Vietnam Market Trades Sideways as Tech Stocks Provide Support

After reclaiming the 1,200-point mark, the VN-Index witnessed a slowdown in its upward momentum. Investor sentiment dampened compared to the previous session, with caution prevailing amid sluggish liquidity. The benchmark index fluctuated around the reference point, briefly dipping below the 1,200-point threshold.

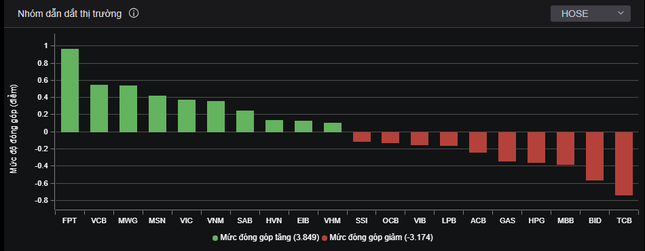

The headline index closed marginally lower by less than 1 point, yet on the HoSE, close to 300 securities declined in value. The VN30-Index remained in the green, but the number of decliners held the upper hand, with 16 constituents in the red.

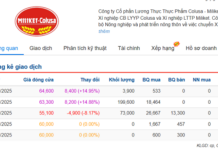

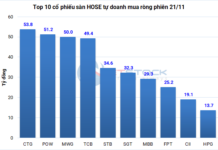

The technology and retail sectors continued their pillar role in supporting the market, with MWG and FPT emerging as the top gainers. MWG was the only stock to surpass VND1 trillion in transaction value, hitting VND1.023 trillion. Meanwhile, liquidity in FPT ranked second with VND708 billion. Capital inflows into MWG and FPT significantly outpaced the overall market, eclipsing other high-volume stocks such as DIG and MSN, which traded below VND400 billion.

FPT continues to lead the market’s advance.

FPT approached its ceiling price during the session, touching VND128,000 per share, but its upward momentum cooled towards the end of trading, closing at VND123,200. The rally in FPT shares gained traction following the announcement of a collaboration with NVIDIA. Additionally, MSN closed 1.8% higher on the day Masan held its shareholders’ meeting in Ho Chi Minh City. Plans for this year’s revenue target of VND90,000 and an IPO of its consumer goods company were among the key topics discussed.

Market heavyweights such as banks, securities firms, construction, materials, oil and gas, and chemicals witnessed a predominantly red performance. The market lacked the impetus from the largest sector by capitalization – banking.

Amid the lackluster and fragmented trading environment, large-cap stocks corrected, while certain penny stocks experienced an upswing. QCG surged to its ceiling price of VND15,900 per share. Over the past month, Quoc Cuong Gia Lai’s stock has climbed by 45%, frequently trading at its upper limit.

At the market close, the VN-Index lost 0.64 points (0.05%) to 1,204.97 points. The HNX-Index declined by 0.3 points (0.13%) to 227.57 points. The UPCoM-Index shed 0.04 points (0.05%) to 88.33 points. Liquidity plummeted, with the HoSE transaction value falling to just over VND12,100 billion.