Illustrative image

At the regular Government press conference for June, held yesterday afternoon (July 6), SBV Deputy Governor Pham Tien Dung announced that, as of July 5, banks had verified and cleaned up around 19 million accounts by cross-referencing them with the microchipped ID cards issued by the Ministry of Public Security. Of these, 10% were assisted in person at bank counters.

Mr. Dung also stated that currently, over 87% of Vietnamese adults have a bank account, totaling nearly 180 million accounts. On average, each Vietnamese citizen has three bank accounts.

Thus, the banks have verified and cleaned up more than 10% of bank accounts in accordance with Decision 2345/QD-NHNN issued by the State Bank of Vietnam.

Previously, on December 18, 2023, the SBV issued Decision No. 2345/QD-NHNN on deploying safety and security measures for online and card-based payment transactions (Decision 2345). According to Decision 2345, from July 1, 2024, electronic fund transfers by individuals exceeding VND 10 million or with a total daily transaction value exceeding VND 20 million must employ one of the biometric authentication methods.

The aim of issuing Decision 2345/QD-NHNN is to ensure that online banking transactions are performed by the account holders themselves, thereby protecting customers and reducing fraud. It also helps prevent the renting, borrowing, buying, and selling of payment accounts and e-wallets for illegal purposes, contributing to enhanced customer protection.

The Deputy Governor further explained that one of the primary objectives is to clean up accounts. The SBV is coordinating with the Ministry of Public Security to verify and clean up customer accounts, after which there will be no more account openings using fake documents.

Regarding Decision 2345, biometric authentication is only required for electronic fund transfers exceeding VND 10 million. This can be done by simply comparing the customer’s face with the one registered in the database of the Ministry of Public Security.

For transactions below VND 10 million or for essential goods and services payments, even up to VND 100 million (such as plane tickets, utilities, taxes, etc.), biometric authentication is not mandatory. In other words, for services where the bank has verified the recipient and integrated them into its app, the limit is VND 100 million, and biometric authentication is only required for transactions exceeding this amount.

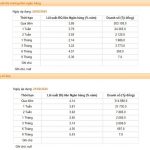

According to SBV statistics, in June 2024, transactions over VND 10 million accounted for about 8% of the total, with an average of 1.8 to 2 million such transactions per day.

As of yesterday, July 5, the peak transaction volume on the National Electronic Payment System was 26.3 million, the highest in the last ten days, of which 8.35% were transactions over VND 10 million.

This indicates that transactions over VND 10 million continue as usual after the implementation of biometric authentication. Only 8.2% of transactions required biometric authentication, while nearly 92% were performed as before, using OTP codes for verification, thus preventing system-wide congestion.

“Some cases of local congestion at certain banks on the first day of implementation have been resolved. Since July 2, transactions have been basically smooth,” said SBV Deputy Governor Pham Tien Dung.

In implementing Decision 2345, the SBV closely monitors the situation and coordinates with the National Population Database Center under the Ministry of Public Security’s C06 to guide and support units in the banking sector in addressing difficulties and obstacles. The SBV has also issued guidance for customers who do not have microchipped ID cards or NFC-enabled phones.

The Deputy Governor cited Vietcombank as an example: as of July 1, customers no longer need an NFC-enabled phone, as the bank has implemented app-to-app connectivity from VNeID to VCB’s app, allowing information to be transmitted directly.

For several days, credit institutions have been working overtime to assist customers. Statistics show that from July 3 to 5, the number of people visiting bank branches for biometric authentication has gradually decreased, and there is no longer any congestion.

“We will proceed with a roadmap, and the highest goal is to protect the legitimate rights and interests of customers,” affirmed the Deputy Governor.

Regarding information security, the Deputy Governor emphasized that the Law on Credit Institutions also stipulates the responsibility of banks in ensuring information security. In addition, there is the Law on Cybersecurity and Decree 13/2023/ND-CP on Personal Data Protection, which banks must comply with. The SBV has also issued many documents and circulars to ensure information security and the continuous and smooth operation of the system.

Banks required to disclose average loan interest rates publicly

Deputy Governor Dao Minh Tu has emphasized that although there are no regulations on disclosing the average lending interest rate, banks need to report on this to ensure fair, objective, and transparent competition.