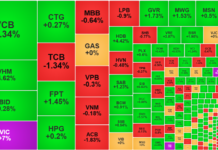

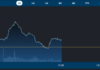

VN-Index surprised the market with a full week of gains in the first five sessions of 2024, with a 3.03% increase (+37.73 points) being the best performance in 17 weeks. Surprisingly, the average matching order value on the HoSE floor was less than VND 13,200 billion/day, the lowest level since the last week of 2023.

Last week’s upward trend coincided with a series of quite positive June and first-half 2024 macroeconomic data (released on Saturday, June 29). According to experts, there were many optimistic signals in this information flow, such as unexpectedly high GDP growth, production and import-export indices… Therefore, the market rise may have found a foothold, but the extremely low liquidity shows that there is also a lot of skepticism.

Experts also said that there are many reasons for investors to lack confidence. Technically, VN-Index may only recover in the short term to retest the old peak again before taking a few more adjustment steps. In terms of macroeconomics, unfavorable factors such as exchange rates or interest rates are still tense. Credit growth is weak, consumption is slow… In general, the fact that investors are not bold in pouring large amounts of money into the market means that they are being cautious and risk-averse.

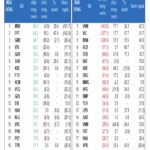

When assessing market opportunities, experts are also very cautious, although the scenario of a deeper decline after VN-Index broke the 1250-point threshold did not happen as expected last week. The impact of large-cap stocks such as VCB, CTG, FPT, and BID on the index is very clear, so opinions are also divided. Some argue that the role of these large-cap stocks is to create a confirmation signal, while others believe that they are affecting the pulling of pillars to sell some other stocks… Experts still only maintain a low to medium stock proportion.

Nguyen Hoang – VnEconomy

With positive macroeconomic data being announced, VN-Index increased quite strongly last week with five consecutive green sessions, but liquidity was extremely low, with an average of just over VND 14,000 billion in matching orders per session. It seems that this information is not enough to stimulate, investors are not enthusiastic about participating in transactions, or they do not trust this uptrend. What are your thoughts on this?

The rapid rebound after breaking through the 1,250-point threshold indicates that the market has just gone through a shake-off phase. With this signal, I believe that the bottom of the short two-week correction has been formed and expect the market to return to an uptrend in July.

Nguyen Thi My Lien

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

In terms of information, we are entering the second quarter’s business results, a sensitive time because if the business results are positive, the stock price will increase accordingly, and vice versa, so it is understandable that investors are cautious in their transactions. Technically, VN-Index is in wave B of the recovery phase, and this wave B is likely to last around one week, so investors should participate with a low proportion.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

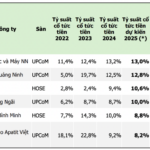

The macroeconomic statistics for the first six months of 2024 have brought more positive prospects for the Vietnamese economy, with second-quarter GDP growth reaching 6.93% YoY, significantly higher than the figure for the second quarter of 2023. The macro economy continues to be stable, inflation is under control, and all three sectors of Agriculture, Industry, and Services are growing well, indicating that expectations for a recovery trend are still progressing.

However, short-term risk factors are dominating the market, such as exchange rate pressure, which has not shown any signs of cooling down, or the fact that deposit interest rates are rising again, which is likely to make investors’ psychological state relatively cautious and not confident enough to reinvest.

Nguyen The Hoai – Director of Dong Nai Branch, Rong Viet Securities

The prediction of the second-quarter business results of enterprises is divided, causing the money flow into the market to be divided as well. This makes the market tend to go sideways without major fluctuations, but in my opinion, if investors can choose stocks with good business results whose prices have not increased or increased much, the efficiency gained will be great.

Nguyen Thi My Lien – Head of Analysis Department, Phu Hung Securities Joint Stock Company

Except for the massive sell-off on Monday, June 24, the market liquidity has remained relatively low in the following nine consecutive sessions, including adjustment sessions. This shows that investors in the stock market are quite cautious. Although the June macroeconomic data is very positive, especially the GDP growth figure and the PMI signal, which shows the prospect of the Vietnamese economy, there are still concerns about exchange rates, weak credit growth, and unmet consumption expectations,… which may affect second-quarter profits.

In addition, deposit interest rates have continuously increased recently, which also indirectly affects the stock market by possibly reducing its attractiveness. In my opinion, the market is likely to accumulate and then enter a new uptrend when the picture of enterprises’ second-quarter business results is revealed and the macroeconomic context in the world market becomes clearer.

Money Flow Trend: Breaking the 1250-point Threshold, Where Will VN-Index Bottom Out?

Overview of the Vietnamese Economy in the Second Quarter of 2024

Le Duc Khanh – Director of Analysis, VPS Securities

The market’s recovery in 5/5 sessions last week took place immediately after the previous adjustment week, along with low liquidity, reflecting the trading psychology of investors in general. VN-Index did not break through the 1,290 – 1,300-point zone but instead adjusted strongly, so the scenario of moving within the range in the first 2 weeks of July will also make investors more cautious in their transactions.

In my opinion, investors’ psychology is still optimistic about the economic prospects but has not been peaceful after the deep adjustment week. The macroeconomic data has somewhat reassured investors’ psychology in the context of net foreign selling, conflicting views on market prospects, and information that has been and is being reflected in the general situation. Investors should still have faith and the ability to return to the old peak zone of 1,290 – 1,300 in July.

Nguyen Hoang – VnEconomy

Last week, you expected VN-Index to adjust more deeply after falling below the 1250-point threshold, but at the beginning of this week, the index successfully recovered above this level. So, was the drop below 1250 points just a “bear-trap”? With the increase last week, has the adjustment phase ended, or will it continue to the milestones you expected last week?

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

In my opinion, there are not enough signals to affirm that last week’s increase was a bear-trap. The 1,250-point threshold is just a short-term support zone, and below it are other important support levels such as 124x and around the medium-term support threshold of 1,210 points. Therefore, VNIndex has not shown any signs of a strong downward trend to form a bear-trap, as the hard support points have not been broken.

However, the subsequent recovery momentum is also not enough to consolidate a positive uptrend, and it is likely that the reaction comes from the new positive macroeconomic data. In the base case scenario, I believe that the index will start to climb with a gentler slope when approaching the resistance areas around 129x again and will fluctuate relatively sideways while short-term risk factors such as exchange rate pressure remain unresolved.

Nguyen Thi My Lien – Head of Analysis Department, Phu Hung Securities Joint Stock Company

The market last week traded positively again with five consecutive gaining sessions, regaining all the points lost in the previous week. The rapid rebound after breaking through the 1,250-point threshold indicates that the market has just gone through a shake-off phase. With this signal, I believe that the bottom of the short two-week correction has been formed and expect the market to return to an uptrend in July.

Le Duc Khanh – Director of Analysis, VPS Securities

There are two important resistance thresholds, 1,285 – 1,290 points and 1,300 points (+/- 5 points), even though the range is not large, but this is the area where up and down sessions often occur, creating an accumulation base. I think VN-Index will fluctuate around the 1,280 – 1,290-point zone for a few sessions.

In my opinion, investors’ psychology is still optimistic about the economic prospects but has not been peaceful after the deep adjustment week. The macroeconomic data has somewhat reassured investors’ psychology in the context of…

Le Duc Khanh

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

My view last week was, “Currently, there are two thresholds that I expect the market to stop falling and bounce back in wave B, which are the areas around 1,236 +/- 5 points and 1,220 +/- 5 points.” The lowest level of this adjustment phase was 1,240.07, which is within the range I predicted. From a technical perspective, I believe that this recovery wave is likely to stop here, and the market will enter adjustment wave C. With this adjustment wave, the thresholds I expect are the areas around 1,220 and 1,180 points.

Nguyen The Hoai – Director of Dong Nai Branch, Rong Viet Securities

When the market broke through the 1,300-point threshold with low liquidity, it adjusted accordingly. And when the market lost the 1,250-point threshold with low liquidity, it rebounded. Given the current context, I tend to believe that the market will not have major fluctuations, accumulate, and stock groups will be divided according to second-quarter business results.

Nguyen Hoang – VnEconomy

The recovery momentum last week was significantly contributed by large-cap stocks such as BID, VCB, FPT, and CTG, which accounted for up to 15/38 of VN-Index’s increase last week. The emergence of large-cap stocks as leaders is a positive signal. However, the VN30 basket also had very poor liquidity. Was this just a pure pillar-pulling phase to take profits?

Nguyen Thi My Lien – Head of Analysis Department, Phu Hung Securities Joint Stock Company

Last week could be said to be a week of gains amid doubts as the liquidity of the whole market was quite low, not only for the VN30 group but also for the Midcap group, although the VN30 group had a better upward momentum and was the locomotive pulling the market up.

From the perspective that the market has bottomed out, I do not think this is a pure pillar-pulling phase to take profits, but the task of this group is to create a confirmation signal to stabilize the market psychology first, and then it is expected to gradually spread to the Midcap group after the pillars take a rest.

The low liquidity but good index increase shows that the supply has been absorbed in the previous sharp decline sessions, so the supply to hinder the price increase is not much. This is a good signal to support the market in the next phase.

From a technical perspective, I believe that this recovery wave is likely to stop here, and the market will enter adjustment wave C. With this adjustment wave, the thresholds I expect are the areas around 1,220 and 1,180 points.

Nguyen Viet Quang

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

The recovery momentum this week was greatly contributed by the trio of banks BID, VCB, and CTG. If we observe, we will see that the common point of these three stocks is that they adjusted earlier than the market and had a sharp decline to near the strong support zone. It is easiest to pull these stocks up because short-term investors are very few. I think this may be a pillar-pulling phase to keep the psychology positive while selling many other stocks.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

These pillar stocks have had earlier adjustments compared to VN-Index, about 10-15% from the peak this year, so they will bottom out and recover earlier than most of the market. However, it is also necessary to observe the ability to attract buying power to spread to all other stock groups because the impact on the index mainly comes from large-cap stocks. A healthy uptrend should be reinforced by spreading money flow and continuous rotation, instead of just focusing on a few stocks.

Nguyen The Hoai – Director of Dong Nai Branch, Rong Viet Securities

In my opinion, there is profit-taking in some stocks that have increased sharply, but at the same time, there is money flowing into stocks with attractive prices that are expected to have good second-quarter business results. Money is flowing.

Le Duc Khanh – Director of Analysis, VPS Securities

I think that part of the reason for the strong performance of some stocks, the slight increase and decrease of some stocks, and the adjustment of some stocks even when the market continuously increased can be explained by the fact that money is flowing quickly, focusing on a few stocks, and the accumulation of stock prices on a large scale. Some stocks have impressive price increases, and the market is still waiting for a phase of breakthrough to a new peak.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.