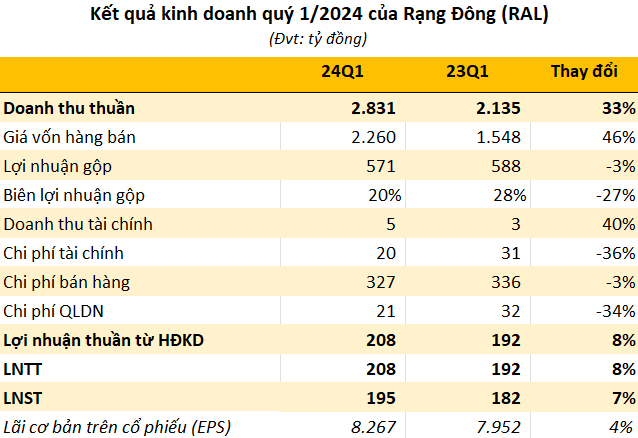

Rang Dong Light Source and Vacuum Flask Joint Stock Company (RAL) has published its Q1 2024 financial statements. In the reporting period, the company recorded net revenue of VND 2,831 billion, an increase of 33% compared to the same period last year. However, the cost of goods sold increased by more than 46%, causing gross profit to decrease by about 3% year-on-year to VND 571 billion, and the gross profit margin narrowed from 28% to 20%.

In the first quarter of the year, financial revenue was about VND 5 billion, up 40%, while financial expenses decreased by 36% to VND 20 billion (more than VND 19.8 billion is interest expense). Selling and administrative expenses were VND 327 billion and VND 21 billion, respectively, down 3% and 34% compared to Q1/2023.

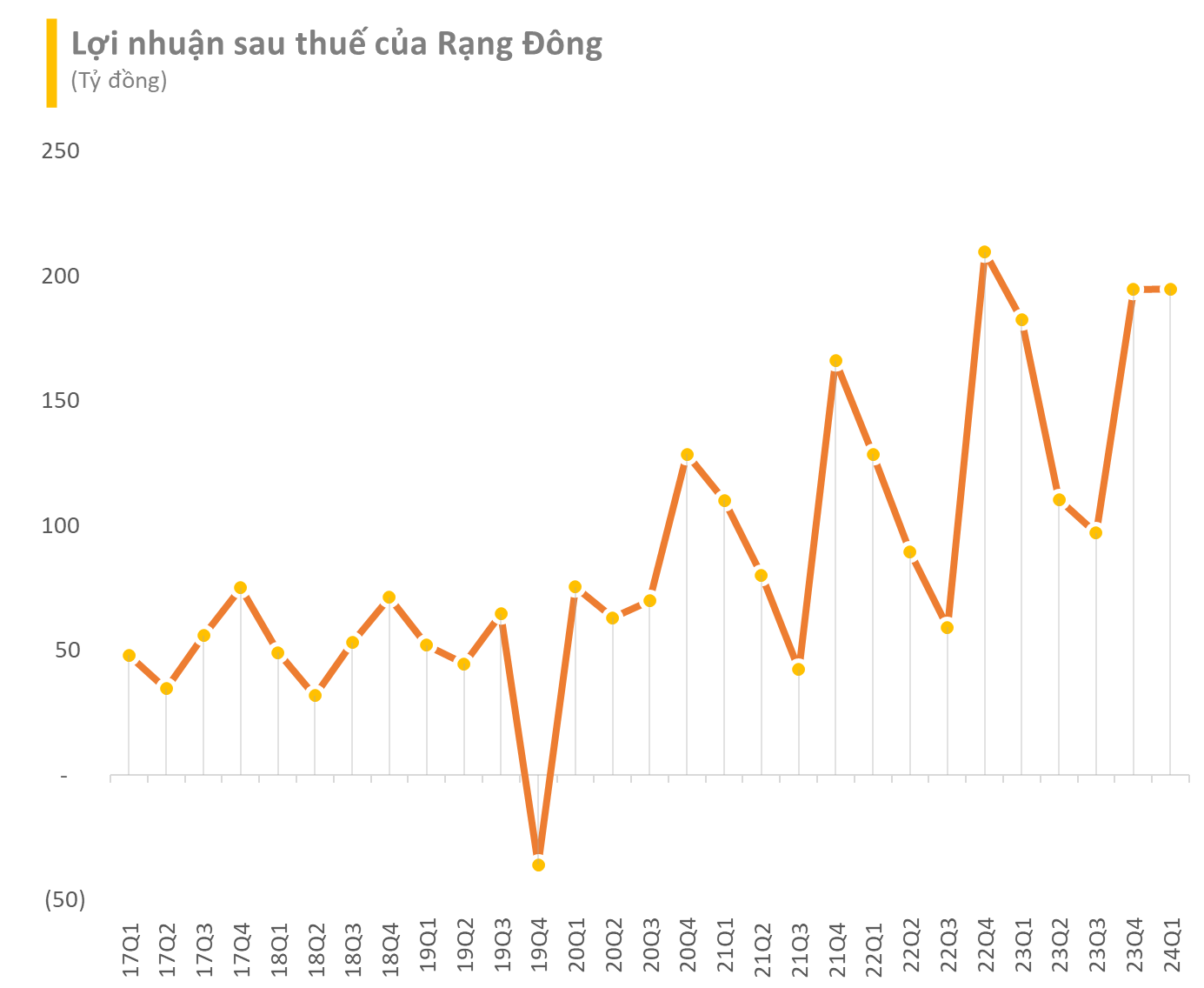

As a result, Rang Dong Light Source reported a pre-tax profit of VND 208 billion in Q1, up 8% compared to Q1/2023. After-tax profit increased by 7% to VND 195 billion, with EPS in Q4 reaching VND 8,267.

As of March 31, 2024, RAL’s total assets reached VND 8,840 billion, an increase of about VND 1,100 billion (+14%) compared to the beginning of the year. In which, the enterprise has VND 1,269 billion in cash, nearly VND 5,641 billion in short-term receivables, an increase of VND 421 billion compared to the beginning of the year; inventory is valued at more than VND 1,428 billion.

Total liabilities increased by VND 894 billion compared to the beginning of the year to VND 5,671 billion, almost all of which are short-term debts. Short-term loans are approximately VND 3,490 billion. Equity reached VND 3,169 billion, including more than VND 720 billion in retained earnings after tax.

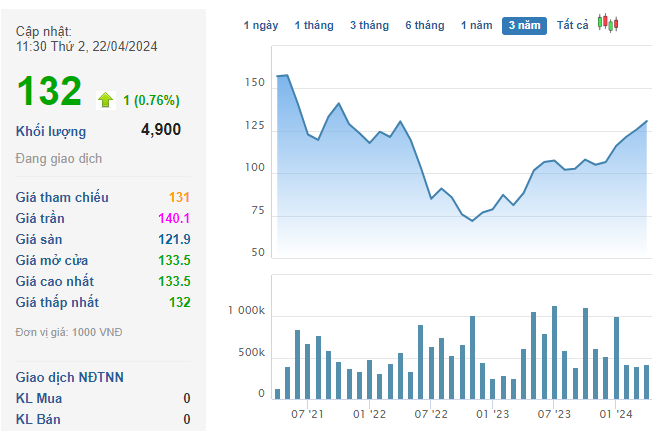

Regarding RAL, the light bulbs and vacuum flasks produced by the company are a familiar brand from the subsidy period for many generations. In addition to “living well” after decades, this legend has also recorded impressive growth in stock price.

In the past, the stock price of RAL has been increasing well. It is currently trading around VND 131,000/share – the highest price range in the past year. Since the beginning of 2024, this stock has increased by more than 21%, with a market capitalization of over VND 3,100 billion.

In related news, on April 25, Rang Dong Light Source and Vacuum Flask will close the final registration list to attend the 2024 annual General Meeting of Shareholders (AGM) scheduled for May 25 and pay the second interim dividend for 2023 at a rate of 25% (01 share receives VND 2,500).

With 23.5 million shares outstanding, Rang Dong will spend nearly VND 59 billion to pay interim dividends to shareholders. The payment date is expected to be May 9, 2023.