In a recent update from HNX, AIG Corporation has acquired nearly 4.3 million GCF shares of GC Food, making a significant move on June 26th. This acquisition has boosted their ownership stake from 14.1% to 28.07%, now holding 8.6 million shares.

A notable transaction occurred on June 26th, as a block trade of over 4 million shares took place, valued at over VND 100 billion. AIG likely purchased these shares at an average price of VND 23,400 per share, reflecting an 11% premium compared to the closing price on the same day.

AIG Corporation first emerged as a major shareholder in GC Food on June 4th, acquiring approximately 2.15 million shares, equivalent to a 6.99% stake. The estimated value of this initial transaction was around VND 50 billion.

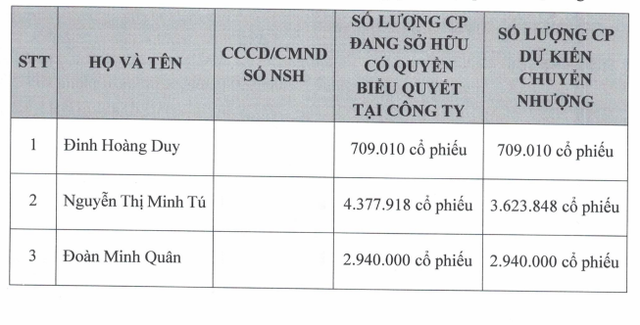

Prior to this, on June 25th, GC Food announced its decision to approve the transfer of shares without the need for a public offering. The transferring party was three GC Food shareholders: Mr. Dinh Hoang Duy, Mr. Doan Minh Quan, and Mrs. Nguyen Thi Minh Tu, who transferred their shares to the AIG Corporation. The transaction was expected to be completed by September 30th.

Interestingly, two out of the three individuals who transferred their shares, Mr. Quan and Mrs. Tu, became major shareholders in GC Food on May 17th, coinciding with the date when VCAM offloaded their entire stake of over 5.9 million GCF shares (19.23%).

GC Food’s Resolution announced on June 25th

It is worth noting that the timing of AIG Corporation’s acquisition of GC Food overlapped with GC Food’s decision to dissolve its subsidiary, Pura Technology Company. GC Food attributed this decision to a shift in business strategy and the subsequent lack of need for the subsidiary’s operations.

GCF, known as the “aloe vera king,” has set ambitious goals for 2024, aiming for a 21% increase in revenue to VND 573 billion and a nearly doubled net profit of over VND 52 billion. The company plans to distribute a 10% dividend for 2024 in both cash and shares, totaling more than VND 42 billion.

The entry of AIG Corporation as a major shareholder could further strengthen GCF’s business strategy, as AIG is a well-known supplier of raw materials in the market, primarily serving large domestic companies in the food, beverage, confectionery, pharmaceutical, and industrial sectors. AIG’s impressive list of partners includes Vinamilk, TH True Milk, Vitadairy, Nutricare, IDP, Nutifood, Friesland Campina, Nestle, Masan, Duc Viet, Dabaco, Acecook, and Vifon.

According to AIG Corporation’s 2023 Consolidated Financial Statements, the company had 8 direct subsidiary companies, 2 indirect subsidiary companies, 1 indirect joint venture, and 2 indirect associated companies as of December 31, 2023. Their total assets amounted to nearly VND 9,507 billion, with inventory accounting for 23%. Equity increased by 15% from the beginning of the year to VND 5,471 billion. In 2023, the company achieved a revenue of VND 11,915 billion and a net profit of VND 787 billion, surpassing their plan by 3%.

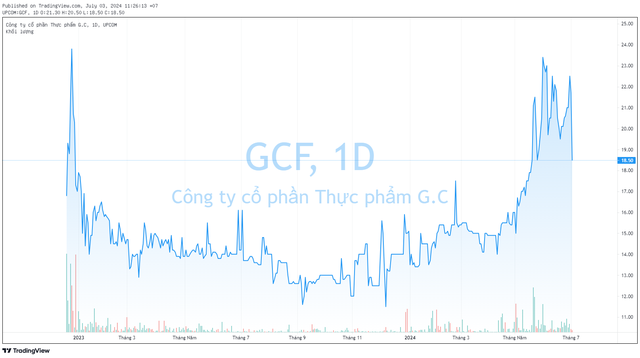

Market Performance: GCF’s share price surged by nearly 50% in May, reaching an all-time high of VND 24,000 per share on May 31st, before retracing and correcting since then. Currently, GCF’s share price is experiencing a downward trend, falling significantly to VND 18,500 per share.

Declining USD Prices: Banks and Free Market Suffer Declines

Approaching Tet holidays, the USD price in banks and the free market dropped significantly, despite the international USD index maintaining a high level.

Unforeseen sharp reduction in flight tickets from Ho Chi Minh City

Unlike the previous days of 27th, 28th, and 29th of the lunar calendar, the airfare from Ho Chi Minh City to northern provinces on 9th February (or 30th of Tet) has significantly reduced. In fact, passengers can still purchase tickets for same-day travel as there are still plenty of flights available.