PAN’s Annual General Meeting Highlights Return to Dividend Payments and Ambitious Growth Targets

Online

Mr. Nguyen Duy Hung – Chairman of the Board of Directors of PAN chaired the company’s 2024 Annual General Meeting of Shareholders held on April 26 in Hanoi. Photo: The Manh

|

According to the vote counting minutes, as of 2:00 PM on April 26, the 2024 Annual General Meeting of Shareholders of PAN was attended by 174 shareholders, representing 55.85% of the total voting shares. The General Meeting met the quorum requirements.

Opening the meeting, Ms. Nguyen Thi Tra My – Member of the Board of Directors and General Director of PAN expressed her pride that six years ago, PAN had less than 1,500 shareholders, and now that number has increased by more than 11 times. Revenue and profit have increased by 3.3 times and more than 4 times, respectively. This is the result of the efforts of nearly 11,000 employees of PAN Group.

“We believe we will overcome difficulties. Difficulties are our companions, and unity will help us overcome them and make our mark“, emphasized the CEO of PAN.

Giving an update on the business results for Q1/2024, PAN recorded consolidated net revenue of 3,462 billion VND and profit after tax of 168 billion VND, increasing by 37% and 58%, respectively, compared to the same period last year. Net profit increased by 109% to nearly 84 billion VND. Thus, after the first quarter, the Group achieved 23% of its revenue target and nearly 19% of its net profit target.

Resuming dividend payments after two years, rewarding shareholders with rice and fish sauce

Before the General Meeting, PAN announced incentive policies to attract investors to attend the meeting with its “homegrown” products. Accordingly, the Company will continue to implement its gift program for shareholders holding at least 25,000 PAN shares, as of the closing date of March 27, 2024.

The gifts include products manufactured by PAN, such as: 50 kg of Vinaseed rice, 6 bottles of 584 Nha Trang premium fish sauce, a gift box containing Lafooco cashew nuts and dried fruit, Bibica candy and biscuits, and SHIN coffee.

It is worth recalling that in mid-2021, Ms. Nguyen Thi Tra My – General Director of PAN stated: “Shareholders are the true owners of the Company and should enjoy its products. Therefore, PAN Group will implement a gift program consisting of agricultural and food products. Sincere gratitude is more valuable than any material value“.

This is the fourth consecutive year that PAN shareholders have received gifts of “homegrown products” at each Annual General Meeting since 2021. Despite offering these shareholder incentive policies, PAN has not paid dividends in 2021 and 2022 in order to reserve resources for capital allocation and investment for development.

However, with the record profit in 2023, PAN plans to submit to the AGM the approval of a cash dividend payment plan at a rate of 5% (for every 01 share owned, shareholders will receive 500 VND), corresponding to an estimated disbursement of over 104 billion VND.

Regarding the profit distribution plan for 2024, PAN also proposed a cash dividend payment of at least 5%.

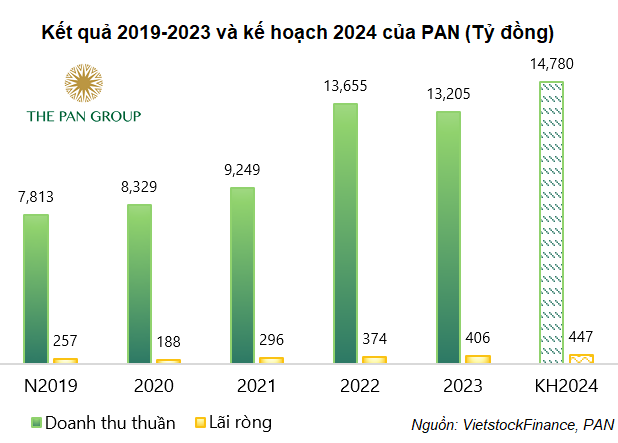

Net profit target of 447 billion VND in 2024

In 2024, PAN targets consolidated net revenue of 14,780 billion VND and profit after tax of 882 billion VND, increasing by 12% and 8%, respectively, compared to the previous year. Net profit is projected to reach 447 billion VND, an increase of 10%. If the plan is successfully implemented, these will be record highs in the Company’s operating history.

PAN’s management team said that the 2024 plan was developed with a relatively conservative scenario in the context of the economy still facing many difficulties, such as inflation and interest rates in Vietnam’s major export markets, including the US and the EU, remaining high, leading to a lack of clarity in consumer demand and orders from these markets. Meanwhile, the domestic market is only just beginning to recover after two years of COVID-19 in 2021 and 2022.

“In a more positive scenario, we expect both the export market and the domestic market to rebound strongly in the second half of 2024, leading to higher-than-expected growth in PAN’s business segments”, said a Company representative.

Looking at each core business segment, first, agriculture (including crop seeds, food grains, plant protection products, and disinfection) is expected to maintain good revenue growth, but profit may increase at a lower rate due to the impact of input price fluctuations, higher purchasing prices, and exchange rate increases. In addition, the El Nino phenomenon is also affecting the crop, fruit, and tree planting seasons and indirectly impacting the consumption of plant protection products.

However, the packaged rice segment is likely to continue to perform well as rice prices remain high, which will partially offset the risks and challenges in the crop seeds and agricultural chemicals segments.

In the packaged food sector, the confectionery segment continues to grow well, following the recovery momentum from the end of 2023, combined with the growth driver of increased exports. Revenue growth is targeted at 15%, while profit before tax is expected to increase by a single-digit percentage, with the estimated higher input material prices in 2023.

Meanwhile, the export nuts segment targets a 10-15% growth in revenue and profit. In 2024, it is expected to fully restore sales to traditional customers and expand the Japanese market as well.

In the aquaculture sector, PAN believes that there will not be a rapid recovery, at least in the first half of the year, due to continued high inflation in major consumer markets such as the US and the EU, and order recovery being slower than expected.

In the shrimp segment, revenue growth is planned to be single-digit, but profit before tax is expected to be higher by 12-15%, due to the expectation of higher profit margins from fully utilizing the self-cultivated pond area and the easing of transportation and feed costs.

In the tra fish segment, which is heavily impacted by the export market situation and the lack of significant improvement in export prices, revenue and profit are expected to increase by a single-digit percentage.

Discussion:

After talking about the challenges, let’s share some specific opportunities for businesses in this situation.

Ms. Tran Kim Lien, Chairman of the Board of Directors of Vinaseed: As the saying goes, “every crisis holds an opportunity,” we, as business leaders, will always look for opportunities and always see more opportunities than risks.

In times of difficulty, especially after COVID, we need to find solutions to adapt to changing consumer habits, such as communication solutions, organizing sales distribution channels, and new consumer trends. Although I am getting older, I can still see many opportunities in the market; the important thing is to choose the right ones that fit our needs.

In the crop seed industry, we are operating a value chain, starting from 2024 we will be operating a sustainable food development solution package, and seeds are just one of those solutions. We are building an end-to-end value chain, optimizing intermediate processes to maximize profit.

A great opportunity for Vinaseed is the process of changing land laws, changing agricultural production methods, and changing crop