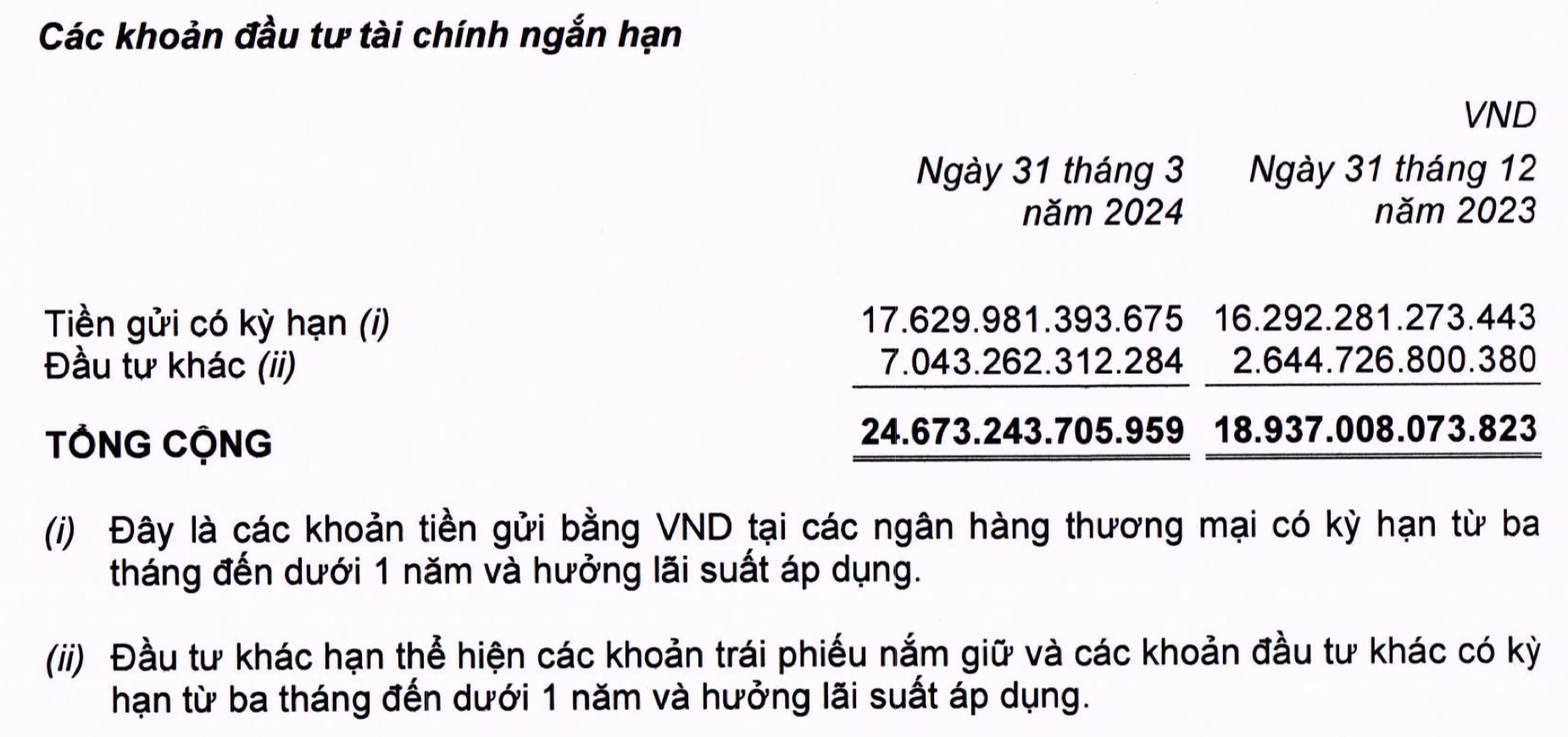

As per the consolidated financial statements of Q1/2024, the World Mobile Investment Joint Stock Company (code MWG) unexpectedly recorded a significant surge in other investments, increasing to over VND 7,000 billion, 2.7 times higher than the beginning of the year. The notes to financial statements indicate that these are held bonds and other investments with terms ranging from 3 months to less than 1 year, and they earn interest at applicable rates.

Source: World Mobile’s consolidated financial statements for Q1/2024

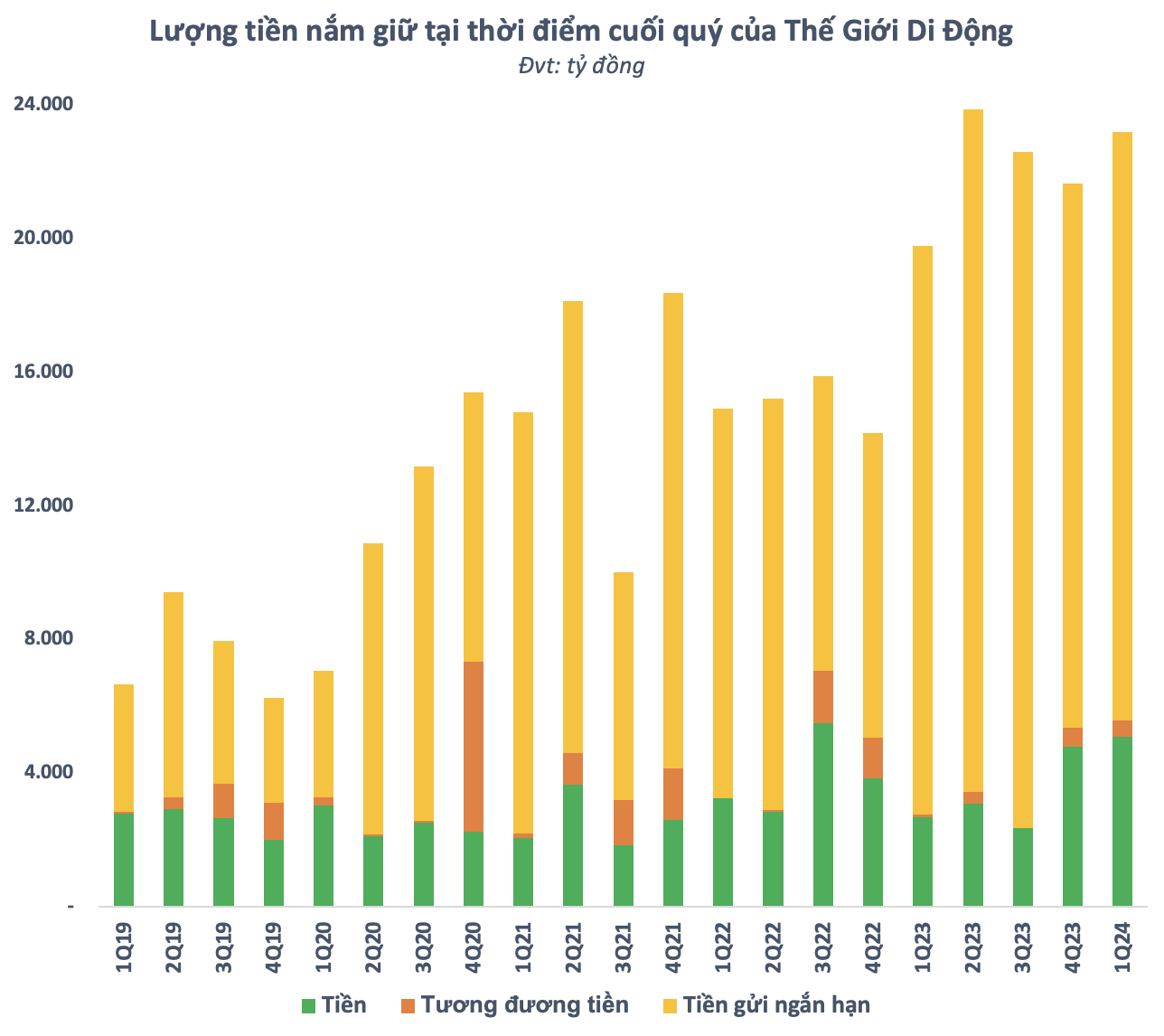

In addition, the amount of cash (cash, cash equivalents, and short-term deposits) of World Mobile also increased by more than VND 1,500 billion compared to the beginning of the year, to VND 23,200 billion. This is the second highest level in its operating history, only slightly lower than the end of Q2/2023. The increase was mainly due to short-term deposits with an ending balance of more than VND 17,600 billion.

The cash flow of World Mobile mainly comes from profits, inventory reduction, accounts receivable, and the private placement of 5% of the shares of its subsidiary, BHX Investment and Technology Joint Stock Company (BHX Investment), to the partner CDH Investments (through Green Bee 2 Private Limited). According to the Q1/2024 LCTT report, World Mobile had an income of VND 1,773 billion from the issuance of shares and capital contributions from non-controlling shareholders.

Sharing at the 2024 Annual General Meeting of Shareholders, the Investment Director of World Mobile said that this was a primary share issuance transaction, and the proceeds would go directly to the company to fund working capital, store expansion, and long-term development plans. After becoming a shareholder, the investor will not interfere in the operation or decision-making of the enterprise.

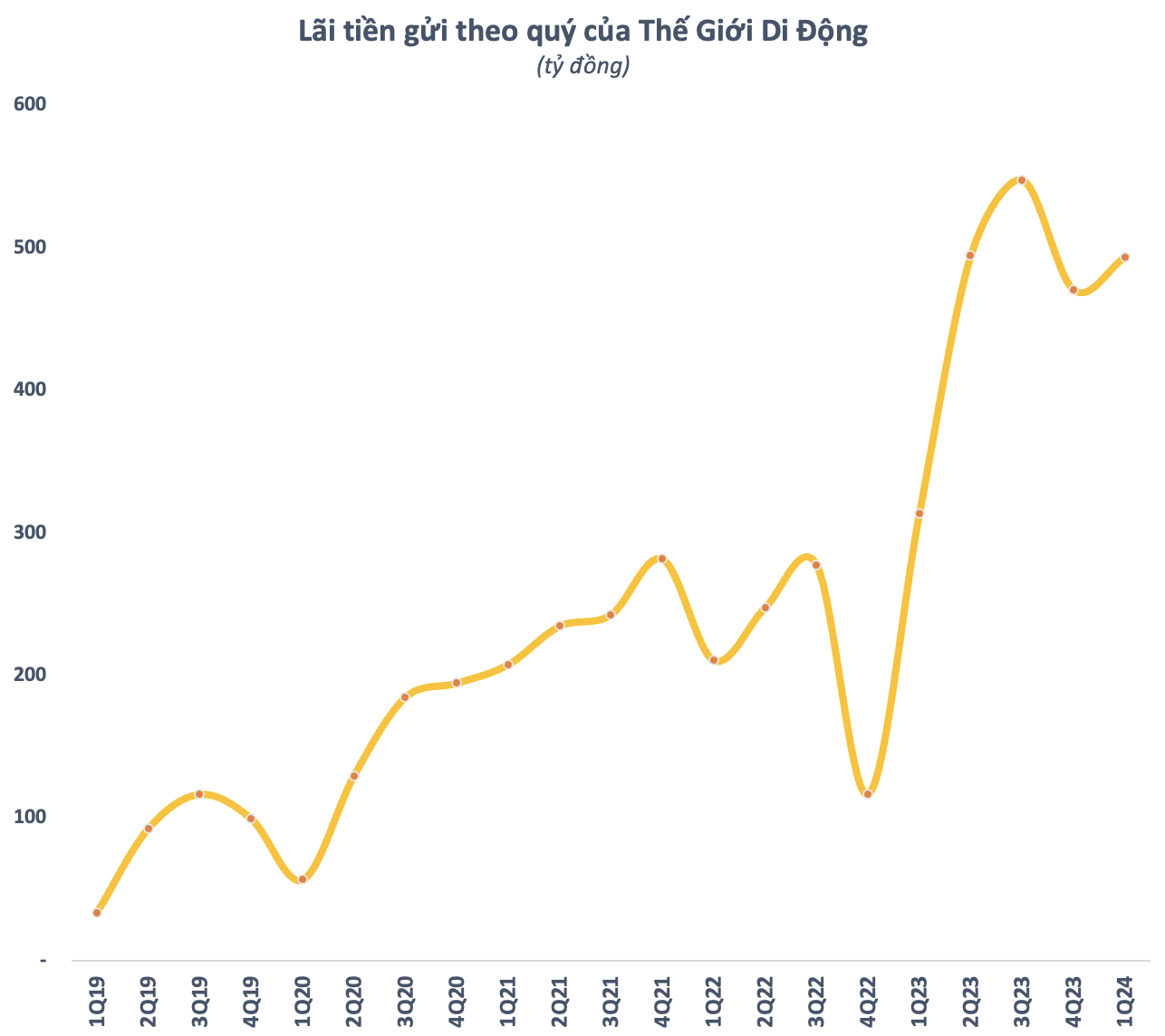

The large amount of deposits helped World Mobile earn VND 494 billion in interest in Q1/2024, an increase of 57% compared to the same period in 2023. This is not the highest figure that the company has achieved in a quarter, but this level of interest income is still very high in the context of record-low interest rates. In addition, the company also recorded an additional VND 32.5 billion in bond interest in Q1.

It is estimated that on average each day in the first quarter of the year, World Mobile earned nearly VND 6 billion in interest on deposits and bonds.

With a “healthy pocket”, in addition to making bank deposits and investing in interest-bearing bonds, World Mobile also took the opportunity to pay off nearly VND 1,500 billion of financial debts in the first quarter of the year. Combined with low interest rates, interest expenses in Q1 also decreased by nearly 10% compared to the same period in 2023, down to VND 267 billion. The strong increase in interest on deposits and bonds while the interest expense decreased significantly contributed to helping World Mobile achieve significant profits in the first quarter.

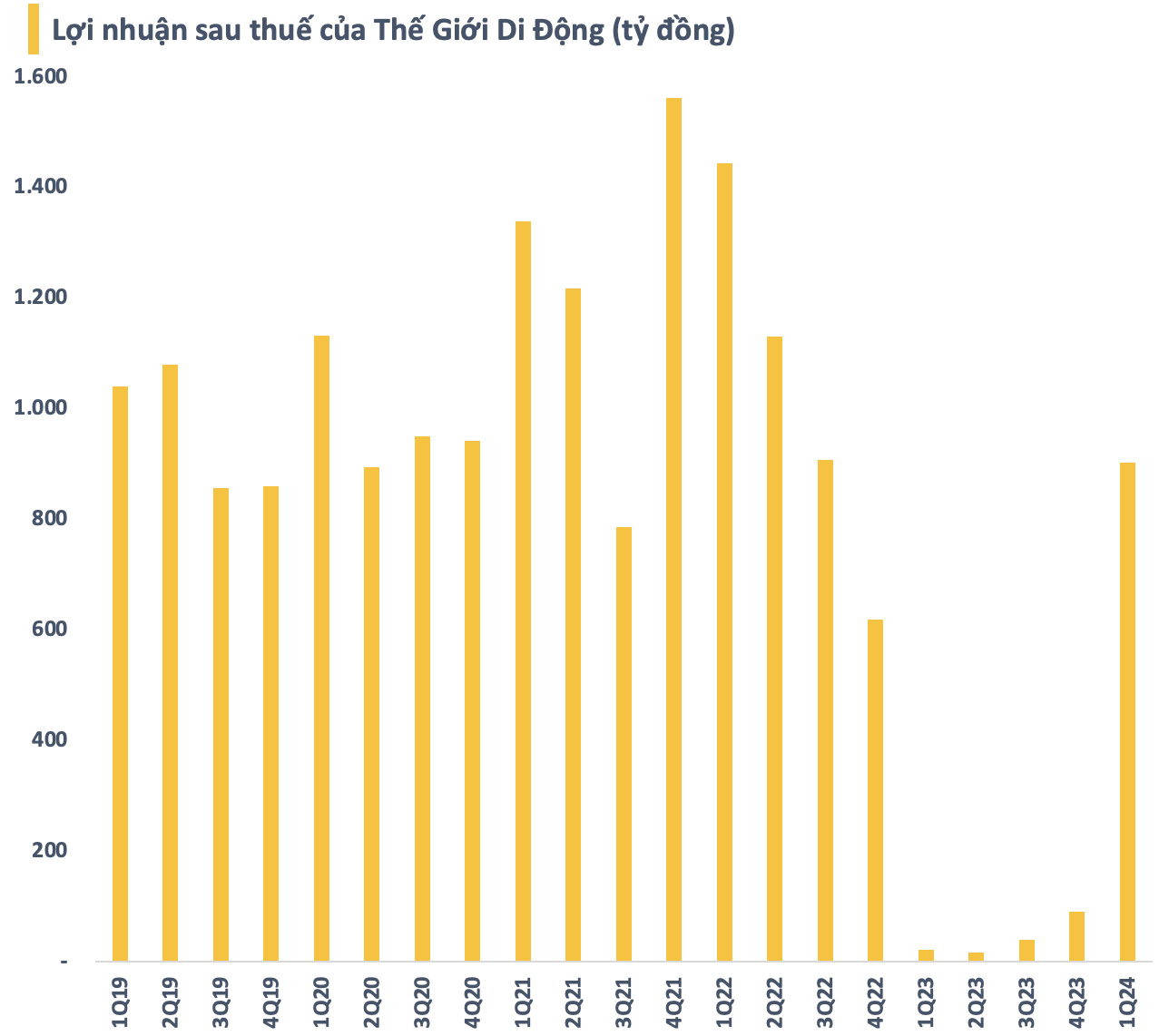

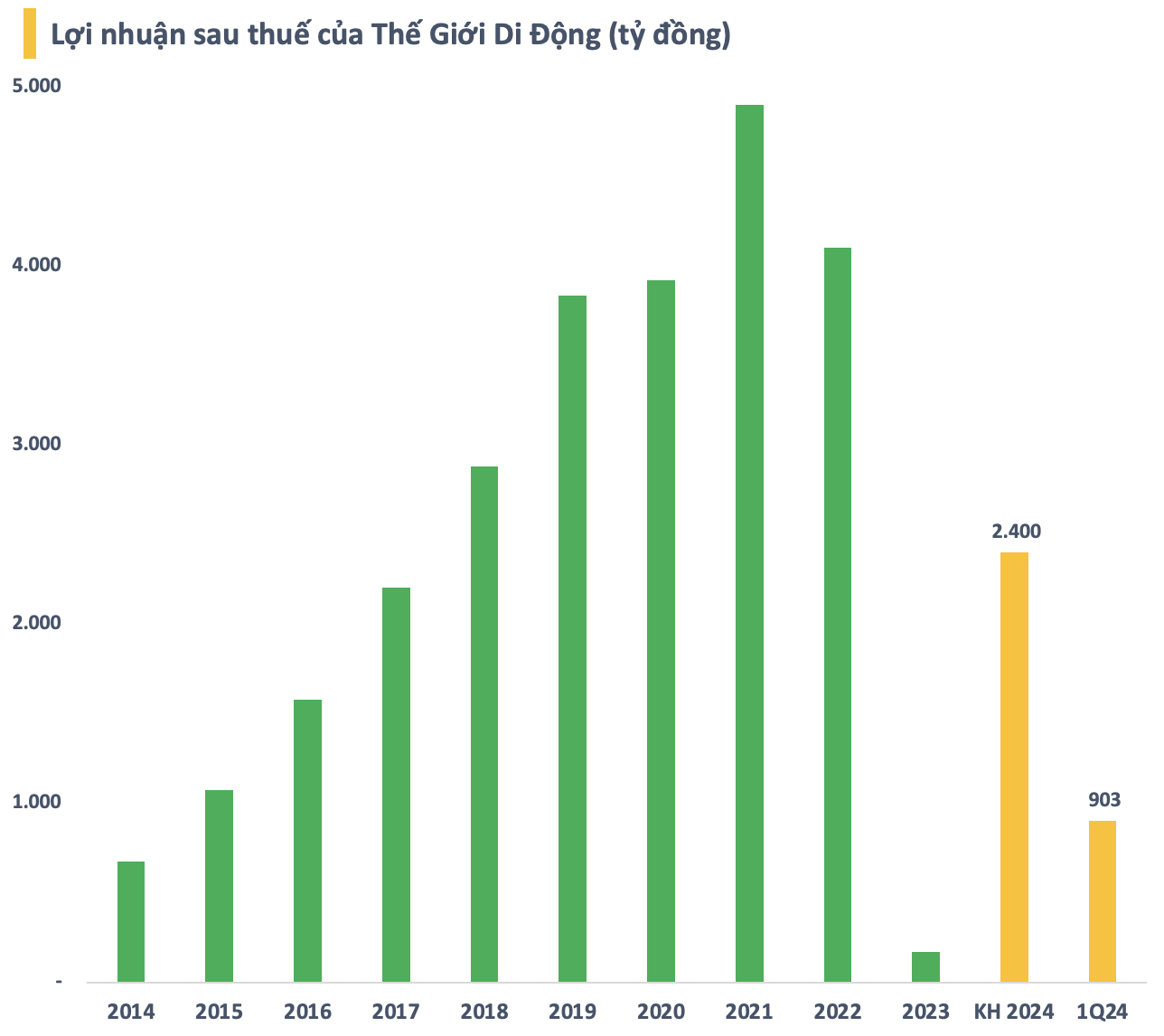

In Q1/2024, World Mobile recorded net revenue of VND 31,486 billion, up by more than 16% compared to the same period last year, fulfilling 25% of the whole-year revenue plan. After deducting expenses, this retailer earned VND 902 billion in net profit, 43 times higher than in the same period in 2023 and the highest level in 6 quarters since Q3/2022.

At the end of March, World Mobile had 1,077 The Gioi Di Dong/Top Zone stores, 2,184 Dien May Xanh stores, 1,696 Bach Hoa Xanh supermarkets, 526 An Khang pharmacies, 64 AVAKids stores, and 55 Erablue stores in Indonesia. Thus, in the past quarter, the company closed 1 The Gioi Di Dong store, 6 Dien May Xanh stores, 2 Bach Hoa Xanh supermarkets, 1 An Khang pharmacy, and opened 17 new Erablue stores in Indonesia.

With the closure of stores, the number of World Mobile employees also decreased by 4,853 after the first quarter. Currently, this retailer has more than 60,500 employees as of the end of March, a decrease of about 19,500 compared to the peak (over 80,000) recorded at the end of Q3/2022.

In 2024, World Mobile sets a revenue target of VND 125,000 billion, an increase of 5%, and a profit after tax of VND 2,400 billion, more than 14 times the achievement in 2023. With the results achieved in the first quarter, this retailer has fulfilled more than 25% of the revenue plan and nearly 38% of the profit target set for the whole year.

According to the management of World Mobile, consumer demand for shopping will generally be flat, or even lower than in 2023 for some non-essential items. However, with a healthy financial foundation and a streamlined “body” after restructuring, Chairman of the Board of Directors Nguyen Duc Tai said that the company is ready to deal with market fluctuations, and has the room and determination to realize its goals in 2024.