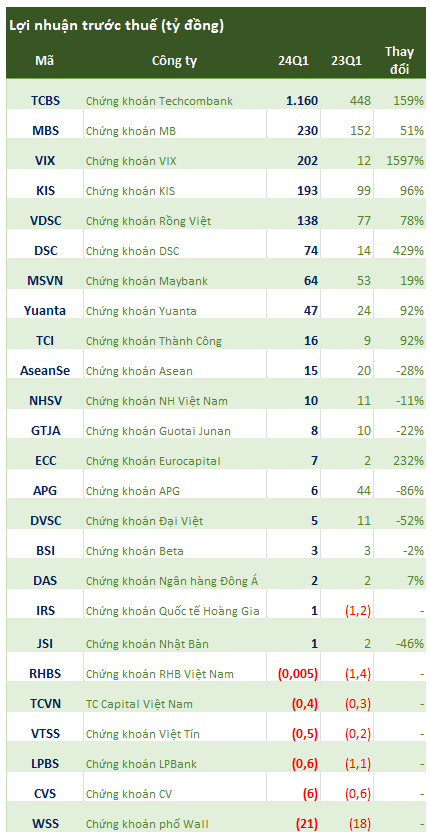

As of the afternoon of April 17, 24 brokerage firms have disclosed their business results for the first quarter of 2024.

Rong Viet Securities (VDSC, code VDS) is the next name to report strong profit growth, with pre-tax profit increasing by 92% year-on-year to VND 47 billion during this period.

Specifically, in the first quarter of 2024, VDSC recorded operating revenue of approximately VND 284 billion, an increase of 89% compared to the same period. In particular, revenue from investment activities increased six-fold to VND 125 billion. Similarly, brokerage revenue also increased by 57% to nearly VND 54 billion. Revenue from lending activities increased by nearly 21% to over VND 89 billion. Meanwhile, VDSC’s total expenses were nearly VND 146 billion.

In contrast, APG Securities reported a decline in its first-quarter profit by 86% to VND 6 billion. This was due to a sharp 40% decrease in operating revenue to VND 30 billion, while operating expenses nearly tripled from VND 6 billion to VND 17 billion, eroding most of the revenue.

Wall Street Securities continued to disappoint with a loss of VND 21 billion in the first quarter, currently the brokerage firm with the biggest loss among the group that has announced its results. In the same period of 2023, the company also lost VND 18 billion. Accordingly, although operating revenue increased by more than 60% year-on-year to nearly VND 13 billion, operating expenses reached VND 32 billion, mainly due to losses from FVTPL assets.

——————————————————————-

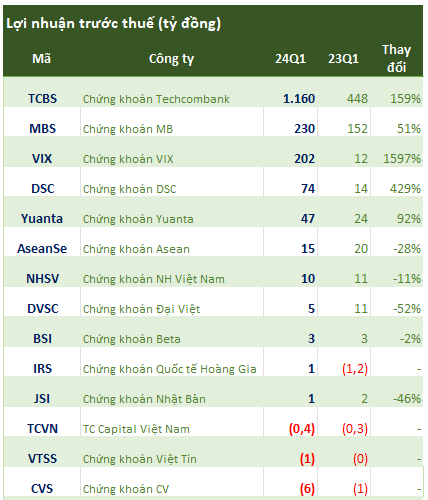

As of the morning of April 17, 2024, 14 brokerage firms have announced their financial statements for the first quarter of 2024, and more familiar names have disclosed their business results for the first three months of the year.

VIX Securities (code VIX) recorded pre-tax profit of VND 202 billion in the first quarter, an increase of 1,597% compared to the mere VND 12 billion profit in the same period of 2023.

Total operating revenue in the first quarter of 2024 increased by 33% to VND 361 billion, with VND 204 billion coming from FVTPL trading profits, in addition to over VND 115 billion in interest income from loans and receivables.

As of March 31, 2024, VIX Securities’ FVTPL portfolio had a book value of over VND 4,900 billion and a fair value of nearly VND 5,218 billion. The outstanding balance of margin loans and advances for securities sales increased by VND 1,151 billion after 3 months, to VND 4,159 billion.

A positive outlook was also recorded at Yuanta Securities Vietnam. The company achieved operating revenue of VND 148 billion in the first quarter, a growth of 28% compared to the same period in 2023. The largest contribution to revenue came from interest on loans and receivables, with VND 86 billion, an increase of nearly 41%. Brokerage revenue also increased by 63% to approximately VND 49 billion.

After deducting related expenses, Yuanta Securities Vietnam recorded pre-tax profit of VND 47 billion in the first quarter of 2024, an increase of 92% compared to the same period last year. Net income after tax reached over VND 37 billion.

On the other hand, NH Vietnam Securities and Dai Viet Securities are new names to announce their first-quarter financial statements, but the results were not particularly positive, as both operating revenue and profit declined compared to the same period last year. NH Vietnam recorded pre-tax profit of approximately VND 10 billion, a decrease of 11%, while DVSC reported a 50% drop in pre-tax profit to VND 5 billion in the reporting period.