Brent Oil Hits Highest Level Since April

Brent crude oil prices surged to a four-month high on Thursday, staying above $87 after data revealed a larger-than-expected draw in US crude inventories.

Brent crude futures ended the session up 21 cents, or 0.2%, at $87.55 a barrel. US West Texas Intermediate (WTI) crude futures rose 18 cents to $84.06 in thin trading due to the US Independence Day holiday.

The Energy Information Administration (EIA) reported a draw of 12.2 million barrels, while analysts surveyed by Reuters had expected a draw of just 680,000 barrels.

Meanwhile, Saudi Aramco reduced the August official selling price for its Arab Light crude to Asia by $1.80 a barrel, slightly above the Oman/Dubai average.

Gold Near Two-Week High

Gold prices steadied near a two-week high on Thursday after weaker-than-expected US economic data raised hopes for a Fed rate cut in early September. Market attention now turns to the US non-farm payrolls report on Friday.

Spot gold was up 0.1% at $2,358.19 per ounce.

Traders are focusing on the upcoming non-farm payrolls data, with expectations of a lower number of jobs added in June compared to May.

Iron Ore Climbs for Fifth Straight Session

Iron ore futures rose for a fifth straight session, buoyed by strong short-term demand, improved steel fundamentals, a weaker dollar, and expectations of more economic stimulus from China.

The most-traded iron ore contract on the Dalian Commodity Exchange, for September delivery, ended the session up nearly 1.8% at 864.5 yuan ($118.89) per ton.

Singapore Exchange data showed August iron ore rising 0.3% to $113.75 a ton, its highest since June 3.

ANZ analysts commented, “The stable macroeconomic environment in China has provided much-needed support for the market.” They added, “The upcoming third plenary session of the 20th Central Committee of the Communist Party of China, to be held from July 15-18, will be crucial as several stimulus measures could be announced to bolster the property sector.”

Additionally, fundamentals in the construction steel sector have improved.

Copper Edges Higher

Copper prices steadied on Thursday as investors balanced optimism about potential US interest rate cuts with concerns about high inventories and soft demand in top consumer China.

Three-month copper on the London Metal Exchange ended the session up 0.1% at $9,878 a ton.

Ole Hansen, head of commodity strategy at Saxo Bank in Copenhagen, noted that the market’s focus had once again shifted to the possibility of a US rate cut.

Robusta Coffee Rises on Tight Supplies

ICE Robusta coffee futures climbed on Thursday, supported by tight supplies from top producer Vietnam.

September Robusta coffee rose 2.3% to $4,153 a ton.

Traders reported ongoing tightness in supplies from Vietnam, with exports expected to remain relatively low.

In the first half of 2024, Vietnam’s coffee exports fell 10.6% compared to the same period last year.

Coffee prices in Vietnam continued to rise this week due to tighter supplies as farmers reduced their stockpile sales, while Indonesian coffee prices eased slightly.

Farmers in the Central Highlands are selling coffee beans for 120,000-122,000 dong ($4.71-$4.79) per kg, up slightly from last week’s range of 119,000-120,200 dong.

Indonesian Sumatran Robusta beans were offered at a premium of $950 above the August contract on the London market, unchanged from the previous week as local roasters maintained their stance.

Wheat Rebounds

European wheat prices rebounded on Thursday after a sharp drop the previous day, but trading volumes were low due to the US Independence Day holiday.

September milling wheat futures on Euronext ended the session up 0.8% at €225 per ton.

China’s weather agency warned of a prolonged heatwave in July across the eastern, central, and southern regions, which could impact the yield of rice, cotton, and other crops as extreme weather continues to threaten food production.

Rubber Prices Slip

Rubber futures on the Tokyo Commodity Exchange slipped on Thursday.

The most active rubber contract on the Osaka Exchange fell 1.2 yen, or 0.36%, to 330.2 yen ($2.05) per kg.

September rubber on the Shanghai Futures Exchange fell 135 yuan to 14,910 yuan ($2,050.78) per ton.

Chinese automaker BYD inaugurated its first electric vehicle factory in Thailand on Thursday, marking its entry into the fast-growing Southeast Asian EV market. The plant will have an annual production capacity of 150,000 vehicles.

Cocoa Futures Decline

Cocoa futures for September delivery on the London market fell 3% to £6,256 per ton.

Traders await the upcoming grind data for the April-June quarter to gauge if the recent price rally has curbed demand.

The outlook for the 2024/25 main crops in West Africa is generally favorable, improving the market’s prospects for a more balanced scenario after the current 2023/24 season (October/September) showed a significant global deficit.

Palm Oil Prices Ease

Malaysian palm oil futures fell on Thursday, tracking losses in soybean oil on the Dalian Commodity Exchange, while the market awaited production and export data from the Malaysian Palm Oil Board (MPOB).

The benchmark palm oil contract for September delivery on the Bursa Malaysia Derivatives Exchange fell 15 ringgit, or 0.37%, to 4,067 ringgit ($864.03) per ton at the close.

A Reuters survey on Thursday revealed that Malaysia’s palm oil stocks in June rose for a third straight month as exports slowed, while production fell from the previous month. Stocks were estimated to be at 1.83 million tons, up 4.53% from the end of May, according to the median estimate of 12 traders, planters, and analysts.

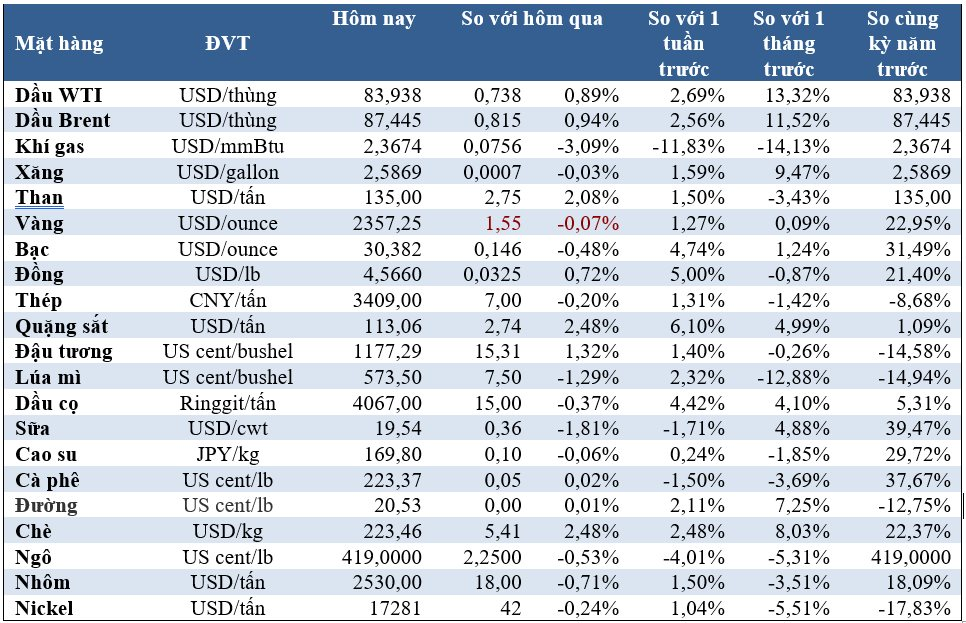

Prices of Key Commodities on July 5:

Market Update on February 3rd: Crude oil, gold, copper, iron and steel, and rubber all decline together.

At the close of trading on February 2nd, the prices of oil, gold, copper, steel, rubber, and coffee all saw a simultaneous decrease, with iron ore hitting a two-week low.