Liquidity in the market decreased compared to the previous trading session, with the VN-Index matching volume reaching over 589 million shares, equivalent to a value of more than 15.3 trillion VND; HNX-Index reached over 48 million shares, equivalent to a value of nearly 1 trillion VND.

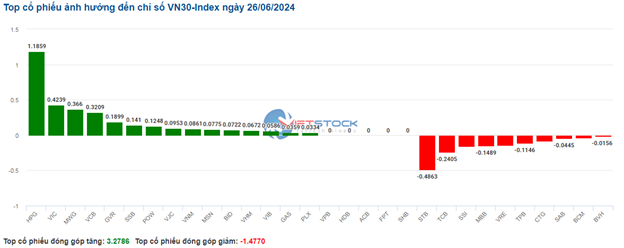

VN-Index opened the afternoon session on a positive note as buying pressure reappeared, and despite some fluctuations, the buyers continued to dominate, helping the index to recover and close above the reference level at the end of the session. In terms of impact, GVR, BCM, FPT, and PLX were the most positive influences on the VN-Index, contributing over 3.3 points. On the other hand, VCB, CTG, VHM, and VRE were the most negative influences, taking away more than 1.4 points from the overall index.

| Top 10 stocks impacting the VN-Index on June 26, 2024 |

HNX-Index also witnessed a less positive performance, impacted negatively by stocks such as VIF (-9.39%), PVI (-2.39%), IDC (-1.14%), and SHS (-1.14%), among others.

|

Source: VietstockFinance

|

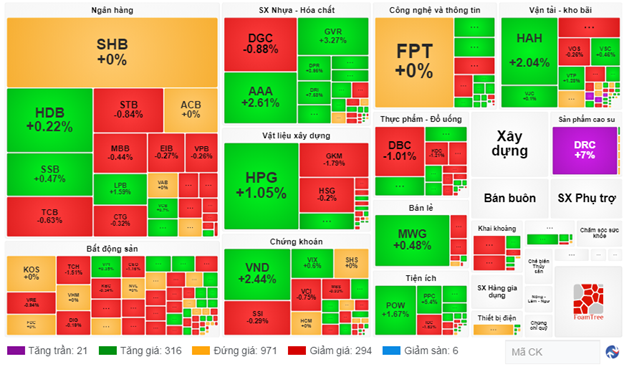

The rubber product industry was the group with the strongest gains, increasing by 5.05%, mainly driven by stocks like DRC (+7%), CSM (+3.24%), and BRC (+1.03%). This was followed by the plastics and chemicals manufacturing industry and the wholesale industry, with increases of 3.83% and 2.04%, respectively. On the other hand, the consulting and support services industry witnessed the sharpest decline of -1.30%, mainly due to TV2 (-1.97%) and VNC (-0.74%).

In terms of foreign trading activities, they continued to net sell over 603 billion VND on the HOSE exchange, focusing on stocks like FPT (279.53 billion), MWG (125.04 billion), AAA (51.02 billion), and VNM (46.21 billion). On the HNX exchange, foreign investors net bought over 13 billion VND, mainly investing in PVS (25.19 billion), VCS (3.84 billion), and IDC (1.32 billion).

| Foreign Trading Activities – Buying and Selling Trends |

Morning Session: Foreign investors continued to net sell, and the VN-Index declined again.

The market witnessed a decline as selling pressure emerged in the latter half of the morning session. At the end of the morning session, the VN-Index fell by 5.31 points to 1,251.25 points, while the HNX-Index dropped by 1.74 points to 238.45 points. The market was slightly tilted towards the sell side, with 231 stocks rising and 446 falling. The VN30 basket was mostly in the red: 6 stocks advanced, 20 declined, and 4 remained unchanged.

The trading volume of the VN-Index in the morning session reached over 284 million units, with a value of more than 7.3 trillion VND. The HNX-Index recorded a trading volume of nearly 26 million units, with a trading value of over 500 billion VND.

Amid multiple pressures, only three industries managed to stay in the green: rubber products (up 4.57%), plastics and chemicals manufacturing (up 0.77%), and agriculture, forestry, and fisheries (up 0.22%). The remaining 22 industries were in the red, with most industries falling by less than 1%. However, the insurance and consulting and support services sectors recorded declines of over 1%.

Specifically, regarding individual sectors, rubber products are currently leading the market with a significant increase of 4.57%. Positive-performing stocks in this sector include DRC, which surged by 6.86%, CSM, which rose by nearly 2%, and BRC, which gained slightly under 1%…

On the other hand, insurance stocks witnessed a deterioration in performance, with a series of stocks in the red, including BVH, PVI, VNR, MIG, and PGI… Only BIC, BMI, and PRE managed to maintain their green status until the end of the morning session.

Foreign investors increased their net selling to over 400 billion VND. The most prominent stocks on the selling side were FPT and MWG. On the buying side, MSN was the most purchased stock but was outweighed by the selling pressure. This dynamic contributed to the negative sentiment in the market towards the end of the morning session.

| Net Trading Value by Stock in the Morning Session of June 26, 2024 |

10:40 AM: Liquidity continued to decline, and a cautious sentiment emerged.

Investors remained hesitant, resulting in a lack of improvement in trading volume, and the major indices moved in opposite directions, fluctuating around the reference level. As of 10:40 AM, the VN-Index slightly increased by 2.54 points, trading around 1,258 points. Meanwhile, the HNX-Index decreased by 0.75 points, trading around 239 points.

Stocks in the VN30 basket experienced mixed performances, but the buying pressure was slightly stronger. Specifically, HPG, VIC, MWG, and VCB contributed 1.19 points, 0.42 points, 0.37 points, and 0.32 points to the overall index, respectively. Conversely, STB, TCB, SSI, and MBB faced strong selling pressure, taking away nearly 1 point from the VN30-Index.

Source: VietstockFinance

|

The rubber products industry maintained its upward momentum, recording the most significant increase of 5.11% with the following stock performances: DRC surged by 7%, CSM rose by 3.56%, BRC gained 0.69%, and SRC remained unchanged.

From a technical perspective, DRC hit the ceiling price and formed a White Marubozu candlestick pattern, accompanied by trading volume surpassing the 20-session average, while the Bollinger Bands indicated a potential breakout. This suggests a positive outlook for the stock. Moreover, the long-term upward trend remains intact, as evidenced by higher highs and higher lows. The positive signals from the Stochastic Oscillator and MACD further reinforce the bullish sentiment.

Source: https://stockchart.vietstock.vn/

|

Following the rubber products industry, the plastics and chemicals manufacturing industry also exhibited mixed performances. Specifically, stocks that maintained their upward momentum from the beginning of the session included GVR (+2.83%), PHR (+2.2%), BMP (+0.29%), and AAA (+2.17%)… Meanwhile, some stocks like DGC, NTP, and LAS faced selling pressure but managed to limit their losses to under 2%.

On the contrary, the insurance industry witnessed a slight decline of nearly 0.3%, with most stocks in the red, including BVH (-0.33%), PVI (-1.54%), and PGI (-0.41%).

Compared to the opening, the number of stocks trading at the reference level remained high, at over 970, indicating a state of fluctuation. However, buyers gradually gained the upper hand. There were 294 declining stocks and 316 advancing stocks.

Source: VietstockFinance

|

Opening: Maintaining a slight gain

At the start of the June 26 session, as of 9:40 AM, the VN-Index rose by more than 3 points to 1,260.07 points. Conversely, the HNX-Index slightly decreased, reaching 239.99 points.

Most sectors were in the green, with several large-cap stocks witnessing positive performances from the beginning of the session, including GVR, which increased by 2.68%, BID rising by 1.24%, VIC gaining 0.97%, and HPG climbing by 0.95%.

Major stocks like GVR, BID, and VCB propelled the market higher, contributing over 1.5 points to the overall index. On the other hand, BCM, MBB, and STB led the group of stocks with negative impacts on the market, but their declines resulted in a loss of less than 0.5 points.

The plastics and chemicals manufacturing industry continued its stable growth trend from the beginning of the session, with stocks like GVR rising by 2.23%, PGR increasing by 1.36%, DCM climbing by 0.55%, and AAA advancing by 1.74%,…

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.