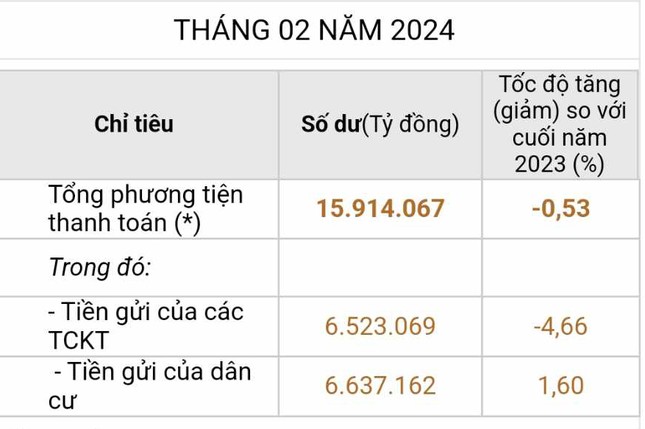

According to the latest data from the State Bank of Vietnam, as of the end of February, household deposits in the banking system reached a record high of nearly VND 6,640 trillion, up 1.6% from the beginning of the year.

Thus, after a decline in the first month of the year, household deposits in the banking system have returned to an upward trajectory.

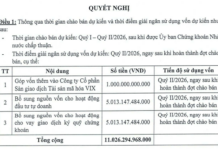

Statistics show a 1.6% increase in household deposits in February 2024 (Photo: Ngoc Mai).

While household deposits in banks have increased significantly, deposits from institutions and enterprises have decreased sharply. This group deposited VND 6,520 trillion in the banking system, a decrease of 4.66% compared to the beginning of the year. The decline in deposits from enterprises has led to a slight decrease in total deposits in the system as of February, from over VND 13,170 trillion in January to VND 13,160 trillion.

Previously, total customer deposits in the banking system at the end of January reached more than VND 13,170 trillion, a decrease of nearly VND 200 trillion compared to the end of 2023.

The return of deposits to the banking system comes despite low deposit interest rates, even as banks start to adjust rates upwards.

At a press conference on April 19, the State Bank of Vietnam announced that as of March 31, the average deposit interest rate for new transactions was 3.02%/year, a decrease of 0.5% compared to the end of 2023.

According to the consolidated financial statements of 27 domestic commercial banks for the first quarter of this year, total customer deposits in the entire banking sector increased slightly by 0.7% compared to the end of 2023, while deposit interest rates continued to show a downward trend in the first months of the year.

The three banks that attracted the most deposits in the past quarter were still the state-owned banks, with a total amount of over VND 4,510 trillion, an increase of VND 544,621 billion compared to the end of 2022. This figure also accounts for nearly 46% of total system deposits.

BIDV continues to lead with total deposits in the past quarter of over VND 1,700 trillion, up 1.8% compared to the end of 2023. VietinBank ranked second with deposit balances of over VND 1,400 trillion, up 1.2%. Vietcombank’s total customer deposits in the past quarter were VND 1,300 trillion, down 3.4%, ranking third.

For the joint-stock bank group, MB Bank continues to lead with VND 558,826 billion in deposits in the first quarter, down 1.5%, and ranked fourth in the industry. This was followed by Sacombank, with deposit balances of VND 533,358 billion, an increase of 4.4%.

Meanwhile, ACB remains in sixth place with total deposits increasing by 2.1% to VND 492,804 billion. The remaining four positions were held by Techcombank (VND 458,040 billion, up 0.8%), VPBank (VND 455,817 billion, up 3%), SHB (VND 444,297 billion, down 0.7%), and HDBank (VND 378,789 billion, up 2.2%).

In addition to the top 10 mentioned above, a number of other commercial banks also recorded increases in customer deposits in the past quarter. Specifically, SeABank reached VND 154,371 billion (up 6.6%); Nam A Bank reached VND 151,160 billion (up 3.9%); MSB reached VND 137,823 billion (up 4.1%); Nam A Bank reached VND 798.1 billion (up 31%); and VietBank reached VND 93,436 billion (up 3.8%).