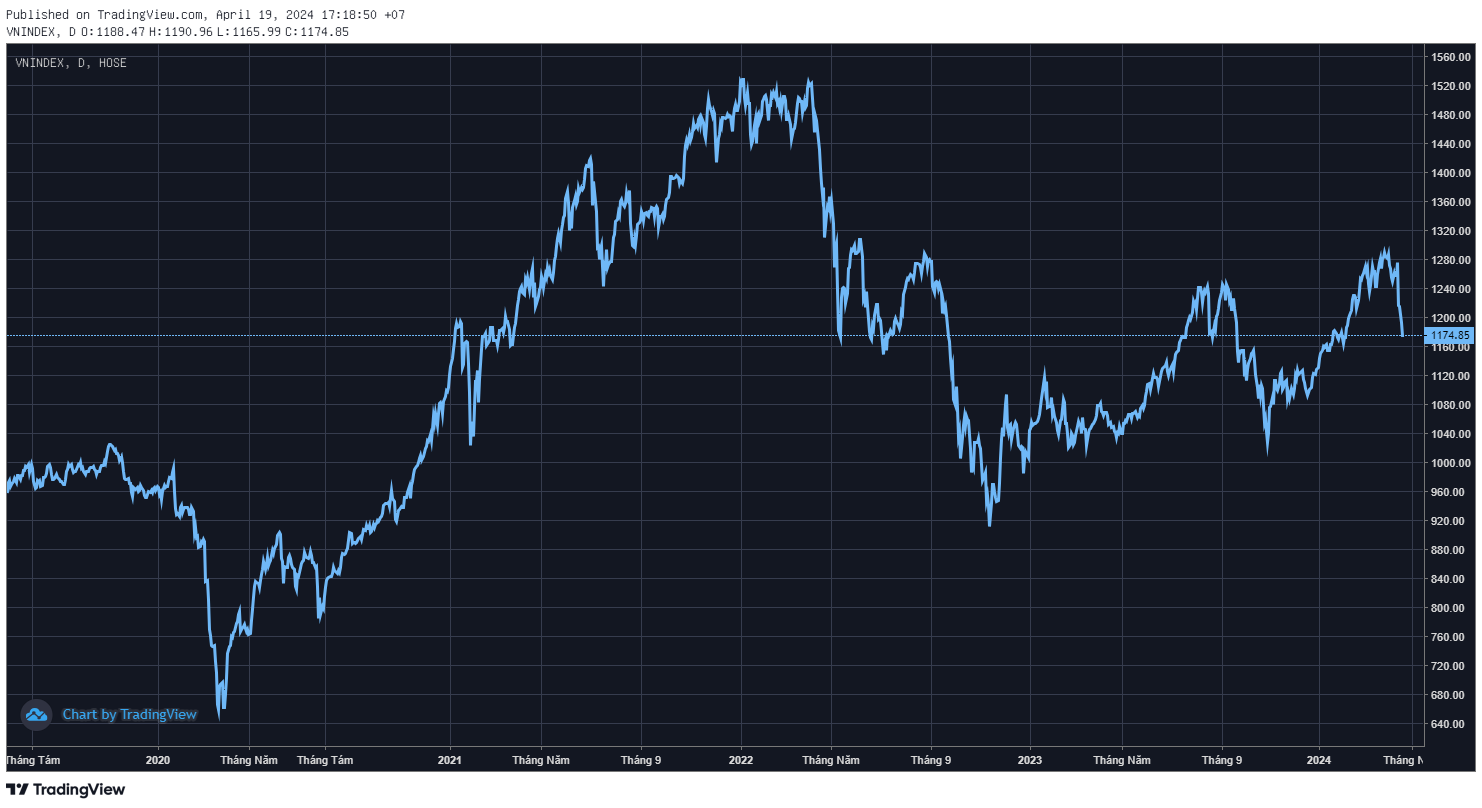

Stock market incurs consecutive days of volatility with more than 100 points loss in just four trading sessions. The factor believed to impact the stock market considerably is the continuously rising exchange rate of USD/VND, surpassing the threshold of 25,000. So, how does the exchange rate factor truly affect the stock market?

USD/VND exchange rate has been continuously escalating since the beginning of the year

Commenting on the issue, Mr. Tran Ngoc Bau – CEO of WiGroup argues that the reason for the market decline is not solely due to exchange rates. The exchange rate factor only serves as a psychological catalyst, reversing the expectations of medium-term investors. In fact, there are numerous factors influencing the short-term correction of the stock market following a period of “exceeding expectations” growth in the past five months, such as global macroeconomic, monetary, and geopolitical signals, and even technical analysis, all of which indicate that the market has entered a risk zone.

VN-Index has witnessed a significant decline in recent trading sessions

Regarding the mechanism through which exchange rates affect the stock market, Mr. Bau believes that if the exchange rate increases by 3-5%, or even more, but remains within the target range committed by the State Bank of Vietnam (SBV), it will not have a significant impact on the stock market. This is because the SBV will not intervene in a way that adversely affects interest rates or the liquidity of the financial system. This is the reason why the VN-Index also performed well during the period when the exchange rate was rising earlier this year.

If the exchange rate reaches a level where the SBV must intervene, it has several tools at its disposal to address the issue, and the impact on the stock market will vary depending on the tool employed. The Wigroup expert outlines four potential scenarios and their respective effects on the stock market.

Firstly, further relaxing the ceiling to allow for a wider range of exchange rate fluctuations. This measure can be implemented in two ways: raising the central exchange rate or widening the fluctuation band. However, this tool will not have a significant impact on the stock market, and its primary effect will be on foreign investment flows (FIIs) on the stock exchange. However, this capital flow accounts for a relatively small proportion, and domestic investors can still “balance” the market if capital inflows remain robust. Nevertheless, this option carries the risk of exacerbating expectations of VND devaluation and, consequently, compelling the SBV to take more drastic actions.

Secondly, if tensions escalate, the SBV will sell USD to intervene through one of two methods: Spot or Forward sales. In the case of Spot sales, USD will be immediately supplied to the market to mitigate exchange rate fluctuations; however, VND will be withdrawn from the market and reduce liquidity in the financial system. Naturally, such a scenario would have a negative impact on the stock market. In the case of Forward sales, the impact will be “less severe” because VND will be withdrawn in the future and the Forward contract can still be canceled. Therefore, investors need to pay close attention to the scale and method of sales in order to assess the potential impact.

Thirdly, if USD sales prove ineffective, raising interest rates may become necessary. Interest rate increases can be categorized into two types: policy interest rates and market interest rates. If the policy interest rate framework is raised, it signifies that the SBV has shifted its policy stance, which would have a significant adverse impact. Conversely, if market interest rates (deposits and interbank rates) are allowed to rise gradually, the impact will likely be less severe. Currently, the SBV is prioritizing the liberalization of market interest rates, and its subsequent actions will be closely monitored.

Fourthly, if the SBV is compelled to sell such a large volume of USD that foreign exchange reserves reach cautionary levels, and interest rates increase on both fronts without resolving the exchange rate issue, the SBV may be forced to halt sales and resort to foreign exchange intervention, requiring businesses to sell a portion or all of their foreign currency to commercial banks to prevent their retention from exacerbating exchange rate pressures. According to the Wigroup expert, such a scenario would have adverse consequences for the stock market, and investors should exercise extreme caution.

“The SBV is currently employing a “dual-pronged” approach, utilizing elements of tools 1, 2, and 3. If the situation does not improve, it will intensify the use of tools 2 and 3. Investors should monitor and adjust their actions accordingly. In my opinion, the SBV is likely to achieve exchange rate stability by effectively utilizing tool 2 and partially utilizing tool 3,” Mr. Tran Ngoc Bau commented.