**HO CHI MINH CITY’S POSITIVE LABOR MARKET TRENDS AND EMPLOYMENT OPPORTUNITIES**

During the first half of 2024, the city licensed 23,610 new businesses, providing employment to 69,764 workers.

Of these, 23,160 were state-owned and non-state enterprises, accounting for 98.09% (with 66,113 workers employed in these businesses); and 450 were foreign-invested enterprises (FDI), accounting for 1.91% (with 3,651 workers employed).

POSITIVE LABOR MARKET TRENDS

According to the Ho Chi Minh City Forecast and Labor Market Information Center (FALMI), the city’s labor market is showing positive development trends, in line with economic growth and development needs. Enterprises are focusing on training and skill development for their workforce, and improvements in income and benefits are helping to attract and retain employees.

There is an increasing demand for jobs in the fields of commerce, administration, office work, translation and interpretation, accounting and auditing, marketing, human resources, management, information technology, architecture, and construction, among others. Employers are seeking candidates with high qualifications and relevant work experience.

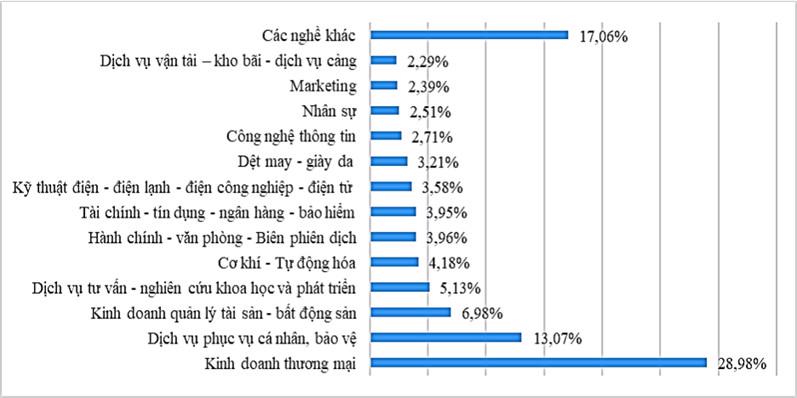

FALMI’s report indicates that several economic sectors had high recruitment needs during the first half of the year, including: Commerce and trade, with approximately 45,963 job openings, accounting for 28.98% of the total labor demand; Personal services and protection, with 20,729 job openings, or 13.07% of the total demand; Real estate and asset management, requiring 11,070 jobs, or 6.98% of the total demand; Consulting, research, and development services, with 8,136 job openings, or 5.13% of the total demand; Mechanics and Automation, with 6,629 jobs, or 4.18%; Administration, office work, and translation/interpretation, needing 6,281 jobs, or 3.96% of the total demand; and Finance, credit, banking, and insurance, with 6,265 job openings, accounting for 3.95%.

Additionally, other industry sectors required 27,056 job openings, representing 17.06% of the total labor demand.

Regarding salary levels, FALMI’s data shows that positions in electronics, information technology engineering, mechanics, marketing director, human resources, and specialized medicine offer monthly salaries above 20 million VND. Jobs with salaries ranging from 15 to 20 million VND per month include programmers, multimedia communication specialists, event organizers, and warehouse managers.

Positions offering salaries between 10 and 15 million VND per month include real estate, marketing, accounting, and finance specialists. Jobs with salaries ranging from 5 to 10 million VND per month include sales staff, security personnel, data entry clerks, mechanical engineers, and industrial machinery operators.

Enterprises pay monthly salaries below 5 million VND to delivery staff, warehouse workers, sales assistants, room cleaners, waiters, cashiers, and receptionists.

However, FALMI’s survey also reveals that many enterprises face challenges in recruiting workers. Out of 654 surveyed enterprises, 154 (or nearly 24%) reported difficulties in finding suitable candidates, particularly in the sectors of wholesale and retail, processing and manufacturing, administrative activities, and support services.

According to Ms. Nguyen Hoang Hieu, Director of FALMI, the main reasons for recruitment challenges include a mismatch between the candidates’ field of study and the job requirements, lack of soft skills and practical application abilities, enterprises’ inability to meet salary expectations, and a shortage of candidates with both high expertise and fluent foreign language skills.

OVER 160,000 JOB OPENINGS

Based on the labor supply and demand survey for the first half of the year, FALMI estimates that Ho Chi Minh City will require approximately 153,500 to 161,500 jobs in the second half of 2024.

The labor demand in the latter half of the year is expected to focus on key industrial sectors and primary service industries. Specifically:

Labor demand in the commercial and service sectors: Approximately 102,676 to 108,027 job openings are expected, accounting for 66.89% of the total labor demand. The industrial and construction sectors will require around 50,701 to 53,343 jobs, or 33.03%, while the agricultural, forestry, and fisheries sectors will need about 123 to 129 jobs, or 0.08%.

Labor demand in key industrial sectors: An estimated 23,961 to 25,210 job openings, or 15.61% of the total demand. This includes 6.79% in the mechanical industry, 3.09% in electronics manufacturing, 3.73% in food and beverage processing, and 1.99% in chemicals, pharmaceuticals, rubber, and plastics.

Labor demand in primary service industries: Approximately 92,161 to 96,965 job openings, or 60.04% of the total demand. This includes 25.38% in wholesale and retail trade, repair of automobiles and motorcycles, 2.09% in transportation and warehousing, 3.84% in accommodation and catering services, 5.18% in information and communication, 5.33% in finance, banking, and insurance, 9.93% in real estate, 5.61% in professional, scientific, and technical activities, 1.85% in education and training, and 0.83% in healthcare and social assistance.

Labor demand for trained workers: An estimated 134,620 to 141,636 job openings, or 87.7% of the total labor demand, are expected to be for trained workers. This includes 19.54% for university graduates and higher, 23.16% for college graduates, 21.72% for intermediate vocational school graduates, and 23.28% for primary vocational school graduates. The demand for unskilled labor is estimated to be between 18,881 and 19,856 jobs, or 12.3% of the total labor demand.

For the second half of the year, FALMI recommends that enterprises develop training plans for three types of workers (management, indirect, and direct labor) tailored to specific industries and qualification levels, with short, medium, and long-term goals aligned with enterprise development objectives and labor market demands.

For job seekers, in addition to specialized knowledge, it is essential to develop job-specific skills and maintain a positive work attitude to ensure successful performance and future career growth.

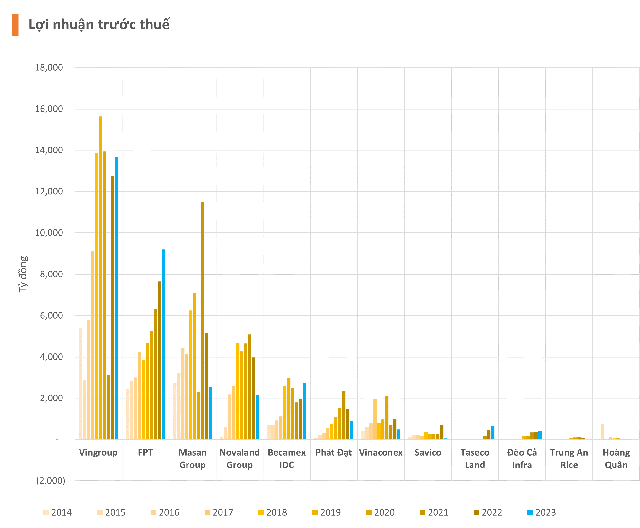

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.

LPBank Achieves 2023 Business Milestone with Lowest Non-Performing Loans in the Industry

In 2023, overcoming the challenges of the economy, LPBank has achieved its business objectives as entrusted by the Board of Shareholders. The credit growth has reached an impressive 16.83%, while the mobilization reached 13.7%. Aiming for extraordinary profitability, LPBank has earned over 7,000 billion VND. Moreover, LPBank has shown exceptional management by significantly reducing its non-performing loans to an impressive level of 1.34%, placing it among the top banks with the lowest non-performing loans in the industry.

SeABank records pre-tax profit of over 4,600 billion dong in 2023, with strong CASA growth

SeABank, a commercial bank in Vietnam, has recently announced its 2023 business results with impressive growth indicators. The non-term deposit-to-total deposit ratio (CASA) reached 11.5%, surpassing previous years. The outstanding loans and mobilized capital grew by 16.76% and 25.35% respectively compared to 2022. The non-performing loan ratio was controlled at 1.94%. The bank’s pre-tax profit reached over 4,616 billion VND.