On June 27, VPI Invest, a leading investment company listed on the Ho Chi Minh Stock Exchange (HOSE) with the ticker symbol VPI, offered 1,500 bonds of the VPIH2426001 series to professional investors at a face value of 100 million VND each.

For this second bond issue, VPI offered an interest rate of 11% p.a. for the first two periods. Subsequent periods will have a floating rate based on the reference rate of four state-owned banks plus a margin of 4% p.a., but not less than 9.5% p.a. The principal will be repaid in a lump sum upon maturity, expected on June 27, 2026.

The bonds are non-convertible and do not come with warrants. They are secured by 8 million VPI shares owned by THG Holdings Investment Joint Stock Company, a major shareholder with a 23.44% stake. These shares are currently valued at approximately 492 billion VND, based on a market price of 61,500 VND per share.

The company’s management also approved the use of proceeds from the bond issue for investment contributions, specifically through a business cooperation contract with its subsidiary, Van Phu Bac Ai Joint Stock Company, in which VPI holds a 60% stake.

Regarding this subsidiary, the construction project for the road connecting Pham Van Dong Street to Go Dua Intersection on National Highway 1 in Thu Duc City is being carried out under a build-transfer (BT) contract between the Ho Chi Minh City People’s Committee and a consortium of investors. As per the contract, the People’s Committee is responsible for handing over several land plots to Van Phu Bac Ai as payment for the BT contract. VPI is currently working with the relevant state authorities to receive the transfer of these land plots. As of the end of 2023, the project is valued at over 2,000 billion VND, but a provision of 270 billion VND has been made.

VPI recently announced a record date of July 8, 2024, at 5:00 p.m. for bondholders to register centrally at the Vietnam Securities Depository (VSDC) and for trading registration at the Hanoi Stock Exchange (HNX).

Road connecting Pham Van Dong Street to Go Dua Intersection. Source: VPI

|

In other bond-related news, the Hanoi Stock Exchange approved the listing of VPI’s 650 billion VND bond issue (code VPI124001) in May. This bond issue was raised from the public and completed in January 2024. It is a non-convertible type, without warrants, and is secured by assets. The plan is to redeem the bonds within three years from the issuance date, with an interest rate of 11% p.a. for the first year, followed by a floating rate plus a margin of 4% p.a. but not less than 9.5% p.a.

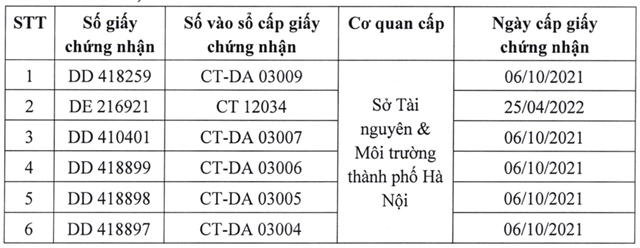

The assets securing this bond issue include real estate assets as per the land use right certificates, ownership of houses, and other assets attached to the land owned by Hung Son Investment and Trading Single Member Limited Liability Company. This company is the investor in the Vlasta Sam Son project in Thanh Hoa province, which was completed in 2022 on an area of over 26 hectares.

Additionally, the collateral includes the rights to assets and insurance benefits arising from partial and/or total insurance contracts related to the commercial services and office space of Hung Son. These assets are valued at approximately 487 billion VND, according to an appraisal report issued by the Finance and Post Insurance Valuation Joint Stock Company.

A portion of the collateral for the VPI124001 bond issue. Source: VPI

|

Furthermore, the collateral includes 16.5 million VPI shares owned by Mr. To Nhu Toan, Chairman of the Board of Directors of VPI, and his wife, Ms. Dao Thi Hong Hanh. These shares are currently valued at over 1,000 billion VND, based on a price of 61,500 VND per share.

The real estate company also obtained bondholders’ approval to adjust the use of proceeds, deciding to contribute the entire amount to Van Phu – Giang Vo Single Member Limited Liability Company. This subsidiary, wholly owned by VPI, is the investor in the mixed-use and residential project at 138B Giang Vo (branded as Grandeur Palace Giang Vo) in Hanoi, spanning over 9,000 square meters.

Previously, VPI intended to allocate a portion of the proceeds, amounting to 150 billion VND, to contribute additional capital to Van Phu Resort – Loc Binh Single Member Limited Liability Company (wholly owned by VPI). This company is the investor in the Loc Binh physical development and recreational sports tourism project in Thua Thien Hue province, spanning 248 hectares, which is currently in the process of obtaining investment legal procedures.

The two major holders of the VPI124001 bond issue are Vietnam Debt Fund SPC, owning 37.34%, and VPBank Securities Joint Stock Company, holding 29.87%.

In 2024, VPI is expected to issue 29.6 million shares, equivalent to 9.26% of the total shares in circulation, to convert 690,000 bonds of the VPIH2124003 series, which will mature in November this year. The expected post-issuance charter capital is 3.2 trillion VND. The recipient of these shares is VIAC (No.1) Limited Partnership. The previously announced conversion price was approximately 35,000 VND per share, which is half of VPI’s current market price. The agreement allows the bonds to earn a cumulative interest rate of only 5% p.a. when repurchased.

Currently, VPI has another bond issue of 243 billion VND (code VPIB2225001) in circulation, which was privately placed in April 2022 with a coupon rate of 10.5% p.a. The maturity date is less than a year away, and the company has recently repurchased 2.5 billion VND worth of these bonds.

Vlasta Sam Son Project Rendering. Source: VPI

|

Tu Kinh

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.