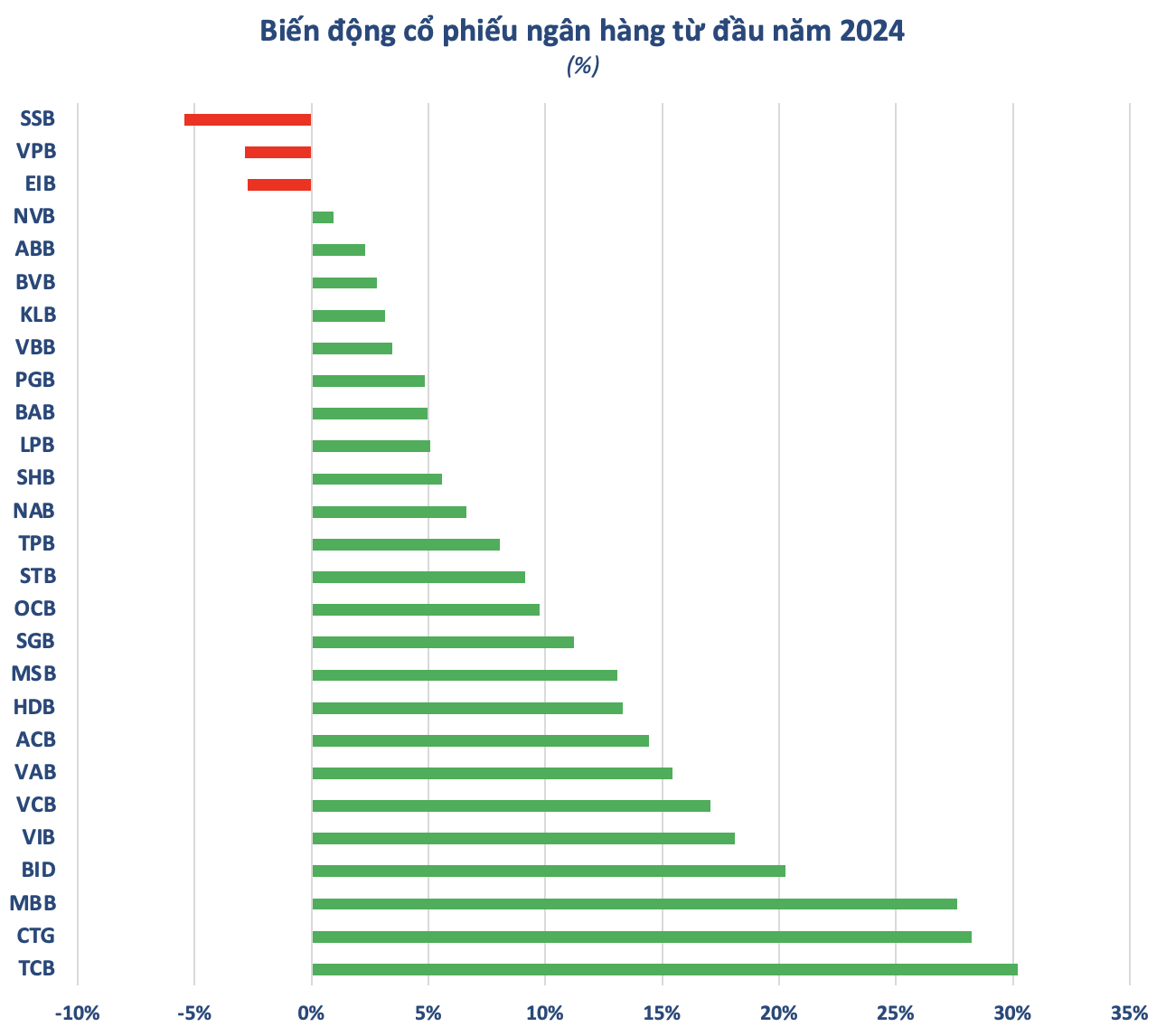

The stock market is booming, with the VN-Index increasing nearly 12% since the beginning of 2024, thanks in large part to the banking sector (which accounts for 40% of the total market capitalization). During the recent wave, many banking stocks have surged by double digits, with TCB, CTG, MBB, and BID even experiencing gains of over 20% since the beginning of the year.

However, there are still some names in the banking sector that have not kept up with the market rally, resulting in underperformance compared to the VN-Index. Surprisingly, there are only three stocks in this category, including EIB of Eximbank.

The presence of EIB among the laggards is unexpected, as this stock has been one of the most heavily bought by foreign investors on the stock exchange since the beginning of 2024, with a value of over 500 billion VND. Pressure from domestic cash outflows is the main reason for the decline of Eximbank’s stock in the context of the bank’s business performance not being very optimistic.

In 2023, Eximbank recorded a net interest income of 4,597 billion VND, a 17.79% decrease compared to 2022. The bank set aside credit provisions of over 694 billion VND, an increase of 6.7 times compared to the previous year (103 billion VND). As a result, the bank’s net profit after tax in 2023 decreased by 26.5% compared to 2022, reaching 2,165 billion VND.

As of December 31, 2023, Eximbank’s total assets reached 201,416 billion VND, an 8.84% increase compared to the beginning of the year. In which, customer deposits amounted to 156,329 billion VND, an increase of 5.19%; Loans granted to customers amounted to 140,448 billion VND, an increase of 7.62%. The bank’s shareholders’ equity was 22,444 billion VND, an increase of 9.6% compared to the beginning of the year.

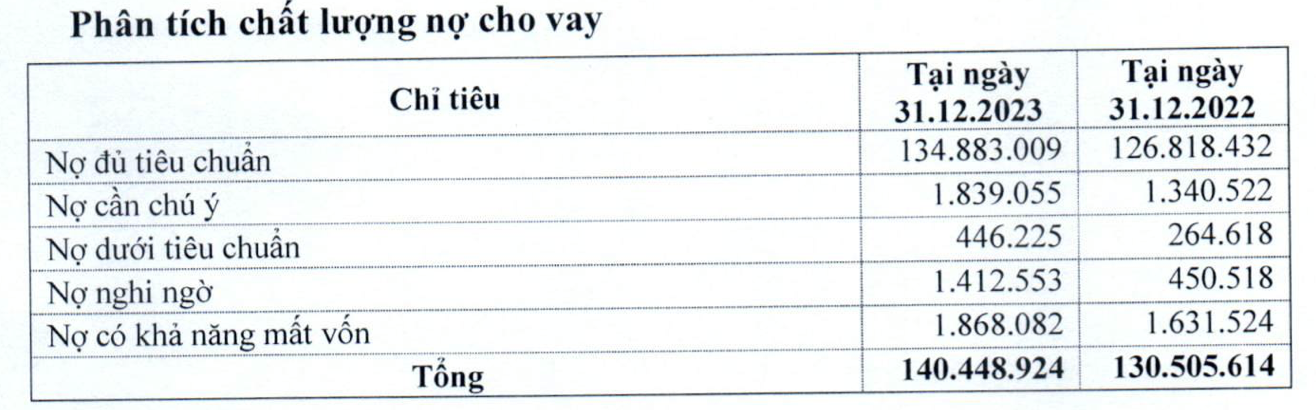

However, the bank’s credit quality has deteriorated significantly. The total non-performing loans of Eximbank by the end of 2023 amounted to 3,726 billion VND, an increase of 58% compared to the beginning of the year. Among them, substandard loans (Group 3) increased by 68% to 446 billion VND; doubtful loans (Group 4) surged by 213% to 1,412 billion VND; potentially loss loans (Group 5) also increased by 14% compared to the beginning of the year, reaching 1,868 billion VND.

Source: Eximbank’s consolidated financial statements Q4/2023

Speaking about the industry’s prospects in 2024, a recent report by SSI Research suggests that the profit growth of banks will be positive this year, but asset quality remains a concern. However, this research team also evaluates that the current valuation mostly reflects credit risks stemming from overdue debts and restructured loans under Circular 02.

According to SSI Research, the valuation is almost unchanged during the process of handling bad debts, but it will be reassessed within 6-12 months before completing the bad debt resolution process. During this period, banks that are able to increase their capital sooner will have better conditions to accelerate the bad debt resolution process, gain additional market share, and achieve more positive results compared to other banks.

More cautiously, VCBS predicts that the banking sector’s profit in 2024 will continue to have significant disparities, with a growth rate of about 10%. VCBS also notes that in the event Circular 02 on debt restructuring is not extended, banks with a high proportion of corporate lending and a low coverage ratio of bad debts may face risks and increased provisioning pressure in 2024-25. Banks with good asset quality will adequately recognize bad debts and restructured debts in order to control the situation.