In 2024, the economic situation is projected to continue to be complex, and the effective implementation of stimulus policies will create a positive psychological effect, building confidence among businesses, banks, domestic and international investors in the State’s responsibility to support businesses in difficulty, as well as confidence in the market outlook and investment environment in the country.

DOMESTIC DEMAND REMAINS WEAK

In 2023, domestic demand was weak and is unlikely to increase significantly in 2024 to the extent that it would negatively impact inflation. Weak domestic demand is evident from various perspectives.

Firstly, the growth rates of capital accumulation (4.09%) and final consumption (3.52%), the two largest components of aggregate domestic demand, were both lower than the GDP growth rate (5.05%). The contribution of final consumption to overall GDP growth was 41.04%, while that of capital accumulation was 26.64%, resulting in a combined contribution of just 67.68%. The remaining 32.32% is attributed to the trade surplus.

Secondly, capital accumulation, the precursor to investment, can be assessed by examining the ratio of total social development investment to GDP over the past few years, as shown in Figure 1.

This ratio has declined over the years, especially in 2023, which was a crucial year in the Five-Year Plan. It was even lower than in 2020, when the Covid-19 pandemic broke out, and in 2021, when the pandemic was at its peak.

In addition to the decline in the investment-to-GDP ratio, a significant amount of capital was diverted into virtual currencies, corporate bonds, and real estate, with some even being invested in gold at the end of the year instead of directly into physical production.

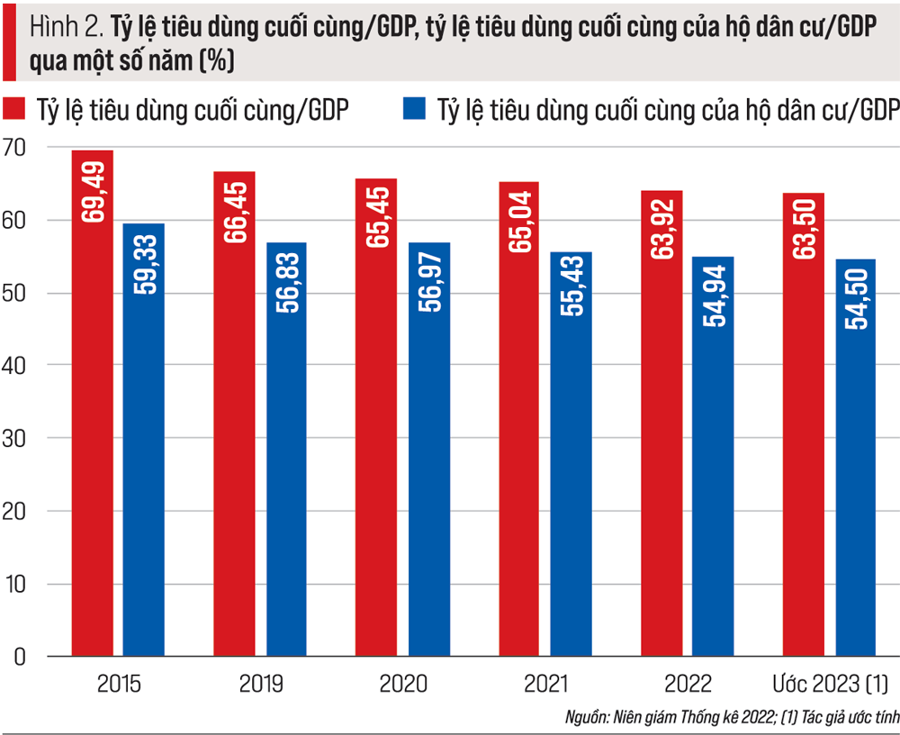

Thirdly, the final consumption rate, which is inclusive of household consumption, has also declined in recent years, as shown in Figure 2.

While this decline was inevitable during the two years of the pandemic, the continued decline in 2022 and 2023 is a cause for concern, as it indicates that final consumption remains weak. This trend reflects a widespread “saving for a rainy day” and “tightening spending” mindset that has persisted since the pandemic years.

Fourthly, the merchandise trade surplus and services trade deficit in recent years are shown in Figure 3.

2023 marked the eighth consecutive year of a trade surplus, with the largest surplus ever recorded (surpassing the previous record set in 2020). The services trade deficit in 2023, though still substantial, has declined compared to the previous three years. If we consider both goods and services, Vietnam has consistently posted a trade surplus. The merchandise and services trade balance has been recalculated based on FOB prices, and the services trade balance has been recalculated excluding transportation services. Specifically, the trade surplus in goods and services from 2018 to 2021 after recalculation is shown in Figure 4.

The weak aggregate domestic demand has contributed to the relatively low GDP growth rate. Without the trade surplus, GDP growth would have been even lower (around 3.5%).

In 2024, the GDP growth target is set higher than the rate achieved in 2023 (6-6.5%, compared to 5.05%). To meet this higher growth target, domestic demand in 2024 must increase, or the trade surplus in goods and services must be maintained at a similar level, or at least decline only slightly.

Domestic demand has the potential to increase, as all three of its components may experience positive developments. Capital accumulation could improve, and the flow of funds that has been invested in other channels may return to direct investment in production and business, or shift to consumption. As a result, the ratio of total social development investment to GDP in 2024 is likely to increase, contributing to a higher growth rate in capital accumulation. While a higher capital accumulation rate can lead to faster GDP growth, it can also make it more difficult to increase investment efficiency and may put pressure on inflation.

Final consumption, which has been weak for the past few years, is expected to gradually recover in 2024 due to salary reforms for civil servants and public employees, and pension increases that exceed the targeted rate of consumer price inflation. However, employment and income of workers in the production and business sector (in both enterprises and the private sector) must also improve; if entrepreneurship is encouraged more, and if fiscal and monetary policies continue to be loosened, etc.

Exports are expected to rebound after a decline in 2023, with a target growth rate of 6%, reaching $376.8 billion. Imports may also increase (targeting $361.8 billion). Nevertheless, Vietnam is likely to maintain a trade surplus in 2024, marking the ninth consecutive year of surplus, although the surplus may not be as high as the record set in 2023 ($28 billion, with a target of $15 billion). Therefore, the impact on economic growth will not be as significant as in 2023.

DEMANDS OF ECONOMIC GROWTH

Although Vietnam’s GDP per capita in US dollars has increased steadily, as of 2021, it remains significantly lower than the world average and many other countries (Figure 5).

In 2021, Vietnam’s GDP per capita ranked 6th lowest in Southeast Asia, 26th out of 42 in Asia, and 82nd out of 120 countries and territories with comparable data. In 2023, the ranking is expected to improve, with Vietnam estimated to reach $4,284 per capita.

To avoid the risks of “falling further behind,” “falling into the middle-income trap,” and “aging before becoming wealthy,” higher economic growth is imperative.

This is a long-term path, but the immediate requirement is to achieve the growth targets for 2024 and 2025 as outlined in the Five-Year Plan (2021-2025).

In 2024, the economic growth target is set at 6-6.5%. While this target reflects the prudence of macroeconomic policymakers in light of the uncertain global economic outlook and domestic constraints, achieving the higher growth rate (6.5%) will not be easy.

Even if the higher growth target is achieved, it will be difficult to fulfill the remaining target of the Five-Year Plan, which is 6.5-7% annual growth. If the growth rate in 2024 reaches 6.5%, it would represent an increase of only 23.94% compared to 2020. Therefore, in 2025, GDP growth would need to be 11.05-13.17% compared to 2024, which would be an unprecedented growth rate since the start of economic renewal. Failure to achieve the growth rate set out in the Five-Year Plan may result in another missed opportunity to achieve the goal of becoming a country with a modern industrial sector and escaping the lower-middle-income group.

STIMULUS MEASURES AND SOLUTIONS

Stimulating demand requires focusing on three main measures and solutions: First, increasing accumulation, directing more investment into production and business, and improving investment efficiency. Increasing accumulation mainly involves increasing the pre-tax profit ratio. For businesses, the pre-tax profit ratio in recent years has been as follows (Figure 6). As can be seen, the overall profit margin of businesses is lower than the interest rate on bank loans, and in some years it has even fallen below the interest rate on bank deposits…

This article was published in the special issue of Economic 2023-2024: Vietnam & The World, published on March 6, 2024. Readers are invited to access the full article here:

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam