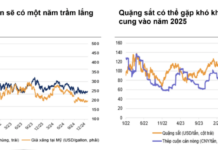

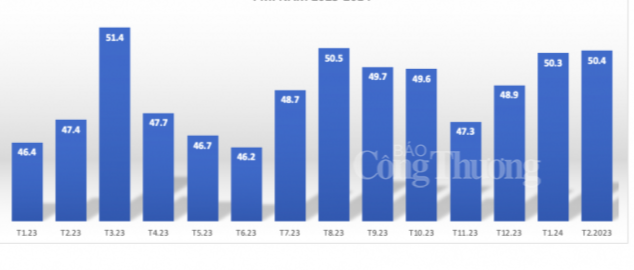

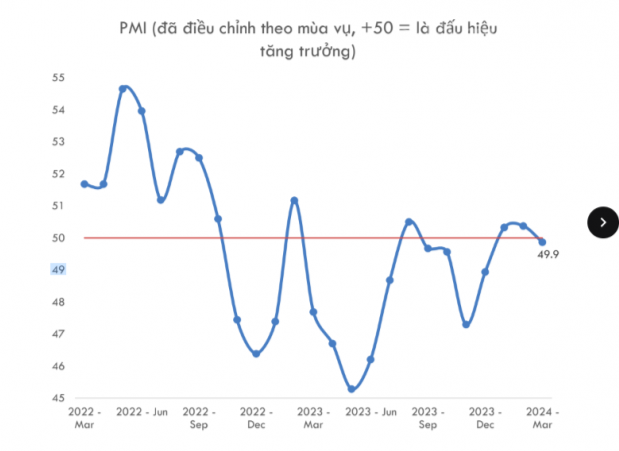

Vietnam’s Purchasing Managers’ Index (PMI) rose from 48.9 in December 2023 to 50.3 and 50.4 in January and February 2024, respectively. However, in March 2024, the index fell back to 49.9 points.

Dorsati Madani – Senior Economist, World Bank

In a report titled “Vietnam Economic Update” released in April 2024, the World Bank stated that Vietnam’s Purchasing Managers’ Index hovered around the 50-point mark, indicating that economic growth had yet to pick up.

According to Dorsati Madani, Senior Economist at the World Bank: “Vietnam’s Purchasing Managers’ Index hovering around the 50-point mark indicates short-term uncertainty, mainly related to the lackluster performance of exports, suggesting that there is some promise for exports, but the recovery has been slow and uneven across subsectors.”

“For instance, the computer industry is doing well, but some manufacturing sectors, such as leather and footwear, have not yet recovered,” Madani added.

Commenting on the PMI, economist Nguyen Dinh Cung, former director of the Central Institute for Economic Management (CIEM) under the Ministry of Planning and Investment, said: “PMI is an economic indicator used to measure activity in the manufacturing and services sectors. In 2023,

Vietnam

only had PMI above 50 in March and August, with the remaining months falling below 50. In 2024, the PMI was above 50 in January and February, but fell below 50 in March. This indicates a contraction in manufacturing activity.”

Earlier, S&P Global also released a report on Vietnam’s Manufacturing PMI for March 2024. According to the report, after a slight improvement in the first two months of the year, business conditions in Vietnam’s manufacturing sector remained largely unchanged in March 2024. Both output and new orders declined, while weaker demand led to a slower increase in input costs and a decrease in selling prices. With a reading of 49.9, the report suggests that the index has signaled an end to the two-month period of improving business conditions at the start of the year.

PMI in 2023 and the first two months of 2024

There are also signs of weak demand in March 2024, with new orders declining despite discounts on goods to boost sales.

“As new orders fell, companies reduced production in the latter part of the first quarter after increasing it in January and February. However, the decline in production was marginal, and was confined to producers of intermediate goods, while manufacturers of consumer goods and capital goods continued to register growth,” the S&P Global report said.

According to economists at the World Bank,

Vietnam’s

GDP growth could reach 5.5% in 2024 and rise to 6% in 2025. This is considered a fairly positive growth rate given the uncertain global economic outlook. However, this growth rate has not yet recovered to pre-COVID-19 levels of 6-7%. Notably, the growth drivers of public investment, consumption, and exports have yet to show signs of a solid recovery.

Regarding the growth outlook, a World Bank representative said that global growth was projected to moderate to 2.6% in 2023 and 2.4% in 2024, before picking up to 2.7% in 2025. Meanwhile, US growth was forecast to be 2.3% in 2024, down from 2.4% in 2023, and then reach 1.7% in 2025. The EU is projected to recover gradually to 0.7% in 2024 and 1.5% in 2025.

Dorsati Madani said that Vietnam’s three main export markets are China, the United States, and Europe. However, these three economies are not expected to show much improvement in 2024, which will affect Vietnam’s export prospects.

PMI dropped to 49.9 in March 2024 after two consecutive months of rising above 50

In order to boost

economic

growth in 2024, the World Bank expert suggested that Vietnam’s macroeconomic policies should be adjusted in line with the domestic and international economic context. In particular, promoting public investment to stimulate economic recovery in the short term is a matter of concern. However, public investment should focus on projects that have a spillover effect on growth, such as transport infrastructure and logistics. These projects will have a positive impact on economic growth recovery in the long term.