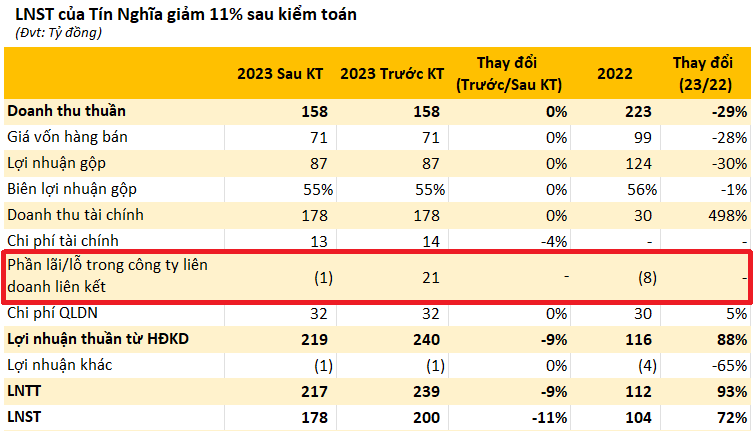

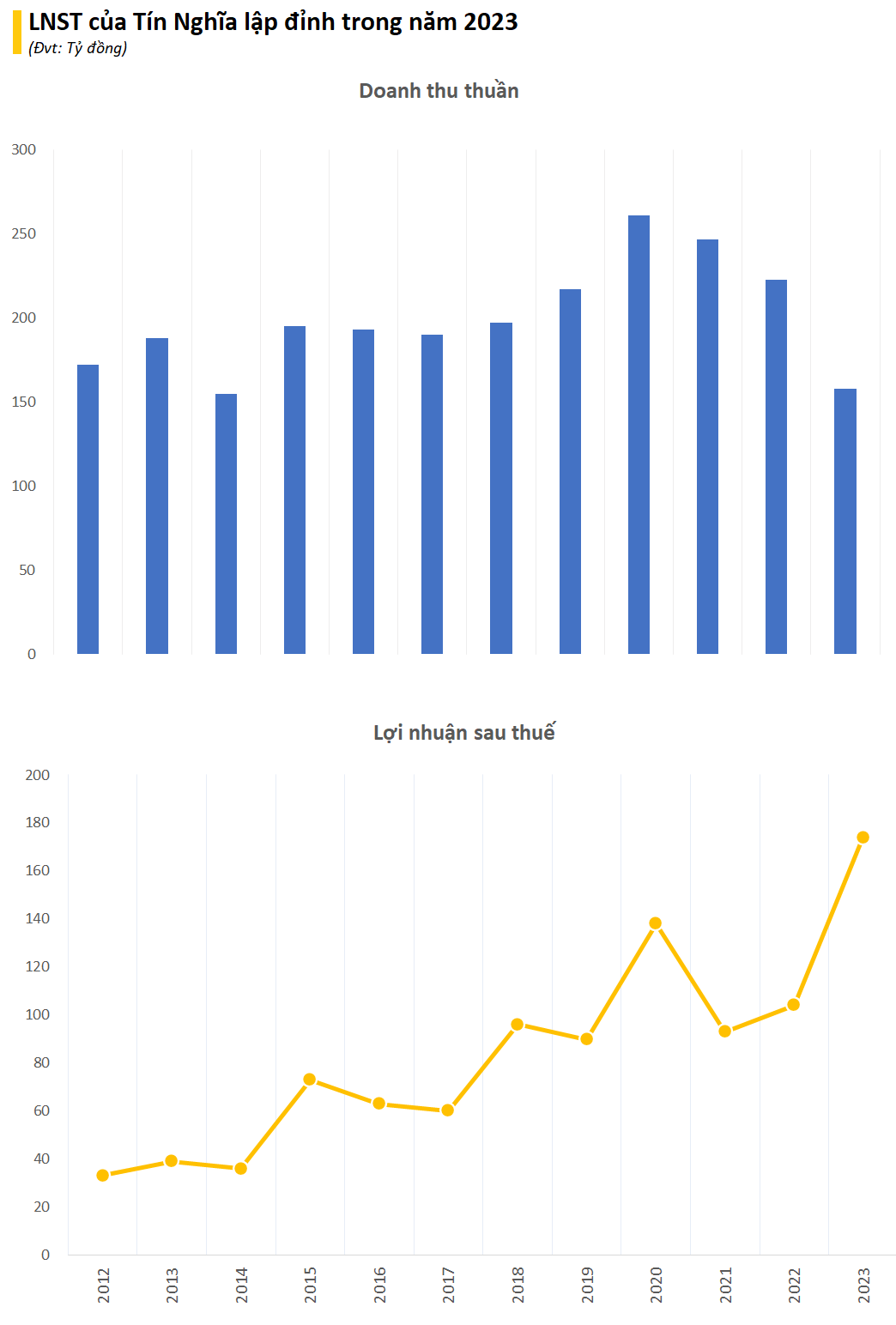

Tín Nghĩa Industrial Park Development Joint Stock Company (TIP) has announced its audited consolidated financial statements for the year 2023, with net revenue of VND 158 billion, a gross margin of 55% corresponding to a gross profit of VND 87 billion, unchanged from the self-declared report and a 30% decrease compared to the previous year 2022.

The decline in TIP’s revenue is mainly due to the exclusion of revenue from the transfer of factory buildings and machinery at Bien Hoa 2 Industrial Park, the discontinuation of land sales revenue, and decreases in other areas such as water supply, wastewater and garbage collection fees, and office kiosk rentals compared to the previous year.

Financial revenue recorded VND 178 billion, nearly 6 times the figure for 2022, of which nearly VND 123 billion came from profits arising from the partnership contract with Phuoc An Port Petroleum Investment and Exploitation Joint Stock Company; the remainder of nearly VND 33 billion is dividends, distributed profits, and VND 22 billion in interest income. Financial costs amounted to more than VND 13 billion, all of which are provisions for investment losses.

Notably, TIP recorded a loss of over VND 1 billion in its joint venture partners, while the self-declared financial statement recorded a profit of VND 21 billion. This has increased costs and eroded Tín Nghĩa’s 2023 net profit by 11% compared to the self-declared report, down to VND 178 billion.

To explain this, Tín Nghĩa stated that the company had not accounted for the adjustment entries to consolidate dividends from Phuoc Tan Trading and Construction Joint Stock Company – a joint venture partner of TIP.

Despite the 11% decrease, the net profit for 2023 is still the highest since the listed real estate company in the industrial park sector was established.

Previously, in 2022, TIP had to explain significant changes in its financial statements after the audit, but the net profit unexpectedly increased significantly after the review. Specifically, according to the audited financial statements for 2022, TIP’s consolidated net profit reached over VND 103.5 billion, an increase of 11.5% compared to a 6% decrease in the self-declared report.

According to the explanation, in 2022, Olympic Coffee Joint Stock Company was no longer a joint venture or affiliate of TIP but became another investment company, and no longer consolidated its financial results. However, in the self-declared financial statements, TIP still consolidated the results. In addition, in the audited financial statements, TIP recorded an additional deferred corporate income tax refund of over VND 15.5 billion, while this figure is only nearly VND 1.3 billion in the self-declared financial statements. This also contributes to the difference in post-tax profits after the review.

In the market, TIP’s stock closed at VND 28,100/cp on the session of March 15th.