Novaland Investment Group (stock code: NVL) has just announced its business results for the first quarter of 2024 with revenue of VND 697 billion, an increase of 15.4% compared to the same period last year. After deducting the cost of goods sold, the company’s gross profit increased by 27.3% to VND 189.7 billion.

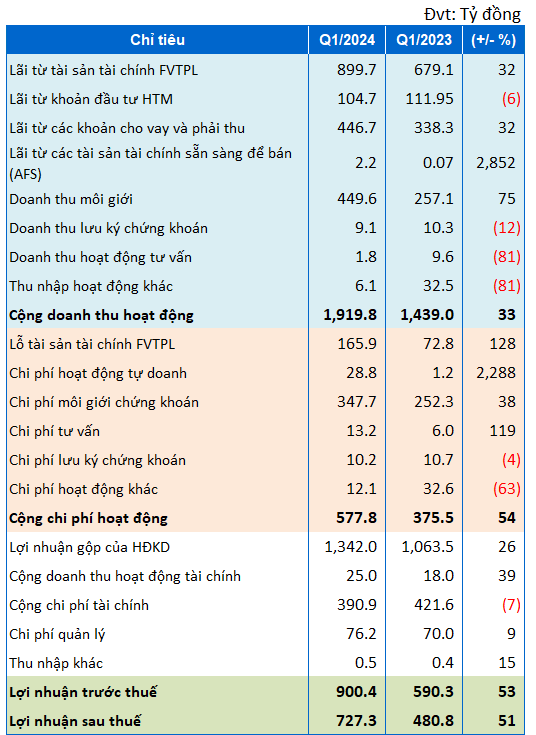

Novaland‘s financial revenue reached VND 640 billion, a decrease of 30.4%. However, financial expenses remained high, at VND 773 billion. Of which, Novaland only had to pay VND 75.4 billion in interest, the remaining financial expenses mainly came from foreign exchange difference losses (VND 452 billion) and interest expenses from investment cooperation contracts (VND 241 billion).

The foreign exchange difference loss came from the revaluation of loans, bonds and other items in foreign currencies.

Other expenses of this real estate company also increased compared to the same period last year. Despite still recording other income of VND 107.4 billion from collecting contract violation fees, Novaland still reported a pre-tax loss of VND 213.7 billion, while in the same period, the loss was only over VND 87 billion.

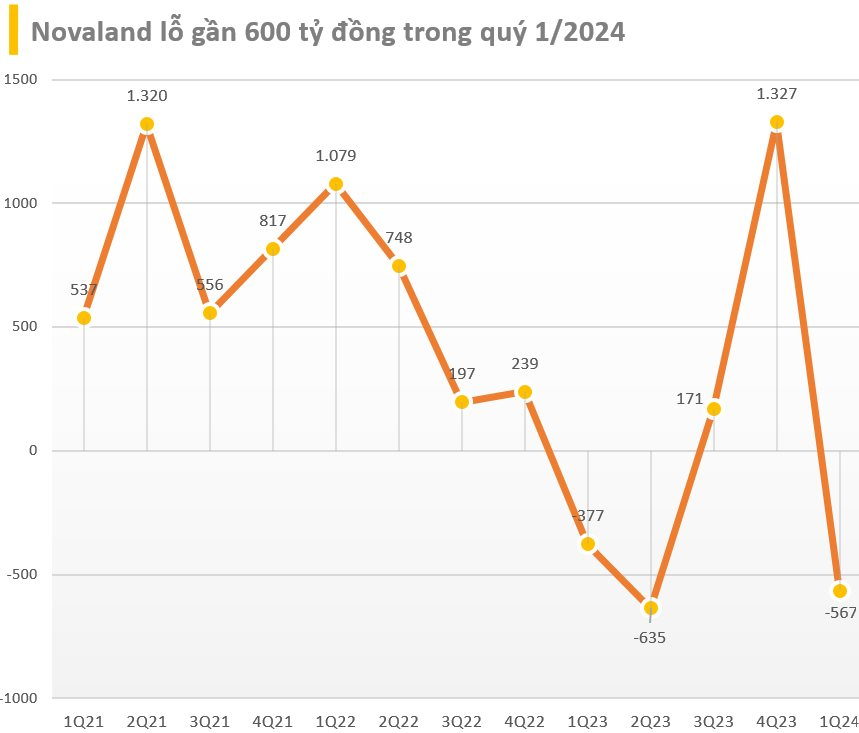

Not only that, this real estate company also had to pay more than VND 387 billion in taxes in the last quarter. As a result, Novaland’s net loss was VND 567 billion, while in the same period, it was VND 377 billion.

As of March 31, Novaland’s total assets reached VND 236,480 billion, a decrease of more than VND 5,000 billion compared to the beginning of the year. Of which, inventory accounts for nearly 60% of the enterprise’s assets, at VND 140,881 billion. The second largest part in the asset structure of this enterprise is VND 43,250 billion, a decrease of 8%.

Novaland’s financial debt was VND 58,232 billion, but the company only had to pay VND 75.4 billion in interest in the last quarter. Owner’s equity reached more than VND 44,700 billion, of which VND 12,927 billion was retained earnings after tax.

In 2024, Novaland also sets a target for next year to bring in VND 32,587 billion (about USD 1.3 billion) in revenue; VND 1,079 billion in profit after tax, an increase of 585% and 122% compared to the same period last year, respectively. The company also has no plan to pay dividends in 2024.

In 2023, the company will continue to invest and hand over key projects such as The Grand Manhattan in District 1, Aqua City in Dong Nai, Nova World Phan Thiet, NovaWorld Ho Tram in Vung Tau…