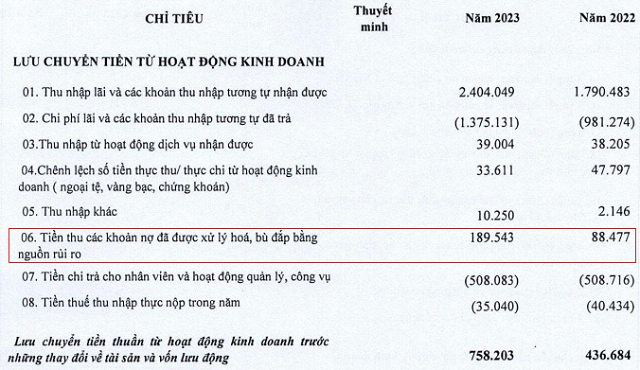

Recently, the public was surprised when a customer in Quang Ninh received a notice of debt recovery from a bank for spending nearly 8.5 million dong on a credit card since 2013. But after 11 years, the accumulated interest on the debt has reached 8.84 billion dong.

According to many experts, such a high level of debt is due to the interest calculation formula when using credit cards and especially for letting the debt be overdue for too long.

Despite this “shocking” incident, Vietnam is still a “sinfully indulgent” credit card market with positive growth.

Figures from the State Bank of Vietnam’s Payments Department show that by the end of July 2023, there were over 103 million domestic cards and 36.7 million international cards in circulation nationwide. Among them, there are nearly 10.8 million cards opened electronically.

According to the RBR’s Global Card Payment Data forecast for Asia-Pacific in 2027, card payment volume in Vietnam in 2021 increased by 34%.

“This increase is due to the government’s policies to promote non-cash payments and e-commerce. In 2021, Vietnam had 570 billion card payment transactions, up 20% from the previous year. Among the payment methods in Vietnam, credit cards accounted for 59% of total card payment volume and debit cards accounted for 41%,” said Winnie Wong, Country Manager of Mastercard in Vietnam, Cambodia, and Laos, shared.

At the end of 2023, VIB International Bank announced that the total expenditure through Mastercard (issued by VIB) in Vietnam reached over USD 3 billion in 2022, more than 7 times higher than in 2018. According to VIB, this is an impressive growth rate for a bank that cooperates with Mastercard.

In the same announcement, VIB also mentioned: The total expenditure through VIB Mastercard abroad reached more than USD 190 million by the end of 2022, increasing more than 5 times in the past 5 years. As for the number of issued cards, including international debit and credit cards in Vietnam, VIB is the leading bank with more than a 5-fold increase.

According to statistics from the Card Association, in the first half of 2023, VPBank’s credit cards achieved an impressive growth rate in transaction volume, reaching 65% compared to the same period last year, higher than the market average of 21%.

Credit cards have achieved impressive growth in the Vietnamese market. Illustrative photo.

Banks continuously introduce new credit cards

Also at the end of 2023, TPBank also announced that it was honored as one of the leading banks in terms of impressive growth in card transaction volume in 2023 by VISA.

This bank is also the only bank honored by VISA for impressive growth in transaction volume abroad for the TPBank Visa Signature high-end card.

Specifically, as of November 2023, TPBank’s card transaction volume increased by 71% compared to 2022, 3 times higher than the average growth rate in the market (24%). The TPBank Visa Signature card’s transaction volume abroad grew by up to 180%, 3 times higher than the market average.

With the optimistic growth figures mentioned above, many commercial banks have continuously launched new international credit card products, alongside dozens of existing international credit card lines.

VIB has nearly 10 international credit card lines, most of which are Mastercard brands. The bank has recently launched the VIB Super Card line, which carries the American Express brand and offers many benefits such as cashback, choose statement date, etc.

At the end of last year, Vietcombank introduced the high-end Vietcombank Visa Infinite credit card specifically for customers in the Elite Diamond segment – the highest-end segment of Vietcombank Priority customers.

Owners of this card will be able to use premium services for free such as health care, dining and resorts, golf discounts, travel…

Also serving the high-end customer segment, OCB launched the OCB Mastercard World card at the end of 2023. This card integrates both credit and payment card functions on the same physical card and the same chip.