Years of punditry and expert opinion have favored all-electric vehicles over hybrids, with frequent disparagement of automakers slow to embrace what has been seen as the automotive future. But with Toyota’s hybrid success story undermining the EV narrative, one vocal critic has been forced to say, “ mea culpa. ”

The Toyota Prius was the world’s first mass-produced hybrid car.

“I Owe Toyota an Apology”

When Toyota first invested billions in the hybrid technology it pioneered, investors and environmental advocates alike lined up to denounce it.

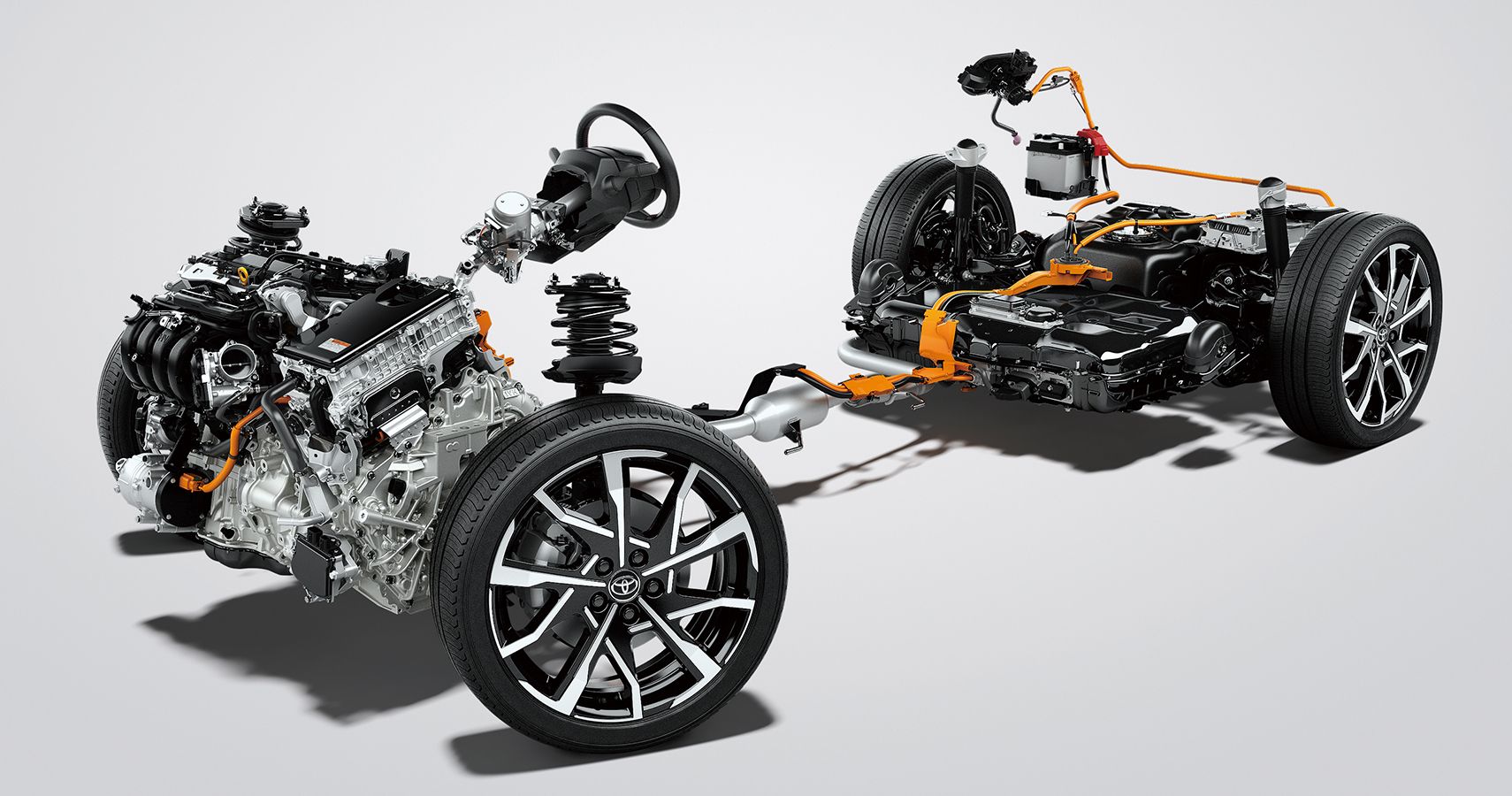

Hybrids are gasoline-powered vehicles that add an electric motor to the powertrain. Hybrid systems vary by the degree to which the electric motor is allowed to power the vehicle. Hybrids can be arrayed on a spectrum of increasing capability: Mild Hybrid → Full Hybrid (also known as a self-charging hybrid)→ Plug-in Hybrid.

Toyota bet that consumers would balk at the high cost of electric vehicles. Now, not only are EVs expensive, but a lack of charging infrastructure has even the most ardent EV enthusiasts cooling on the technology; a shift visible in markets from Europe to the U.S. where EVs were expected to thrive.

Against this backdrop, auto analyst Adam Jonas, head of global auto and shared mobility research at investment bank Morgan Stanley, has retracted his previous statements.

Morgan Stanley auto analyst Adam Jonas.

Jonas had been confident that government regulations would force the adoption of EVs. He also believed that consumer appetite for EVs would be so strong that hybrids would go the way of the dodo.

But in a recent note to clients, Jonas confessed, “Mea culpa. From 2019 through much of 2021 we forecasted Hybrid Electric Vehicle share losses driven by regulation, EV preference, and consumer adoption. We were wrong. HEVs are proving to be a viable transition technology and a potential share gainer in 2024.”

Hybrids Are “Having a Moment”

While demand for EVs has grown over the last three years, according to data from Jato Dynamics, market share has actually declined in markets like the UK, and growth has slowed in the U.S. and Europe.

The slowdown in EV growth has vindicated Toyota’s doggedly held position: Toyota sold 3.4 million hybrids in 2023, up nearly a million units year over year. That helped the company earn an operating profit of $33 billion.

As mentioned above, these three types of hybrids vary primarily in the power of their electric motors, the size of their battery packs, and thus the extent to which they can operate independently of the gasoline engine. While a plug-in hybrid can often travel dozens or even hundreds of miles on electric power alone, a mild hybrid typically provides only limited assistance during start-up and acceleration.

Unsurprisingly, the cost of these hybrid models scales with their capabilities. Toyota’s preferred full hybrid system employs a relatively small battery, but enough to make a significant contribution to fuel economy while allowing the gasoline engine to remain the primary source of power. That makes full hybrids more affordable and less disruptive to use.

The Honda CR-V was the best-selling hybrid in the U.S. in 2023.

The big money automakers had bet their futures on capturing value in the electric vehicle space, or at least breaking even. While that remains the long-term goal, the unexpected strength of hybrids has prompted a change of plans. In the U.S., the hybrid market has been dominated by Toyota, Honda, Hyundai, and KIA. Now, however, domestic automakers are scrambling to catch up.

General Motors, which had mostly phased out its hybrid offerings, announced last month that it would resume selling them, acknowledging that consumer readiness for EVs is taking longer than expected.

Ford similarly projects that its hybrid sales will increase by 40% this year — double the growth rate of 2023. One of the most notable hybrid success stories in the Ford lineup is the Maverick compact pickup. It was the fifth best-selling hybrid in the U.S. in 2023, trailing only Toyota and Honda products.

The Ford Maverick comes standard with a hybrid powertrain.

“Our data tells us that while the EV is where the puck is going…it’s taking longer than we anticipated maybe 18 months ago,” Ford CEO Jim Farley told investors. “The role of the hybrid is getting bigger as a bridge in the transition for the industry, and it’s going to be a bigger part of our long-term portfolio.”

“Hybrids Aren’t So Bad After All”

Jessica Caldwell, an analyst at Edmunds, notes that hybrids were once considered “unsexy, uncool,” and were not seen as a necessary step in the transition from gasoline to electric. Today, it has taken some serious backpedaling for carmakers to change this narrative.

Hybrids allow manufacturers to reduce carbon emissions while easing the transition away from internal combustion engines, which have powered the industry for over a century. Meanwhile, full hybrids have proven highly profitable, often delivering double-digit margins, outperforming both gasoline-only vehicles and plug-in hybrids, and blowing away EVs.

Noting the positive impact that hybrids can have, Stellantis CEO Carlos Tavares has argued that increasing sales of EVs to green-minded consumers while also selling more hybrids “could make a very, very positive footprint on the planet.”

Hybrid powertrains can significantly improve fuel economy.

For its part, Toyota’s stock price has increased by 80% over the past year as a result of the company’s success with hybrids. In contrast, shares of Tesla, the world’s leading EV maker, have declined by about 5% over the same period.

Jaguar Land Rover, a laggard in the EV space, has benefited from its focus on hybrids during the EV slowdown. While a fully electric version of its flagship Range Rover is set to arrive later this year, the automaker’s hybrids will help the company meet U.K. emissions targets.

Still, Macquarie auto researcher James Hong warns that automakers should be careful