Hanoi Beer, Alcohol and Beverage Joint Stock Corporation – Habeco (code BHN-HOSE) announces a Decision on administrative sanctions for tax violations.

Accordingly, Habeco has violated the deadline for submission of tax declaration forms; falsely declared the basis for calculating tax resulting in a reduction of the deductible VAT but not leading to a shortage of tax payable; falsely declared the basis for calculating tax resulting in a shortage of tax payable, but the business transactions were fully reflected in the accounting system, invoices, and legal documents.

For the above violations, Habeco shall be subject to the main penalty of a fine of VND 1.94 billion; be required to pay the full amount of tax arrears to the State budget in the amount of VND 13.3 billion; be required to pay the full amount of late payment of tax to the State budget in the amount of VND 4.2 billion.

Thus, the total amount of fines, additional taxes, and late payment of taxes that Habeco has to pay is VND 19.4 billion. The amount of late payment of tax as mentioned above is calculated up to 3 January 2024.

In addition, the Large Enterprise Tax Department – General Department of Taxation requires Habeco to be responsible for self-calculating and paying the amount of late payment of tax from 3 January 2024 to the time of actual payment of the additional tax and fines (as mentioned above) to the State budget as prescribed. At the same time, Habeco is required to adjust the deductible input VAT for the subsequent period by VND 11.3 million.

Regarding business results, at the end of the first quarter of 2024, BHN recorded a net revenue of VND 1,308 billion, up 12% compared to the same period. However, after deducting expenses and taxes, Habeco reported a net loss of nearly VND 21 billion, while in the same period it lost VND 3.7 billion.

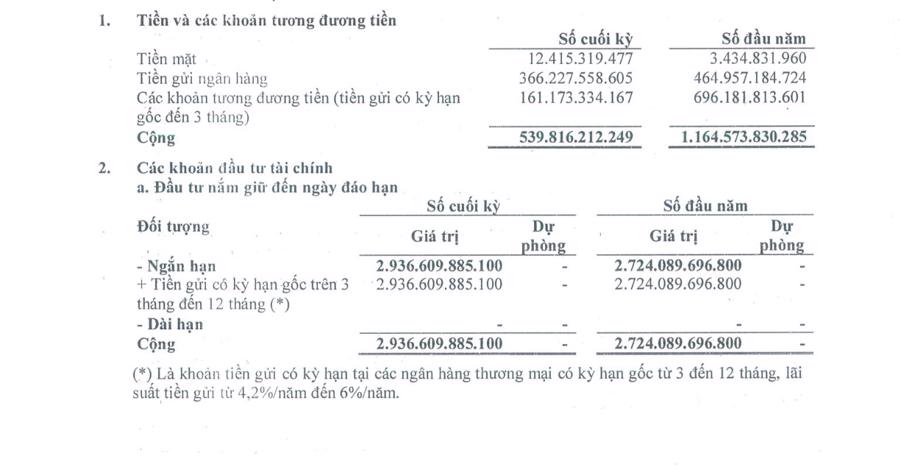

During the period, BHN recorded a 13% increase in selling expenses, from VND 204 billion to more than VND 230 billion; administrative expenses increased by VND 7 billion to VND 92 billion; financial revenue decreased to nearly VND 38 billion. However, the company currently has deposits in the bank of about VND 3,464 billion.

According to BHN’s explanation, the company reported a loss of nearly VND 21 billion because the interest rate level decreased, causing financial revenue to decrease compared to the same period. In addition, BHN increased investment in marketing activities to achieve the overall goals set for 2024.

It is known that the company has successfully organized the 2024 Annual General Meeting of Shareholders. Accordingly, the company’s shareholders have approved the business plan for 2024 with the revenue from the sale of main products being VND 6,543.3 billion, profit before tax reaching VND 248.7 billion and profit after tax VND 202 billion; pay dividends for 2024 at a rate of 7.5%.

In addition, BHN reported on the progress of divestment from Hanoi Alcohol and Beverage JSC and divestment from non-core investments. BHN said that prior to the loss-making business results, the financial situation of Halico carried high risks, so from 2018, BHN has carried out the necessary work to divest all equity capital in Halico. BHN’s divestment policy in Halico has been approved by the Ministry of Industry and Trade.

BHN has developed divestment methods, however, all methods are facing many difficulties and obstacles due to the loss-making business results, Halico does not meet the conditions for offering for sale in the form of public auction as prescribed in the Securities Law and guiding documents.

As for the capital transfer option through transactions on the Hanoi Stock Exchange’s system in the form of matching orders or agreements, it is currently not feasible because the price of Halico shares according to the valuation results is outside the price range of share transactions on the market and the liquidity is very low due to no transactions.

According to BHN, given the above difficulties, to proactively request the implementation of the policy, in the process of developing a divestment plan, BHN has submitted a report to the Ministry of Industry and Trade, the Ministry of Finance, and the State Securities Commission for instructions and guidance.

In 2023, BHN continued to coordinate with the consulting unit to develop a divestment plan, update progress and difficulties encountered in the implementation process for reporting to the Ministry of Industry and Trade; continue to propose that the Ministry of Industry and Trade consider reporting to the Government to allow BHN to apply the method of auctioning Halico shares at the Hanoi Stock Exchange even if Halico’s financial situation does not meet the conditions for public offering of securities as prescribed by the Securities Law.

BHN said that the company has conducted research, proposed, and contributed comments to the draft Law replacing the Law on Management and Use of State Capital for Investment in Production and Business at Enterprises and the draft Decree amending and supplementing a number of articles of Decree No. 140/2020/ND-CP, in order to remove obstacles and difficulties for enterprises in which the State holds less than 100% of the charter capital, such as HABECO, when divesting investments in other enterprises.

Regarding divestment from non-core investments: BHN has developed and submitted to the Ministry of Industry and Trade for consideration and approval of the Restructuring Project of Hanoi Beer, Alcohol and Beverage Joint Stock Corporation and its member companies for the period 2021 – 2025, which includes divestment from non-core investments to focus resources on improving BHN’s operating efficiency and competitiveness.

After the Restructuring Project is approved, BHN will organize the development of a divestment plan at non-core investment units, report for instructions from competent State management agencies to ensure that the divestment complies with the provisions of law.