately VND 17 billion, mainly thanks to other income of over VND 20 billion as compensation for land recovery from the People’s Committee of Vung Tau City. The high business management costs are the cause of profit erosion.

As of December 31, 2023, VRC’s asset scale is VND 1,719 billion, mainly inventory with VND 1,175 billion (equivalent to 68%). The company allocates to the projects of Nhon Duc Residential Area, Phuoc Loc – Nha Be (VND 784 billion), ADC Phu My Residential Area (VND 358 billion), and Long An Residential Area (VND 33 billion).

VRC’s project land fund mainly comes from the acquisition of ADEC Joint Stock Company – a company of government origins. VRC has invested in this company since 2017 and owns 60.06% of the capital with an investment value of nearly VND 320 billion.

In addition, VRC also invested VND 483 billion in My Xuan Shipbuilding and Port Service Joint Stock Company.

Equity is approximately VND 1,260 billion, and total liabilities are over VND 459 billion. The majority of the liabilities are loans, amounting to VND 416 billion.