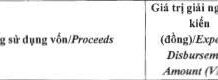

Technical Signals for the VN-Index

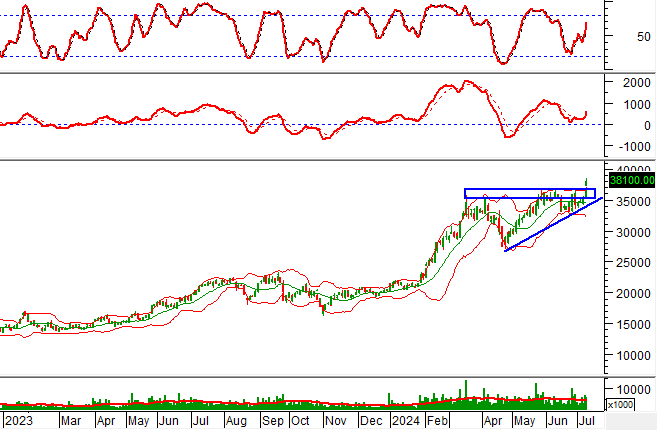

During the trading session on the morning of July 9, 2024, the VN-Index gained points, with a significant increase in trading volume. This indicates a positive sentiment among investors.

At present, the VN-Index is moving sideways after breaking above the Middle Bollinger Band. The MACD indicator continues to rise, having previously given a buy signal, suggesting that the short-term optimistic outlook remains intact.

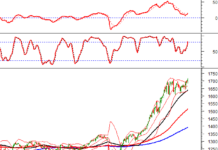

Technical Signals for the HNX-Index

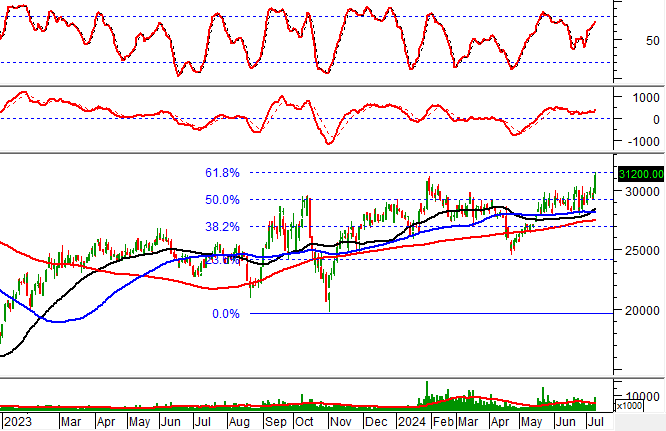

On July 9, 2024, the HNX-Index rose, along with improved trading volume in the morning session, indicating the optimism of investors.

In addition, the HNX-Index is being well supported by the SMA 50-day and SMA 100-day moving averages. The MACD indicator has given a buy signal again, suggesting that the medium-term upward trend of the stock is still being maintained.

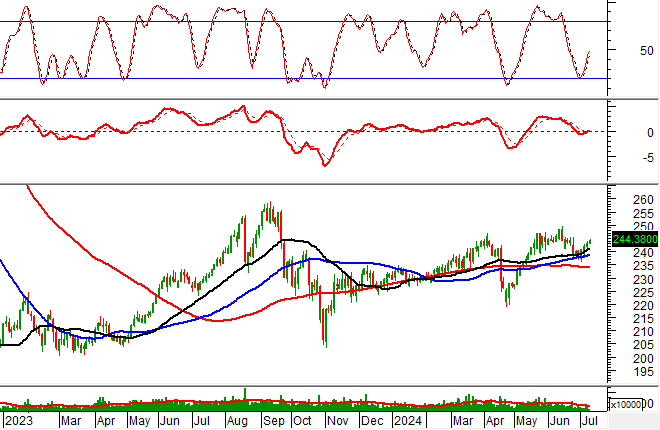

GVR – Vietnam Rubber Group – JSC

On the morning of July 9, 2024, GVR witnessed a strong surge in price, forming a Rising Window candlestick pattern, while liquidity significantly increased in the morning session, surpassing the 20-session average. This indicates active trading among investors.

Furthermore, the stock price rebounded after successfully testing the Middle Bollinger Band. The Stochastic Oscillator indicator continues to rise, having previously given a buy signal, reinforcing the strength of the stock’s current upward trend.

Additionally, the stock price has broken through the upper edge (corresponding to the 35,000-36,8000 region) of the Ascending Triangle pattern. If the upward momentum is maintained, the potential price target that could be achieved in the coming time is the region of 43,800-44,200.

PC1 – PC1 Group JSC

On the morning of July 9, 2024, PC1 witnessed a sharp rise in price, forming a near-identical long-body candlestick pattern, along with improved trading volume in the morning session, surpassing the 20-session average. This indicates the optimism of investors.

Currently, the stock price has rebounded after successfully testing the Fibonacci Projection 50% threshold (corresponding to the 28,900-30,4000 region). The MACD indicator has given a buy signal again, suggesting that the short-term upward trend is likely to continue in the next sessions.

Technical Analysis Department, Vietstock Consulting

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.