“GenZ Finance” is an essential program designed to equip high school students with personal financial management skills and the ability to recognize and protect themselves against loan shark activities. It aims to empower students with effective financial management techniques and awareness of the risks and pitfalls of loan sharks and financial traps as they embark on their independent lives after graduation.

The program is proudly sponsored and supported by Dai Nam University, KeyPerson Company, and a host of partners and experts from financial institutions, banks, insurance companies, telecommunications providers, and more. It is a practical initiative that aligns with the “National Financial Strategy towards 2025, with a vision to 2030” launched by the Prime Minister on January 22, 2020. As such, it has garnered significant interest and support from teachers and school leaders in the northern region.

The third season of “GenZ Finance” achieved impressive milestones: It was implemented in nearly 40 high schools in the northern region through a combination of direct and online lectures, directly reaching and training over 25,000 high school students.

Associate Professor Dr. Dang Ngoc Duc, Head of the Faculty of Finance and Banking at Dai Nam University, shared: “GenZ Finance has become an annual activity of Dai Nam University. This program is crucial in helping high school students develop a proper understanding and early orientation towards personal financial management and the recognition and prevention of ‘loan shark’ activities. Therefore, both the Finance and Banking and Financial Technology majors in our Faculty include a personal finance course in their curriculum.”

Illustrative image

The organizers of “GenZ Finance” took great care in preparing the program’s content and supplementary activities to engage and motivate both students and teachers. They are proud to have provided an exciting and enlightening experience, offering updated and relevant knowledge in the field of finance and personal financial management capabilities.

In this third season of 2024, the program also yielded interesting survey results prior to its commencement:

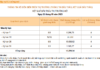

47.6% of the students received allowances from their parents daily, weekly, or monthly: This indicates that students are being exposed to small amounts of money at an early age, underscoring the importance of equipping them with financial management skills as soon as possible.

83.6% of the students knew how to save their own money: Most students demonstrated a sense of financial awareness by saving towards specific goals, such as purchasing items, small investments, or emergency funds. However, the majority were unfamiliar with popular financial management methods like the 50/30/20 rule or the 6-jar method…

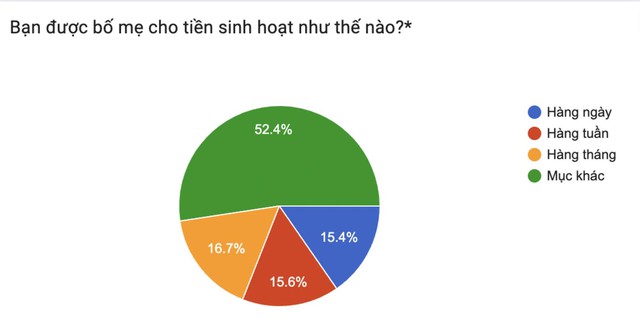

69.4% of the students had started earning money since high school: Peer pressure and the current entrepreneurial trend have prompted students to seek ways to make money early on. This highlights the need to equip them with skills to manage their personal finances and protect themselves from scams as early as possible.

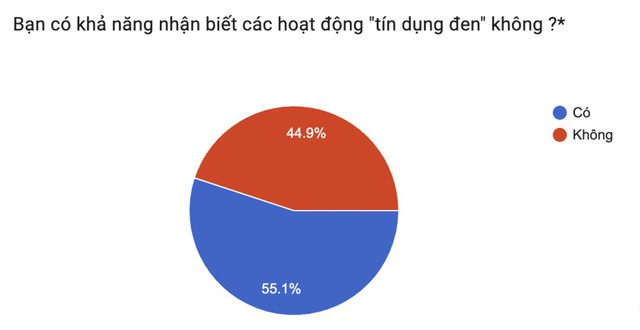

44.9% of the students were unable to recognize the signs of loan shark activities: Despite their limited financial means, students can still fall prey to scammers due to their naivety and lack of knowledge. Additionally, recognizing loan shark activities can enable them to warn their loved ones and families to stay vigilant.

The success of “GenZ Finance” would not have been possible without the invaluable contributions of our wonderful speakers, who shared their personal experiences and insights with the students in a relatable and easy-to-understand manner.

Speaker Nguyen Thi Mai Anh, a former employee of VPBANK and currently working at the FinTech Development and Innovation Center of DNU, remarked:

“Personal financial management skills are essential for controlling your spending. When you are no longer dependent on others for money, you can invest in the best and most suitable things for yourself, allowing you to satisfy your hobbies and needs at a higher standard of living.”

Speaker Nguyen Thi Mai Anh sharing her experiences

Trinh Anh Duc, a 12th-grade student at My Duc A High School, shared his thoughts: “Lately, I’ve been learning about finance, but I’ve never attended any financial seminars before. Before listening to today’s sharing session, I didn’t know how to spend money wisely. After attending this session, I found it very beneficial. It helped me gain control over my finances and spend more wisely. I feel quite intrigued by the field of finance now.”

Trinh Anh Duc, a 12th-grade student, shared his thoughts on the program

“I vividly remember the sharing of a high school principal in Bac Giang province, who said that at the age of 55, he had just learned about reasonable and useful financial management methods. He wished he had known about them earlier so that he could have managed his finances more effectively. Testimonies like this inspire us to continuously improve the program. For the upcoming fourth season of ‘GenZ Finance,’ we plan to start earlier, expand our reach, and collaborate with more quality experts and partners to spread this meaningful initiative.”

Cracking down on multiple black credit rings linked to bank employees offering high-interest loans

The Ho Chi Minh City Police have recently cracked down on several black credit gangs collaborating with bank employees, operating loan services with an interest rate of 180% per year, illegally profiting billions of Vietnamese dong.

Digitizing children’s traditional piggy banks with TPBank App for Kids

Just ahead of the Lunar New Year 2024, TPBank’s App introduces the Beloved Child Account, which helps parents and children receive and manage lucky money as well as learn financial planning and savings for the future. The Purple Bank has digitalized the beloved piggy bank of children on its digital banking app with super convenient features.

Bring the personal experience of home with Techcombank Mobile

With relentless efforts from Techcombank, Techcombank Mobile is steadily evolving to become a unique digital banking space, where users can freely express their individuality.

Remove bottlenecks in implementing audit recommendations

In recent years, the State Audit Office (SAO) has always been concerned with the monitoring, testing, and urging the implementation of audit conclusions and recommendations. However, despite the efforts of many ministries, sectors, localities, and units to implement audit conclusions and recommendations, there are still many that have not been implemented. In fact, many audit recommendations have been left hanging for years with billions of dong still outstanding, and there are many bottlenecks in mechanisms and policies that have not been resolved.