On April 11, 2024, in the afternoon, Ho Chi Minh City People’s Court handed down a prominent ruling that will reverberate through Vietnam’s business world’s highest echelons.

Truong My Lan, 68, the former Van Thinh Phat Group chairwoman, was sentenced to death for three combined counts: assets embezzlement, bribery, and lending regulations violation in credit institutions’ operations.

The verdict concluded a widely anticipated case that exposed Lan’s crimes’ staggering scale and their devastating impact on the Vietnamese banking system.

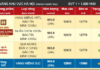

According to the court, Lan’s actions caused a loss of over VND 677,000 billion ($27 billion) to Saigon Commercial Joint Stock Bank (SCB), a financial institution she effectively commandeered through her web of control.

“Defendant Truong My Lan is the true owner and controls more than 91.5% of SCB shares,” the court declared, rejecting Lan’s claims of holding only a 15% stake. “The investigation further determined that the individuals who held a total of more than 75% of the shares at SCB had all admitted to acting on Truong My Lan’s behalf.”

Lan’s Complex Scheme

The court’s detailed account of Lan’s crimes depicted a sprawling, meticulously executed scheme.

Starting in 2012, Lan and her accomplices systematically diverted funds from SCB through a range of tactics, including selecting and appointing personnel in key SCB positions, establishing specialized lending and disbursement units within SCB, and creating thousands of “ghost companies” to obtain loans.

They collaborated with appraisal firms to inflate the value of collateral assets, generated false loan documents to withdraw funds, and bribed and influenced state agency officials to overlook their violations.

“Defendant Lan directed the creation of false loan documents for 304 customers with 368 loans, with a total outstanding balance of more than VND 132,000 billion ($5.28 billion),” the court found.

“Applying the principle of benefiting the defendant, Truong My Lan’s actions caused damage to SCB of more than VND 64,600 billion ($2.58 billion), after deducting the value of the loans’ collateral assets,” it added.

The court further determined that between January 1, 2018, and October 7, 2022, Lan directed the creation of 916 false loan applications to withdraw and appropriate SCB’s funds, resulting in an outstanding principal of over VND 415,600 billion ($16.62 billion) and interest of VND 129,300 billion ($5.17 billion).

Bribery and Obstruction of Justice

Lan’s crimes extended beyond the theft of vast sums of money. The court also found her guilty of bribery, a charge that exposed her efforts to hide the bank’s troubles from authorities.

“While SCB was being inspected, Truong My Lan met and discussed with Do Thi Nhan, Head of the inspection team (former Director of the Inspection Department, Bank Supervisor II, State Bank of Vietnam), and directed Vo Tan Hoang Van (General Director of SCB) to provide $5.2 million USD to Do Thi Nhan to conceal the situation at SCB,” the court revealed.

The jury assessed that these payments to the inspection team and bank supervision officials aimed to “conceal and not fully report the violations so that SCB would not be put under special control, enabling Truong My Lan and her accomplices to continue illegally withdrawing and utilizing SCB’s funds, leading to severe damages to SCB.”

Lan’s Downfall and Consequences

The court’s verdict was clear and forceful, reflecting the severity of Lan’s crimes. In addition to the death penalty, she was ordered to pay a staggering nearly $30 billion in compensation to SCB.

“Regarding civil liability, defendant Truong My Lan appropriated, causing damage of more than $27 billion, equivalent to the outstanding balance of 1,284 loans,” the court stated. “The defendants should have fully compensated, but the nature of the lost funds suggests that defendant Truong My Lan used or directed the use of them, while the other defendants followed defendant Lan’s instructions in committing the violations.”

The court’s ruling also included Lan’s co-conspirators, totaling 84 individuals, who received prison sentences ranging from three years suspended to life imprisonment for their involvement in the scheme.

The Wider Implications

The Truong My Lan case has significant implications for Vietnam’s ongoing efforts to strengthen its financial system and combat corruption. The magnitude of the fraud exposed at SCB has underlined the vulnerabilities in the country’s banking regulations and the need for more robust oversight mechanisms.

“This case highlights the critical importance of transparency and accountability in the financial sector,” said an economist at Vietnam National University, who requested anonymity. “It serves as a wake-up call for policymakers to review and enhance the regulatory framework to prevent such large-scale abuses from occurring in the future.”

The verdict could also drive a reevaluation of Vietnam’s approach to corporate governance and the role of major shareholders in directing financial institutions. Experts have called for increased scrutiny of beneficial ownership structures and stronger checks and balances to prevent individuals from wielding unchecked power.

The amended Law on Credit Institutions is a significant advancement in addressing this challenge.

Effective July 2024, the law introduces a crucial change: reducing the maximum institutional shareholding from 15% to 10%. A similar decrease applies to combined shareholder and related party limits, dropping from 20% to 15%. Individual ownership remains capped at 5%, but a substantial shift towards transparency is evident.

Banks are now required to disclose all shareholders holding 1% or more, along with their clearly identified related parties. This yearly disclosure mandate, implemented during shareholder meetings, aims to cultivate a more transparent and stable banking environment.

However, leading experts maintain a cautious stance, acknowledging that the implementation of this law, among other measures, is crucial. As the nation grapples with the aftermath of this landmark case, the focus will be on ensuring that the lessons learned are translated into meaningful reforms to protect the integrity of Vietnam’s financial system and safeguard the public’s interests.