Technical signals of VN-Index

In the morning trading session on March 18, 2024, VN-Index decreased points and at the same time appeared a candle pattern similar to Black Marubozu, while cutting down the Middle line of Bollinger Bands, showing investor pessimism.

In addition, the Stochastic Oscillator continues to trend downwards after giving a sell signal, indicating that the risk of correction still exists.

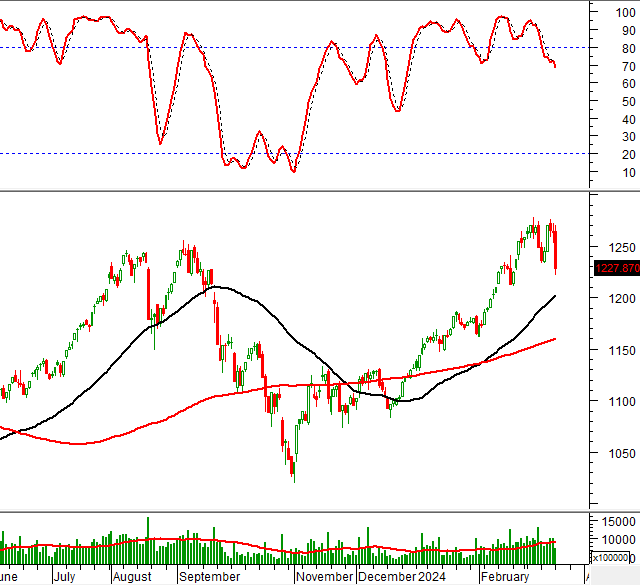

Technical signals of HNX-Index

In the trading session on March 18, 2024, HNX-Index decreased sharply and appeared a long red candle with morning trading volume exceeding the 20-session average, showing negative sentiment of investors.

The MACD and Stochastic Oscillator indicators give a sell signal. This indicates that selling pressure may continue in the following sessions.

DIG – Development Investment Construction Corporation

In the morning trading session on March 18, 2024, the stock price of DIG continued to rise accompanied by morning trading volume exceeding the 20-session average, reflecting the optimistic sentiment of investors.

The stock price continues to rebound within the bullish price channel, with the MACD and Stochastic Oscillator giving a buy signal, indicating positive prospects.

However, the stock price is also facing supply pressure as it undergoes a secondary test at the Fibonacci Retracement level of 61.8% (equivalent to the range of 29,500-30,500).

DPG – Dat Phuong Corporation

In the morning session on March 18, 2024, the stock of DPG formed a Rising Window candle pattern with trading volume above the 20-day average, indicating positive sentiment of investors.

The stock price continues to rise after a Golden Cross appeared, with the MACD giving a buy signal when it cuts above the Signal line, indicating a fairly optimistic outlook.

In a positive scenario, the stock price may continue to target the next price range at the Fibonacci Retracement level of 38.2% (equivalent to the range of 46,500-47,500).

Technical Analysis Department, Vietstock Advisory Room