Despite numerous policies to address obstacles in the real estate market, it seems that wasn’t enough to help the cement industry overcome its struggles in the past year.

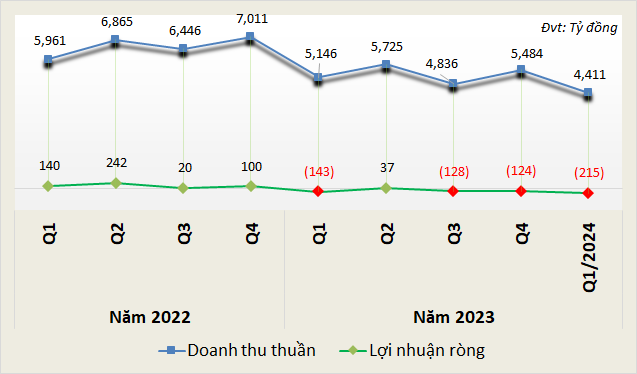

According to data from VietstockFinance, the financial reports of 17 listed cement companies from Q1/2022 to Q1/2024 show a challenging landscape. The industry started feeling the impact in early 2023, with revenue declining from over VND 7,000 billion (Q4/2022) to over VND 4,400 billion in Q1/2024.

Worse still, the industry continued to incur losses of over VND 215 billion in the first quarter of this year, compared to a loss of VND 143 billion in the same period last year. This marks the third consecutive quarter of losses for the cement industry.

|

Revenue and Profit of Cement Companies from Q1/2022 to Q1/2024

Source: VietstockFinance

|

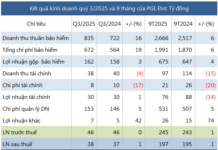

Only One Company Increased Profit

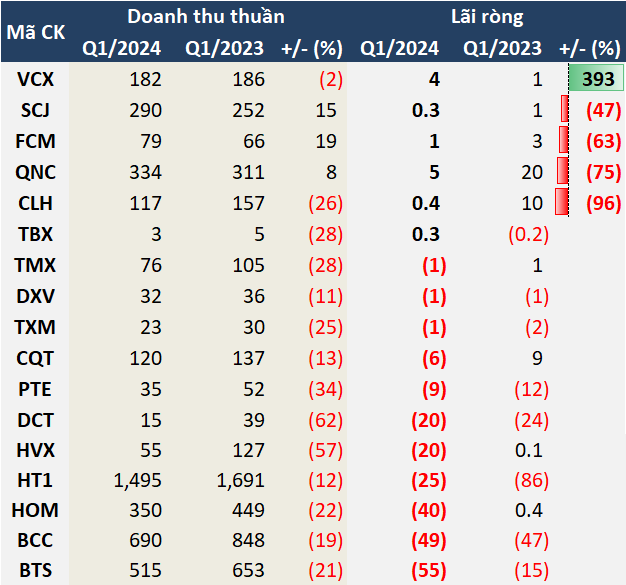

VietstockFinance’s statistics show that out of the 17 listed cement companies that published their financial statements for Q1/2024, only one company increased its profit, four reduced profits, and one company turned a loss into a profit. The remaining 11 companies incurred losses, with four turning from profitable to loss-making and seven continuing to be loss-making.

Yên Bình Cement (UPCoM: VCX) was the sole company to achieve profit growth, reaching over VND 4 billion, nearly five times higher than the previous year. This positive outcome was due to a significant reduction in production costs and the cost of goods sold, which boosted profits.

Thái Bình Cement (HNX: TBX) also achieved favorable results by maximizing cost-cutting measures, resulting in a net profit of nearly VND 300 million, compared to a loss of VND 154 million in the same period last year.

Among the companies that experienced a decline in profits, La Hiên VVMI Cement (HNX: CLH) stood out with a 96% plunge in profit to nearly VND 400 million in Q1.

CLH attributed this sharp drop to the impact of market recession, stagnant real estate sector, and decreased demand for cement, especially during the Tet holiday break. Additionally, the average selling price of their products also decreased compared to the previous year. Furthermore, the company had to halt one of its production lines for an extended period for maintenance and equipment repairs, which affected their operational efficiency during the past quarter.

|

Financial Performance of Cement Companies in Q1/2024

(Unit: Billion VND)

Source: VietstockFinance

|

All the remaining companies incurred losses in Q1. Notably, industry giant Vicem Hà Tiên Cement (HOSE: HT1) continued its loss streak with a loss of VND 25 billion, compared to a loss of VND 86 billion in the same period last year.

Similarly, Bỉm Sơn Cement (HNX: BCC) posted a net loss of nearly VND 49 billion, marking the seventh consecutive quarter of losses for the company.

VICEM Bút Sơn Cement (HNX: BTS) recorded a loss of over VND 55 billion, making it the heaviest loss-making company and marking its sixth consecutive quarter of losses.

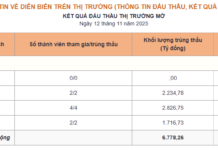

Pessimistic Outlook for 2024

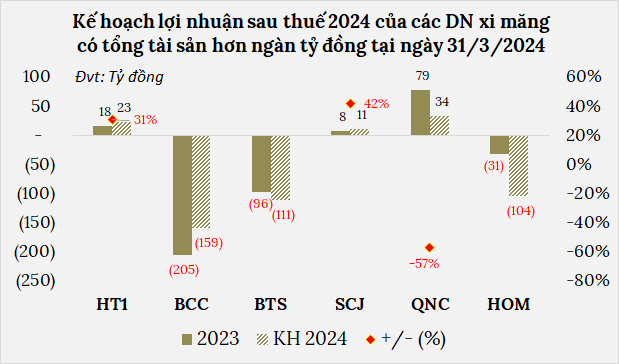

The challenges are expected to persist for the cement industry, as evident by the pessimistic plans set by several major players.

For instance, Bỉm Sơn Cement forecasts a loss of nearly VND 159 billion for 2024, with total revenue estimated at nearly VND 3,096 billion, a meager 0.5% increase from 2023.

Acknowledging the ongoing difficulties, VICEM Hoàng Mai Cement (HNX: HOM) projects a loss of nearly VND 104 billion, while BTS plans for a loss of VND 111 billion.

HT1 and Sài Sơn Cement (UPCoM: SCJ) exhibit a more optimistic outlook, targeting net profits of over VND 23 billion and VND 11 billion, respectively, representing increases of 31% and 42% compared to 2023. Quảng Ninh Cement (UPCoM: QNC) aims for a net profit of VND 34 billion, a 57% decrease from the previous year.

Source: VietstockFinance

|

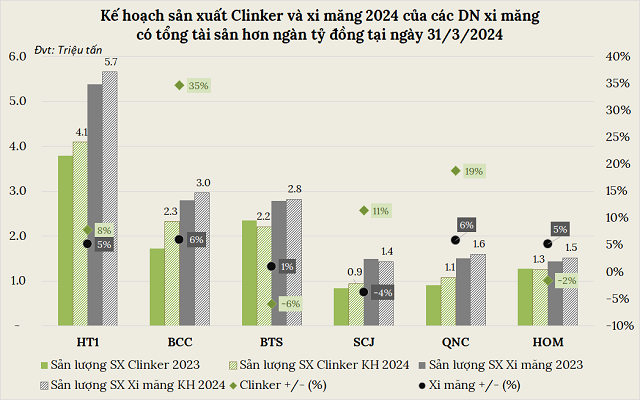

In terms of production volume, most companies have set growth targets. HT1, for instance, plans to produce nearly 4.1 million tons of clinker and 5.66 million tons of cement, an increase of 8% and 5%, respectively, from the previous year. Similarly, BCC aims to produce over 2.3 million tons of clinker, a 35% increase, and nearly 3 million tons of cement (including outsourced production), a 6% increase.

Source: VietstockFinance

|

When Will the Industry Turn a Profit?

According to industry leaders, Vietnam’s cement exports are not expected to grow in 2024 compared to 2023 due to competition from exporters like China, Turkey, and other regional players.

Additionally, the high cost of raw materials and energy is expected to persist, while cement demand remains low, significantly impacting the performance of many companies in the industry.

Mr. Hà Quang Hiện, Chairman of the Board of Directors of Logistics Vicem (HOSE: HTV), assesses that the cement industry has never faced such challenges in sales in over 120 years. Most cement companies are struggling and incurring losses.

Mr. Lưu Đình Cường, CEO of HT1, believes it is challenging to predict when the cement industry will recover, as it heavily depends on macroeconomic factors and the global economic landscape.

This uncertainty underscores the understandable pessimism reflected in the 2024 plans of many cement companies, with several anticipating continued losses for the year.