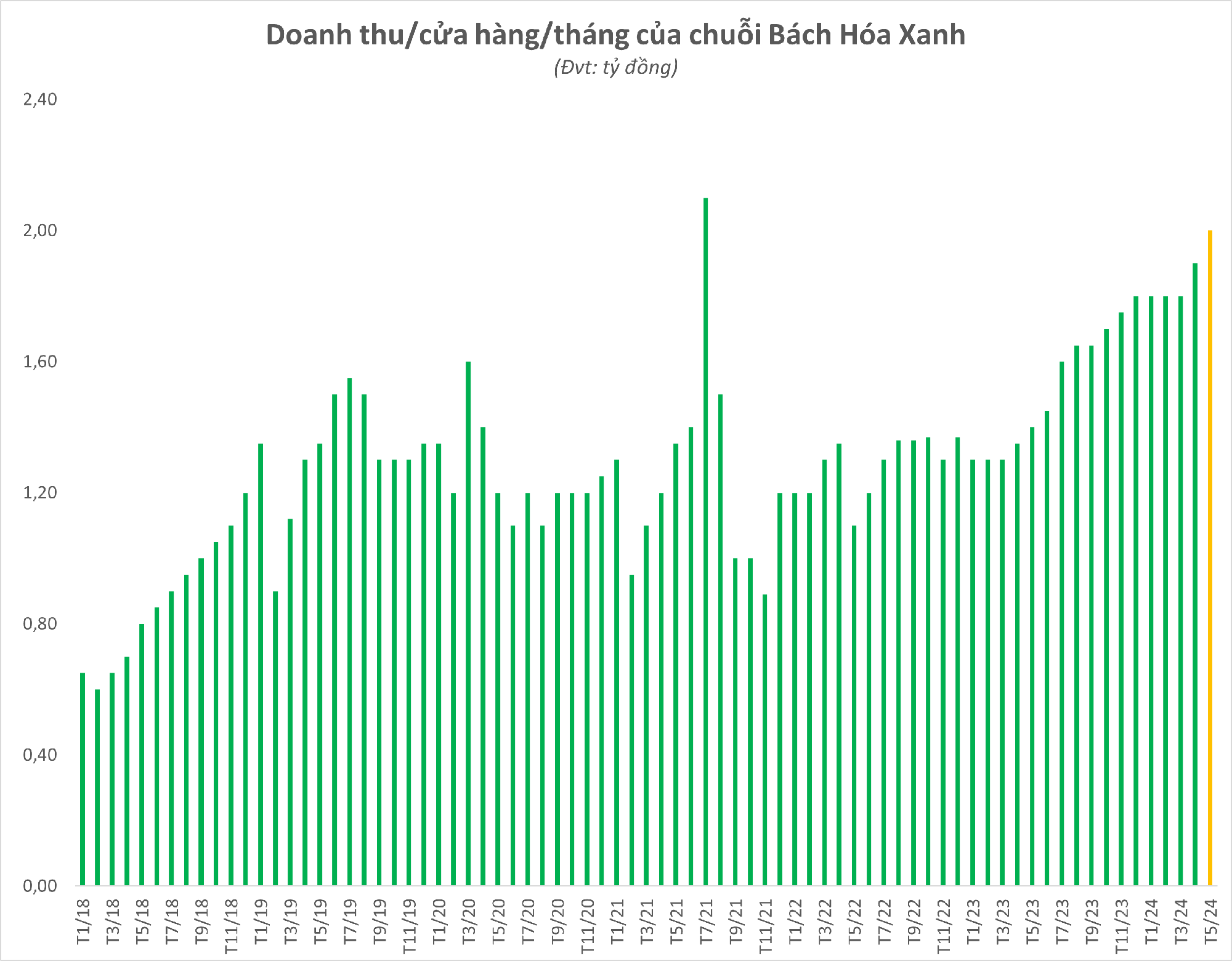

The Bach Hoa Xanh supermarket chain, considered by Mobile World Group (MWG) Chairman Nguyen Duc Tai as the key driver of the company’s growth in the next five years, has been under the spotlight as the group revealed its latest financial results. MWG’s recent report showed that each Bach Hoa Xanh store brought in an average of VND 2 billion in revenue in May 2024.

With this figure, it is likely that the supermarket chain turned profitable in May, as many securities companies had previously forecasted the break-even point for Bach Hoa Xanh at VND 1.8 billion per store. The VND 2 billion mark is also a record high for the chain since its inception (except for the sudden surge during the pandemic in July-August 2021).

This number also exceeded Mr. Nguyen Duc Tai’s wildest dreams. “When Bach Hoa Xanh first started, selling items like bunches of vegetables and packets of noodles, we only hoped to reach a revenue of VND 1.2 billion per store per month. However, the reality now is that revenue has climbed to VND 1.8-1.9 billion per store per month, far surpassing our expectations when we launched this project,” Mr. Tai shared at an investor meeting.

Moreover, MWG’s leadership revealed that the company aims for Bach Hoa Xanh to be profitable in 2024. More ambitiously, Bach Hoa Xanh’s CEO, Mr. Pham Van Trong, projected that the supermarket chain’s profit could reach the “four-digit” range within the next 1-2 years. (Referring to profits of thousands of billions of VND – PV)

In a recent update, DSC Securities stated that repositioning the Bach Hoa Xanh chain as a “mini-supermarket” was a pivotal move, enabling MWG to tap into the habits of Vietnamese consumers who prefer buying small-value products (worth $4-5) frequently and mostly travel by motorbike. Additionally, rental costs for smaller spaces are much lower than those for large supermarkets, and the minimart format can already cater to over 70% of essential product needs. Moreover, the minimart model currently accounts for only about 50% of the consumer market, leaving ample room for expansion.

As MWG restructures its business lines and focuses on Bach Hoa Xanh, DSC believes that this chain will gradually account for a higher proportion of the group’s revenue and become its primary growth driver in the future. More optimistically, DSC suggests that by diversifying its product portfolio, Bach Hoa Xanh can achieve new revenue milestones per store this year.

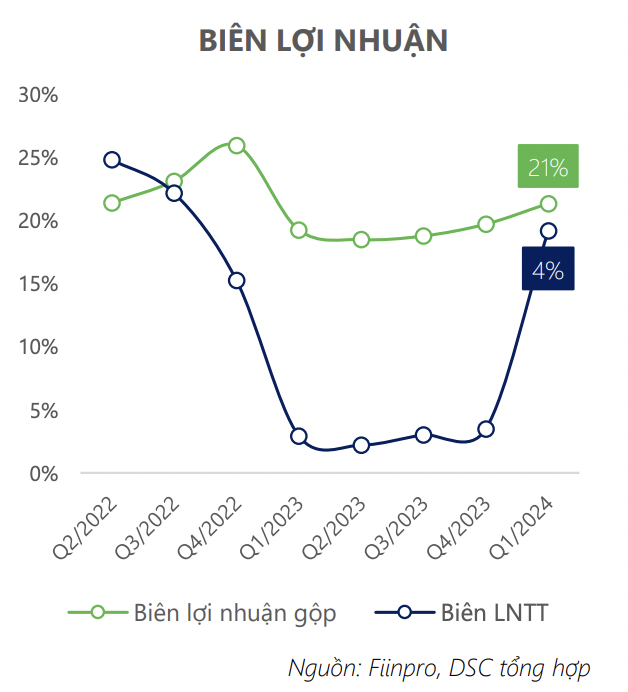

“Reducing quantity and improving quality” optimizes costs and enhances profit margins; the ICT segment is expected to recover

Apart from the growth driver of Bach Hoa Xanh, DSC also highlights MWG’s efforts to maximize cost efficiency by streamlining its personnel and closing underperforming stores. This strategy’s effectiveness is evident in the significant improvement in profit margins. Additionally, the reduced pressure from optimized inventory levels and MWG’s decision to end the price war with competitors have also contributed to the group’s enhanced revenue and profit margins.

According to DSC, the primary growth driver for the ICT segment in the last quarter was the impressive sales performance of refrigeration equipment and household appliances. DSC believes that with the continued potential for strong growth in sales of high-gross-margin products like air conditioners amid the scorching weather, there is room for further improvement in MWG’s gross profit margin in Q2 2024. However, the recovery will gradually weaken in the second half of 2024 due to milder weather conditions reducing the demand for air conditioners.

Instead, the focus will shift to major sporting events such as the Euro and Olympic Games, expected to boost TV consumption and become a new supporting factor for MWG.

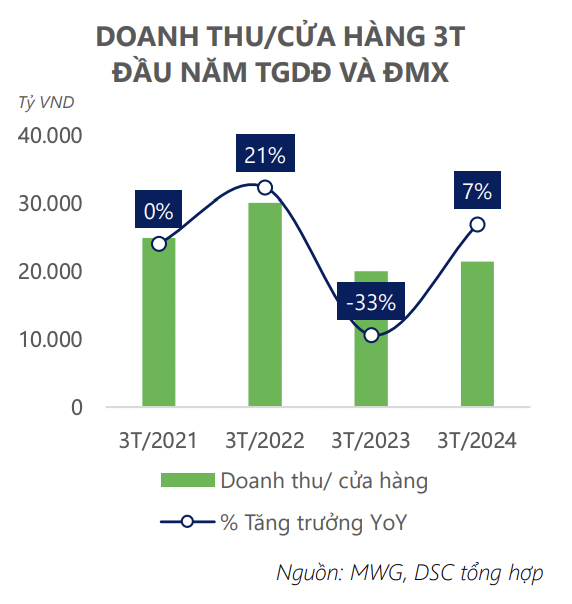

Regarding the The Gioi Di Dong (TGDD) chain, DSC predicts a clearer recovery path in late 2024, driven by the electronics replacement cycle. Specifically, the demand for laptops, tablets, and mobile phones surged during 2020–2021. Comparing MWG’s revenue during this period, it aligns with the peak sales performance of the TGDD chain. Given the average lifespan of mobile phones is about 2.5 years and that of laptops is around 3–5 years, the demand for these products will gradually recover in late 2024, especially with the launch of new iPhone models in Q3, creating a growth catalyst for the TGDD chain.

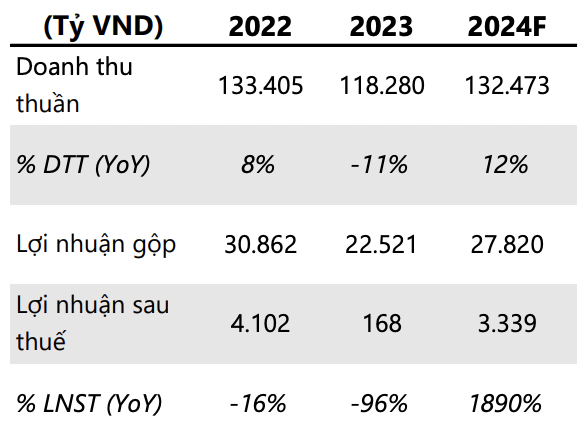

DSC estimates that MWG’s business results for 2024 will show a recovery, with net revenue and net profit reaching VND 132,473 billion (up 12%) and VND 3,339 billion (up 18.90%), respectively. According to DSC, with positive macroeconomic indicators, the recovery prospects for retail businesses like MWG this year are quite clear.

World Mobile slashes workforce, FPT Retail takes advantage and hires thousands of salespeople

The year 2023 has been challenging for Thế Giới Di Động and FPT Retail, and they have chosen different ways to regain growth momentum.

World Mobile closes nearly 200 stores, how does the stock perform?

Large bank stocks continued to decline, making it difficult for the VN-Index as the Lunar New Year approaches. However, the main index managed to recover and surpass the 1,180-point mark thanks to the strong performance of a few individual stocks. Despite the recent closure of 200 stores by Thế giới Di động, MWG emerged as the market leader.