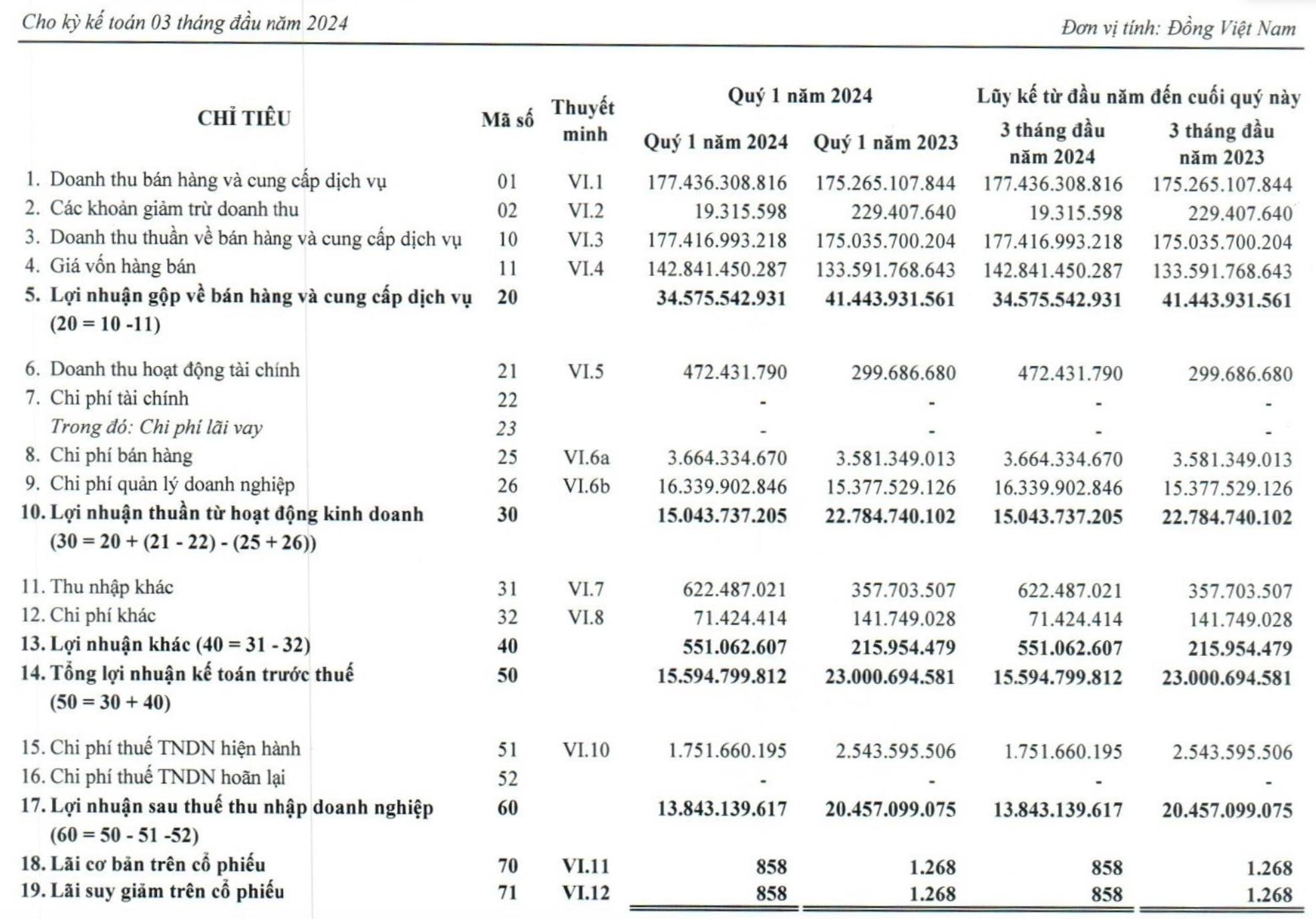

Tam Duc Heart Hospital JSC (code TTD) has just announced its financial report for the first quarter of 2024 with revenue reaching over VND177 billion, a slight increase compared to the same period last year. After deducting expenses, Tam Duc Heart Hospital reported a post-tax profit of VND13.8 billion, a decrease of nearly 33% compared to the first quarter of 2023. This is the lowest profit level in the past eight quarters of this enterprise.

In 2024, Tam Duc Heart Hospital plans to do business with the target of total revenue reaching VND700 billion and after-tax profit of VND82 billion, both slightly decreasing compared to the previous year. With the results achieved after the first quarter of the year, the enterprise has only achieved 25% of the revenue plan and 17% of the profit target for the whole year.

In 2023, Tam Duc Heart Hospital recorded revenue of nearly VND742 billion, a slight increase of over 2% compared to 2022. Post-tax profit decreased by 10% compared to the same period, down to VND83 billion.

However, Tam Duc Heart Hospital surprisingly proposed to shareholders to increase the cash dividend from 30% to 33%. The enterprise has provisionally paid in two installments in August 2023 and January 2024. If approved, Tam Duc Heart Hospital will have one more cash dividend payment with a rate of 13%. In 2024, the enterprise also plans to pay dividends at a rate of 33%.

Tam Duc Heart is a rare hospital with shares traded on the UpCOM exchange, besides Thai Nguyen International Hospital (code TNH) listed on HoSE. This stock is currently trading at around VND77,900 per share with very low liquidity, only a few hundred to a few thousand units per session. Major shareholders mainly hold for the long term to receive dividends and do not have the need for short-term trading.