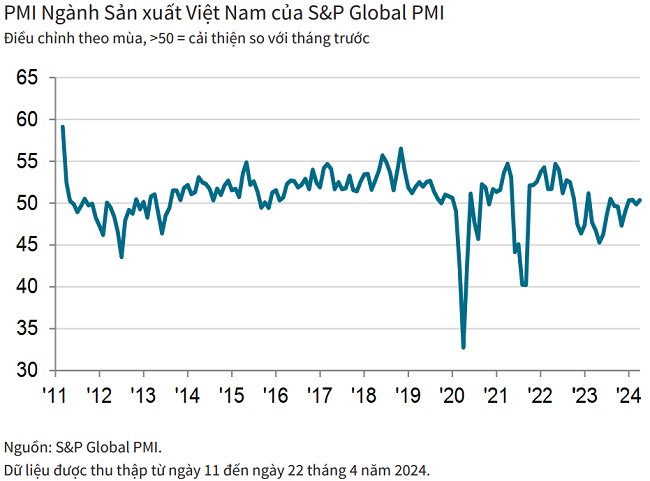

Vietnam’s Manufacturing Sector Growth Resumes Amidst Order Influx

On the morning of May 2, S&P Global released its Vietnam Manufacturing Purchasing Managers’ Index (PMI) report for April 2024. The report highlights three key observations: renewed production growth driven by new orders, a second consecutive month of price declines, and the first job shedding in three months.

The report suggests a rebound in Vietnam’s manufacturing sector in April, as new orders surged, boosting production output. However, companies reduced staffing levels, and business sentiment deteriorated. Input costs continued to rise but at a slower pace, enabling manufacturers to pass on discounts to customers to attract new orders.

According to S&P Global, a key positive from the survey was that new orders rebounded, and the increase was robust after a modest decline in the previous month. Moreover, the pace of expansion was the strongest since August 2022. Panel members cited improved market demand and success in winning new clients.

New export orders also picked up but only modestly and remained below the overall increase in new orders.

Another factor contributing to manufacturers’ increased new orders was a second consecutive monthly decline in output prices as they competed on price and accommodated customer requests for discounts. The rate of reduction in prices was the strongest in nine months.

Companies discounted prices despite a further increase in input costs, albeit a softer one, which allowed firms to lower their selling prices without putting too much pressure on profit margins. Where input costs did rise, panel members reported higher oil and transportation costs. There were also some mentions of increases in sugar prices.

The sharp rise in new orders led to a renewed expansion in manufacturing output in Vietnam. However, the pace of growth was only modest.

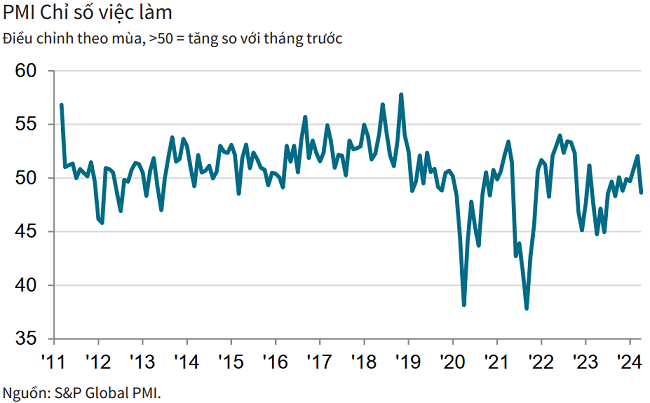

Despite the gains in new orders and production in April, ongoing weak demand conditions forced companies to reduce their staffing levels for the first time in three months, often achieved by laying off temporary workers.

However, with new orders picking up again, the drop in staffing levels strained companies’ abilities to complete orders on time. As a result, backlogs of work increased for the first time in three months, although the rise was only fractional.

Purchasing activity rose for the first time in six months in response to higher new orders, but the increase was only modest as companies remained hesitant to build up stocks. In fact, stocks of purchases fell sharply again, extending the current period of reduction to eight months.

Stocks of finished goods also declined, partly reflecting the need to fulfill higher new orders at a time when production was constrained. The pace of depletion eased compared to March.

Supplier delivery times were unchanged in April, ending a three-month period of lengthening delivery times. Some companies reported improved supplier inventory levels, which helped to speed up deliveries.

Recent market volatility has dampened business confidence to a three-month low. However, hopes of stable and improved demand conditions in coming months supported optimism that output will rise over the next year.

Commenting on the survey findings, Andrew Harker, Economics Director at S&P Global Market Intelligence, said that order books at Vietnamese manufacturers saw a welcome boost in April after a recent period of weakness.

There were also signs that the rebound in activity may have caught companies by surprise, as they had been shedding workers in response to subdued demand, resulting in a rise in backlogs of work. Therefore, it is possible that some of these workers will be recalled to work over the coming months.

“More broadly, the stop-start nature of new orders in recent months has left companies uncertain about the future. A more stable environment over the coming months would help manufacturers to plan production and resource inputs more effectively,” Andrew Harker hoped.