SC5’s 2024 Annual General Meeting of Shareholders was held on the morning of April 20

|

Having won contracts worth over 1,700 billion in 2023, the 2024 business plan involved a decline

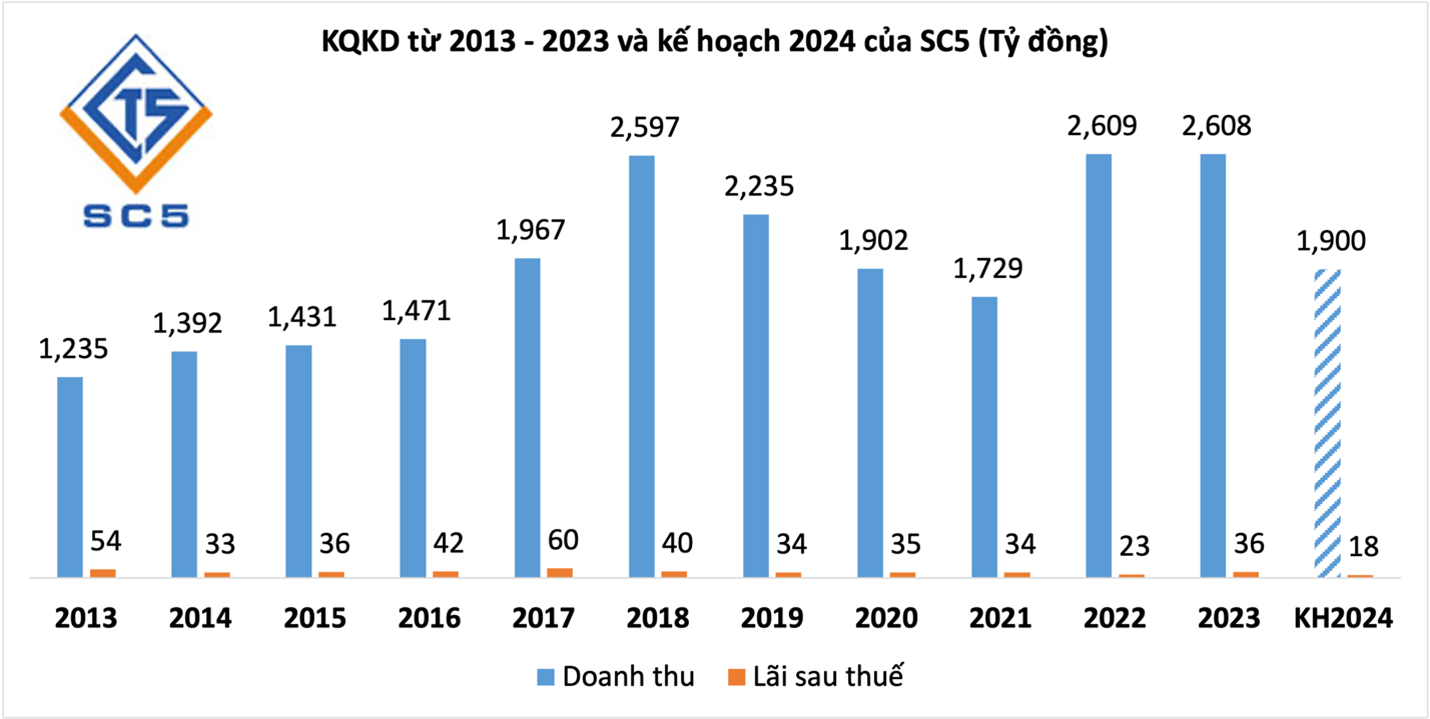

SC5’s General Meeting of Shareholders approved the 2024 business plan with total revenue of 1,900 billion VND, a 27% decrease compared to 2023, with construction revenue accounting for the majority at 1,832 billion VND. Post-tax profit was over 18 billion VND, a 50% decrease, the lowest in over a decade for SC5 since 2013. Shareholders also approved the continuation of a 3% dividend payment in 2024.

|

According to Mr. Nguyen Dinh Dung – Vice Chairman of the Board of Directors and General Director, construction remained the industry facing the most difficulties in the past year. The real estate market had “stalled”, labor costs, fierce competition in finding work, and input materials continued to increase, while previously signed contracts with investors had fixed unit prices, causing the economic efficiency of projects to decline, eroding profits for businesses, and construction companies struggled to operate.

Despite this, in 2023, the Company won contracts for 14 projects with a value of over 1,713 billion VND, ensuring sufficient work for employees and providing a foundation for plans in the following years. These included major contracts such as the contract to supply materials and construct and install the Nguyen Van Linh Water Supply Line 1, District 7, and District 8 (worth over 732 billion VND).

Some other contracts include the contract for construction and installation of equipment for the Lien Chieu District Medical Center (over 103 billion VND); the wastewater collection and treatment system for Tay Ninh City – Phase 1 (141 billion VND); the construction of a wastewater treatment plant and equipment: Development of dynamic cities in Hai Duong City, Hai Duong Province (over 288 billion VND); the environmental sanitation project for Ho Chi Minh City – Phase 2 (nearly 104 billion VND)…

In addition, the Company also continued to complete the implementation of legal procedures for Phase 2 of the Residential Area Project in Phuoc Long B Ward, Thu Duc City; coordinating and supporting customers who had built houses in the planning area of Phase 1 with correct permits to be granted certificates of ownership by the competent state agency, Mr. Dung added.

What does the new Chairman of the Board of Directors have?

SC5’s General Meeting of Shareholders approved Mr. Pham Gia Phu (born in 1996) as the new Chairman of the Board of Directors and Mr. Nguyen Dinh Dung – Vice Chairman of the Board of Directors and General Director for the term 2024 – 2029; the remaining 3 members of the Board of Directors include Mr. Nguyen Kinh Kha, Mr. Pham Van Tu, and Mr. Pham Thanh Van.

In addition, the Supervisory Board was also approved, with Mr. Vu Van Hung – Head of the Board, Ms. Vu Thi Hang, and Mr. Nguyen Kha Tuan (replacing Ms. Le Thuy Thanh Quyen) as members.

Mr. Pham Gia Phu (far right), was elected as the new Chairman of the Board of Directors of SC5

|

It is known that Mr. Phu has a professional qualification of Master – Investment Analyst, he was appointed as a Member of the Board of Directors of SC5 on June 7, 2023, and is the son of Mr. Pham Van Tu (born in 1968, deceased) – former Vice Chairman of the Board of Directors and General Director of SC5. While in office, Mr. Tu was the largest shareholder of SC5 when he owned up to 48.96%, equivalent to more than 7.3 million shares.

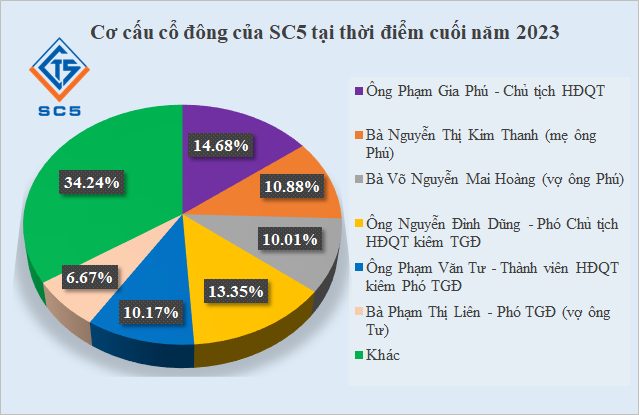

As of the end of 2023, Mr. Phu is also the largest shareholder when he owns more than 2.2 million shares, a proportion of 14.68% in SC5. Ms. Nguyen Thi Kim Thanh (Mr. Phu’s mother) owns more than 1.6 million shares, a proportion of 10.88%, and Ms. Vo Nguyen Mai Hoang (Mr. Phu’s wife) owns 1.5 million shares, a proportion of 10.01%. As a result, Mr. Phu’s family owns almost the majority of shares in SC5 when they own up to 35.57%.

Source: VietstockFinance

|

At the end of the meeting, all submissions were approved.

SC5’s debt payable exceeds 2,100 billion VND

In the audited financial statements for 2023, SC5 recorded revenue of nearly 2,608 billion VND, almost unchanged compared to 2022; net profit was over 36 billion VND, an increase of 62%.

At the end of 2023, SC5’s total assets reached nearly 2,540 billion VND, an increase of 5% compared to the beginning of the year. Most of the assets are in the form of current assets, with over 2,458 billion VND, accounting for 97% of total assets.

This company’s debt also increased by 5% to 2,185 billion VND, accounting for 86% of SC5’s capital, mainly in short-term debt with nearly 2,152 billion VND, accounting for 98% of total debt payable. SC5’s largest creditor is the Joint Stock Commercial Bank for Industry and Trade of Vietnam (HOSE: CTG) – Branch 3 with a sum of nearly 674 billion VND.

Compared to the current equity of over 355 billion VND, SC5’s debt payable is 6.15 times more. This shows that the pressure to repay debts in the short term is extremely high for the company.