SBV’s annual general meeting on the morning of April 22. Photo: KN

|

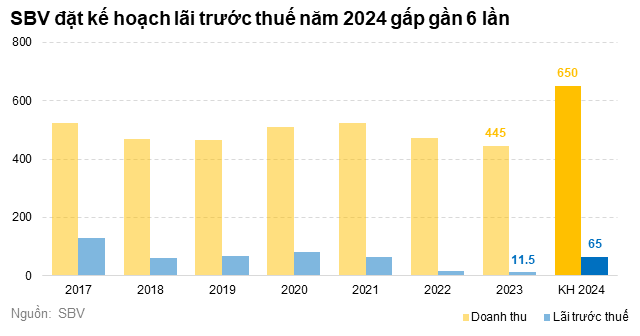

2024 pre-tax profit projected to increase six-fold

Mr. Huynh Tien Viet – Member of the Board of Directors represented the Board of Directors in presenting the company’s performance in 2023. He stated that in the past year, the domestic market was stagnant, fuel costs increased, offshore operations were unstable, and the number of vessels in the market decreased. Specialized agricultural products, such as banana tying cords, also experienced a decline.

Regarding exports, Mr. Viet reported that for existing product lines, there were fluctuations in traditional markets, with some regions affected by high shipping costs and reduced purchasing power.

The company expanded into new markets, signed contracts, but was unable to execute them due to insufficient machinery. For new products (supermarket products), the company is still gaining market and production experience, so they have not yet significantly contributed to revenue. Finally, the civil war in Myanmar last year also impacted SBV’s business operations.

In 2024, the Board of Directors aims to restore exports as planned in the previous year, as they have now acquired sufficient machinery for signed export orders; they will leverage the favorable exchange rate from 2023; reduce financial costs, which will continue to be beneficial from 2023 to 2024; and exploit the potential of certain agricultural cords and commercial products.

The target revenue for 2024 is VND 650 billion, a 46% increase compared to the actual revenue in 2023. Pre-tax profit is targeted at VND 65 billion, a 5.6-fold increase. This plan was approved by the general meeting of shareholders.

In the presentation by Ngo Tu Dong Khanh – General Director of SBV, he also mentioned that the company faced many challenges in 2023. The company failed to meet its planned targets, achieving only 18% of its profit target and 68% of its revenue target.

The company finalized the dividend for 2023 at VND 250 per share, equivalent to 2.5% of the par value. According to a document previously published on the company’s website, the company intended to propose not paying dividends for 2023 to preserve cash flow for the company’s upcoming major investment projects.

General Director Ngo Tu Dong Khanh reporting on the company’s 2023 performance. Photo: KN

|

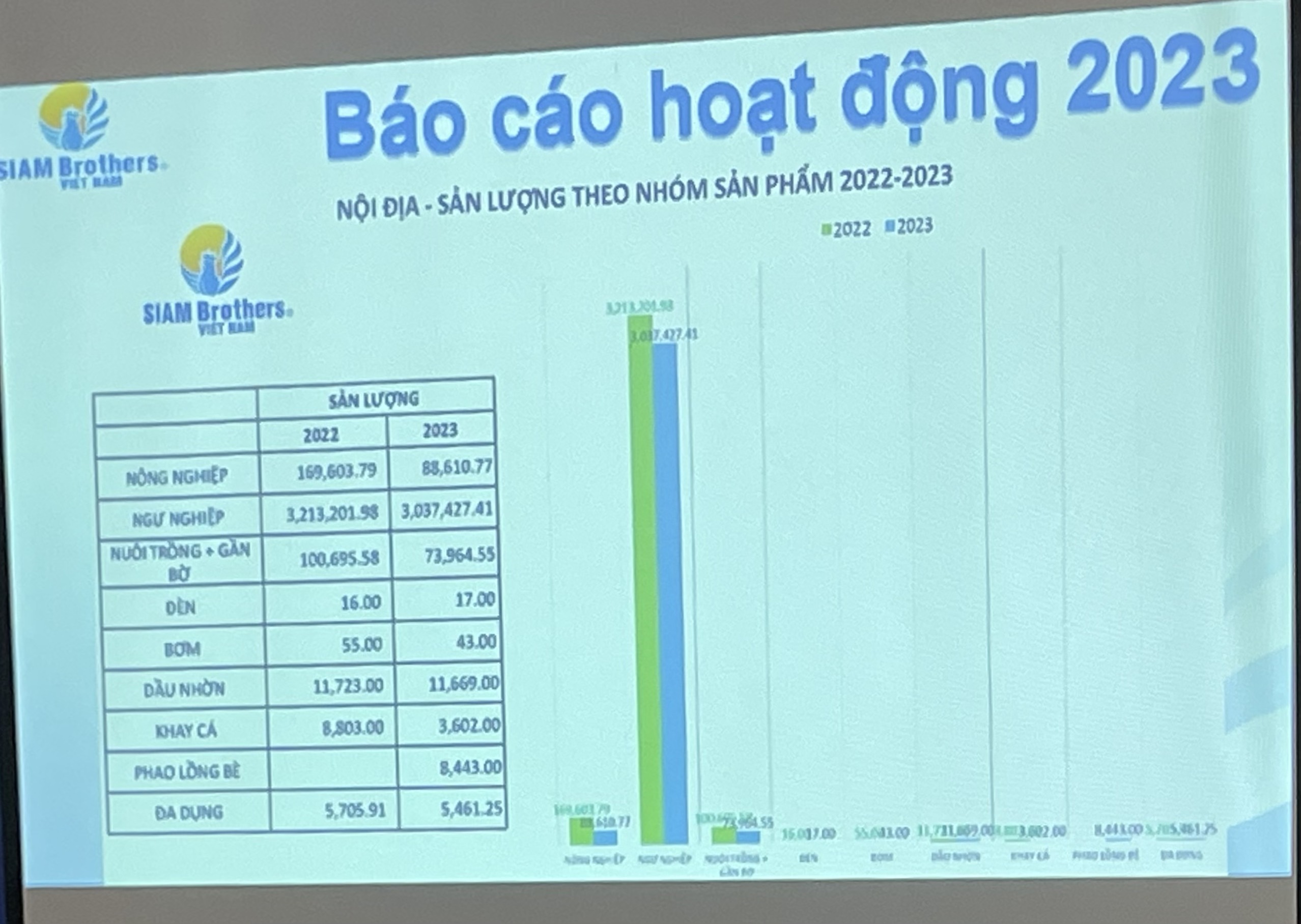

The General Director added that the revenue structure in 2023 did not change much compared to 2022. The sales volume of product groups varied significantly, with the output of cord products declining. Similarly, products for the marine industry, including lamps, pumps, lubricants, and fish trays, also decreased compared to the previous year. The only new product introduced in 2023, cage floats, had a fairly good output and is still under development.

Production volume by product group. Photo: KN

|

In terms of markets, the Southeast Asian market declined significantly due to reduced purchasing power and consumption. In contrast, the company expanded into new markets such as the UK, Australia, the US, Morocco, Costa Rica, and Sweden.

Regarding other business segments, the solar energy segment had revenue of VND 4.7 billion in 2023 and a pre-tax profit of over VND 1.3 billion; the factory rental segment has been operating quite stably since 2021.

The export market is expected to grow rapidly

At the general meeting, Mr. Tran Thanh Long – Acting Commercial Director presented in detail the 2024 revenue growth plan. The target is for exports to account for 47% of revenue (around 38% in the previous year) and they are expected to grow rapidly as SBV’s export market has now reached 30 countries worldwide. The remaining 53% of domestic revenue, SBV is determined to develop products for specific applications, tailored to specific markets.

Mr. Tran Thanh Long – Acting Commercial Director presenting at the general meeting. Photo: KN

|

Specific action plans were also set for each segment. In the fishing segment, the company will standardize transportation costs from the company’s warehouse to the market and implement 2-3 regional warehouses to consolidate and ship orders. In the diversified and agricultural cords segment, the focus will be on building a standardized distribution system.

Regarding exports, he assessed that the current export market is quite positive, with exports to 30 countries and sales to 3 out of 10 major supply chains in the world.

Speaking about cage float products, Mr. Long said that in Vietnam today, this segment is a hot spot, with over 1.3 million wooden cage floats in the market, which are scattered and unstable. Currently, the government is implementing a policy to plan agricultural development with a vision to 2030, and is determined to address this issue.

Currently, SBV is providing a multi-purpose cage float solution that is one of the best options for this direction.

On the other hand, SBV will now standardize its supply plan, which is one of the key issues when focusing on exports, to ensure a stable cash flow. One of these is standardization by SKU; standardization of maximum and minimum inventory levels on a quarterly basis to control production costs and inventory costs; standardization of raw materials; standardization of inventory using FIFO; and finally, coordinating production and sales plans to avoid overstocking.

Implementing a VND 172 billion project to fulfill major contracts

Ms. Diem Quynh reported that based on major contracts and in preparation for receiving orders from customers, SBV presented to the general meeting of shareholders a plan to issue shares to fund the construction of additional factories, which was approved.

The aforementioned project is divided into two phases: phase 1 includes the construction of the entire factory for both phases, and phase 2 equips the factory with a capacity of 3,000 tons.

The total investment for phase 1 is VND 172 billion, with equity accounting for 35%, or VND 60 billion; the remaining VND 112 billion is borrowed capital, accounting for 65% of the total investment. Phase 2 includes additional investment in machinery, which is expected to be implemented in the second year if the business results of phase 1 progress favorably.

The source of funding for phase 1, as mentioned, comes from the issuance of 6 million additional ordinary shares to existing shareholders and/or new shareholders, equivalent to VND 60 billion in charter capital.

Moreover, to facilitate management and meet customer requirements, the company intends to establish a subsidiary with 100% of the charter capital owned by SBV. The subsidiary’s name will include the element “Siam”, the legal form will be a limited liability company (LLC), and the charter capital will be VND 60 billion. The general meeting also approved this proposal.

|

SBV’s plan to establish a subsidiary

Source: Document from SBV’s general meeting of shareholders

|

The general meeting also approved the 2024 Board of Directors’ remuneration,