Domestic Stock Market Suffers Steep Drop

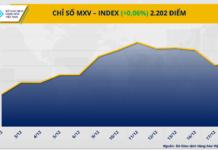

The domestic stock market experienced a significant decline last week, with the VN-Index falling nearly 60 points on the opening day (April 15).

Subsequent trading sessions saw continued losses, resulting in a total drop of 101.75 points (-7.97%) for the VN-Index, erasing the gains made in the first three months of the year. This marks the most significant weekly decline for the VN-Index since October 2022.

”Up the Stairs, Down the Elevator”

According to statistics from Vietnam Construction Securities Corporation (CSI), all 21 industry groups on the market suffered losses.

The most significant declines were seen in sectors such as: securities (-12.59%), industrial parks (-11.31%), and construction (-10.58%).

Meanwhile, “defensive” sectors were less affected, including: aviation (-0.29%), pharmaceuticals (-1.51%), and telecommunications (-2.71%).

A survey by brokerage firms revealed that the market’s sharp decline last week exceeded the expectations of all experts and investors. As a result, many were caught off guard and suffered heavy losses.

Mr. Ngo Quoc Hung, an expert at the Research Division of MB Securities Corporation (MBS), stated that the stock market had begun experiencing difficulties since the beginning of April, with the past week marking the peak. “It can be said that the phenomenon of ‘Sell in May,’ also known as the month of profit-taking, has arrived early.”

The market lost all the gains made over the past five months in just one week. “What investors often say about the market and stocks – ‘going up the stairs, going down the elevator’ – has happened,” Mr. Hung explained.

Domestic stock market drops sharply and rapidly in just 1 week, leading to heavy losses for many investors. Photo: TAN THANH

According to Dr. Le Dat Chi, Head of the Finance – Banking Department at Ho Chi Minh City University of Economics, multiple factors contributed to the sharp decline in the stock market last week, wiping out all the gains from previous months.

Specifically, several negative developments occurred simultaneously, such as record-breaking gold prices and a rapidly rising exchange rate. The pressure from gold prices further fueled the exchange rate, leading to an increase in government bond interest rates. The State Bank of Vietnam issued credit bills to withdraw money, resulting in higher interest rates but a persistent high exchange rate.

Additionally, many investors expressed pessimism as the US Federal Reserve (FED) may reduce its interest rate cuts to only 2-3 times in 2024, instead of the anticipated 4-5 times, due to ongoing inflation concerns in the US. US interest rates remain high, leading to a significant increase in the USD value and putting pressure on the exchange rate in Vietnam.

Moreover, geopolitical tensions in the Middle East, particularly the escalation of the Iran-Israel conflict, have contributed to rising oil prices. This is a significant factor in fueling expectations of future inflation, prompting many to invest in gold and abandon stocks. Investment funds also continued to sell more than they bought, putting pressure on the stock market.

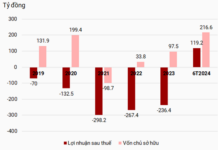

Dr. Le Dat Chi believes that a supporting factor for the stock market at this time is the strong Vietnamese economy, with positive growth indicators in terms of exports, foreign currency reserves, and remittances. Additionally, the promising business results for the first quarter of 2024 reported by listed companies and the upcoming annual general meetings of shareholders in 2024, with many positive announcements, will help investors regain their balance.

Positive Signs Emerge

A positive development for the stock market last week was the return of foreign investors, who net bought stocks worth 680 billion dong in the final trading session when the VN-Index dropped to 1,175 points.

Securities experts believe that from a technical standpoint, this level of the VN-Index may enable the market to find an equilibrium point. According to Mr. Ngo Quoc Hung, with the over 100-point discount in the VN-Index last week, many stocks have lost 20%-30% of their value, making them quite attractive for investors with funds to buy and hold for a medium-term recovery of 3-6 months.

In the short term, most stocks have reached their “oversold” zones. Investors with cash might start selecting stocks that have fallen the most for immediate recovery.

Investors who are unfortunately “stuck with shares,” meaning they hold stocks that have fallen too sharply, may consider the strategy of “catching the bottom” step by step to reduce losses.

“Investors need to carefully select stocks with good potential and attractive valuations. They should divide their investment capital into smaller portions and disburse it in stages to minimize risks.

Those who have not had time to ‘exit the market’ should not be too pessimistic because some positive signs emerged during the final trading session of last week,” Mr. Hung emphasized.

According to Dr. Pham Anh Khoi, CEO of Financial Services and Real Estate (FINA), the difficulties faced by the stock market continue to be issues related to