However, it is worth noting that market liquidity was relatively tight, with the VN-Index matching volume reaching nearly 433 million shares, equivalent to a value of nearly VND 12 trillion; the HNX-Index reached more than 48 million shares, equivalent to a value of over VND 870 billion.

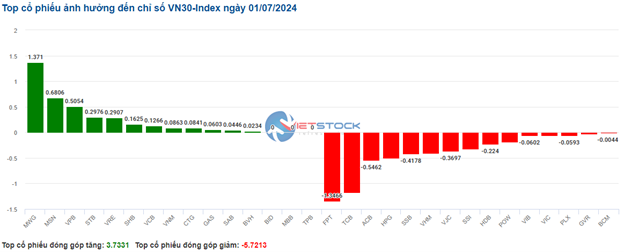

The VN-Index opened the afternoon session on a positive note as buying pressure reappeared, helping the index recover and close above the reference level at the end of the session. In terms of impact, CTG, MWG, VCB, and BID were the most positive influences on the VN-Index, contributing over 4.8 points to the gain. On the other hand, FPT, TCB, POW, and LPB were the most negative influences, taking away more than 1.6 points from the overall index.

| Top 10 stocks impacting the VN-Index on July 1, 2024 |

The HNX-Index followed a similar trajectory, with positive influences coming from DTK (-5.76%), MBS (-2.25%), SHS (-1.79%), and PVI (-1.77%)…

|

Source: VietstockFinance

|

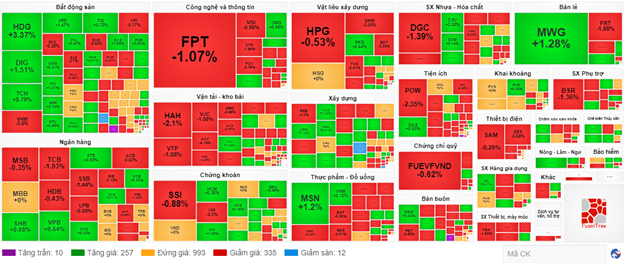

The consulting and support services sector was the top-performing group, surging 4.88%, mainly driven by TV2 (+6.56%), KPF (+1.32%), and TV3 (+0.79%). This was followed by the retail and household goods manufacturing sectors, which rose 3.34% and 1.45%, respectively.

On the flip side, the information and technology sector witnessed the sharpest decline in the market, falling by 0.98%. This was primarily due to losses in FPT (-1.46%), SGT (-3.39%), GLT (-6.6%), and ICT (-6.75%).

In terms of foreign trading activities, foreign investors continued to offload a net amount of over VND 827 billion on the HOSE exchange, focusing on stocks like FPT (VND 249.4 billion), TCB (VND 91.64 billion), DGC (VND 80.81 billion), and VHM (VND 68.47 billion). On the HNX exchange, foreign investors net bought over VND 9 billion, mainly in IDC (VND 10.94 billion), VGS (VND 4.81 billion), and TNG (VND 3.77 billion).

| Foreign Trading Activities |

Morning Session: Caution Prevails

At the end of the morning session, the VN-Index fell 3.82 points, temporarily settling at 1,241.5 points, while the HNX-Index dropped 1.01 points to 236.57 points. The market breadth inclined towards decliners, with 412 stocks falling and 246 stocks rising. The red zone also dominated the VN30 basket, with 16 stocks declining and 14 advancing.

According to the General Statistics Office, Vietnam’s gross domestic product (GDP) in the second quarter of 2024 grew positively, estimated at 6.93% year-on-year. This growth rate was slightly lower than the 7.99% recorded in the second quarter of 2022 during the 2020-2024 period. The agriculture, forestry, and fishery sector grew by 3.3%, contributing 5.4% to the overall economy’s added value; the industry and construction sector expanded by 8.3%, contributing 45.7%; and the service sector grew by 7.1%, contributing 48.9%.

However, the sectors did not show significant improvements, and liquidity remained very low by the end of the morning session. This was partly due to the previous session’s sharp decline, which made investors cautious.

The market’s liquidity was low, and foreign investors net sold nearly VND 492 billion, causing the main indices to turn red. The trading volume of the VN-Index reached only 186 million units, with a value of just under VND 5 trillion. The HNX-Index recorded a trading volume of only 22 million units, equivalent to VND 361 billion. If the market continues to be lackluster in the afternoon session, the trading volume is likely to remain below the 20-session average.

The sector performance in the morning session did not see significant changes, with most sectors trading sideways. Notably, the consulting and support services sector maintained its momentum even as the overall market traded weakly. Specifically, TV2 and TV3 rose well, gaining 3.78% and 1.57%, respectively, but TV3 achieved good liquidity in the morning session, while TV2‘s liquidity remained below the 20-session average.

The insurance sector also traded positively, with a broad-based gain. In particular, PTI surged 4.7%, and PRE rose 1.06%. Meanwhile, stocks like BVH, PVI, and BMI temporarily held on to slight gains in the morning session.

The remaining sectors, including seafood processing, banking, securities, household goods manufacturing, and utilities, traded weakly and experienced strong differentiation.

10:40 AM: Still Under Selling Pressure

Sellers continued to dominate the market, causing the main indices to fluctuate and extend their previous losses. As of 10:30 AM, the VN-Index fell 0.96 points, hovering around 1,244 points, while the HNX-Index dropped 0.29 points to trade around 237 points.

Although the June 2024 PMI data, which was recently released, showed a significant improvement, rising to nearly 55 points, the VN30 basket’s breadth remained tilted towards decliners. Stocks like FPT, TCB, and ACB were still under intense selling pressure, respectively taking away 1.35 points, 1.17 points, and 0.55 points from the VN30-Index. Conversely, MWG, MSN, and VPB recovered, collectively contributing over 2.4 points to the overall gain.

Source: VietstockFinance

|

The information and technology sector led the decline, falling by 0.97%, and exhibited strong differentiation with selling pressure prevailing. Specifically, the losses were concentrated in stocks such as FPT (-1.46%), CTR (-2.2%), SGT (-3.73%), and ICT (-6.43%)… Most of the remaining stocks remained unchanged, except for CMG (+0.66%) and ITD (+4.6%), which maintained positive buying pressure.

The electrical equipment sector also declined sharply, with selling pressure focused on industry leaders such as GEX (-0.68%), CAV (-0.72%), RAL (-0.6%), and SAM (-0.14%).

On a positive note, the retail sector rose by a healthy 1.04% as the news of the VAT reduction to 8% from July 1 to December 31, 2024, came into effect. However, this group also experienced strong differentiation, with mixed performances among the industry leaders. Specifically, MWG (+2.88%), PNJ (-0.84%), and FRT (-0.96%) displayed contrasting trends.

Conversely, the consulting and support services sector performed well and led the market’s support, rising by 2.15%. TV2 (+3%), TV3 (+0.79%), and KPF (+0.33%) were the main contributors to the sector’s gain. Meanwhile, TV4 (-1.4%) remained under selling pressure.

Compared to the opening, the number of unchanged stocks remained high, but sellers continued to dominate, with 335 declining stocks and 257 advancing stocks.

Source: VietstockFinance

|

Opening: Fluctuating from the Start

The VN-Index opened slightly higher before reversing course and falling more than 2 points to 1,243 points. There were 13 stocks that hit the ceiling price, 203 rising stocks, 1,159 unchanged stocks, 226 falling stocks, and 7 stocks hitting the floor price.

Recent data showed that Vietnam’s manufacturing Purchasing Managers’ Index (PMI) by S&P Global rose sharply to 54.7 in June, compared to 50.3 in May. This not only indicated a third consecutive month of improvement in the manufacturing sector’s health but also signalled a significant strengthening of business conditions.

The improvement in business conditions was largely reflected in the growth of both output and new orders in the middle of the year. Notably, the number of new orders increased to a level just below the record high recorded in March 2011, the first month of data collection for the survey.

Large-cap stocks such as MSN, BID, and VPB led the index’s gainers, contributing nearly 1 point to the rise. Conversely, stocks like FPT, GVR, and TCB dragged the market lower, collectively taking away nearly 1.5 points from the index.

Additionally, the seafood processing sector continued its stable growth trajectory in the market, with most stocks maintaining their upward momentum. Notable gainers in the sector included ASM, which rose nearly 1%, VHC (+0.86%), IDI (+1.33%), FMC (+0.61%), CMX (+0.48%), and ACL (+1.96%).

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Accelerating disbursement of the 120 trillion VND credit package for social housing

Deputy Prime Minister Trần Hồng Hà has recently issued directives regarding the implementation of the 120,000 billion VND credit package for investors and buyers of social housing, workers’ housing, and projects for the renovation and construction of apartment buildings.