Illustration.

Oil Falls as Storm Beryl Could Curtail US Demand

Oil prices fell by around 1% to a one-week low as Storm Beryl forced the shutdown of refineries and ports along the US Gulf Coast, while hopes for a potential ceasefire in Gaza could ease worries about disruptions to global oil supplies.

Brent crude futures dropped 79 cents, or 0.9%, to $85.75 a barrel, while US West Texas Intermediate (WTI) crude fell 83 cents, or 1.0%, to $82.33.

Storm Beryl battered Texas with strong winds and heavy rain as it moved inland, leading to refinery and port closures, the cancellation of hundreds of flights, and power outages affecting over 2.7 million homes and businesses.

In the Middle East, negotiations for a US-proposed ceasefire plan to end the nine-month-long war in Gaza are underway, mediated by Qatar and Egypt.

Elsewhere, investors are monitoring elections in the UK, France, and Iran this week and their potential impact on geopolitics and energy policies.

France’s left-wing parties expressed their desire to govern but acknowledged the challenges and time required for negotiations following Sunday’s elections, which hindered the far-right’s quest for power.

In the US, President Joe Biden reaffirmed his commitment to his reelection campaign as he seeks to prevent a potential uprising from Democratic Party members concerned about losing the White House and Congress in the November 5 US elections.

In Asia, crude oil imports declined in the first half of 2024 compared to the previous year, largely due to lower tourist arrivals in China, the world’s largest oil importer. In India, the world’s third-largest oil consumer, fuel consumption rose 2.6% year-on-year to 19.99 million tons in June. Germany’s exports fell more than expected in May due to weak demand from China, the US, and other European countries. Kazakhstan’s Energy Ministry announced it would make up for its excess oil production above the OPEC+ quota in the first half of the year by September 2025.

The Organization of the Petroleum Exporting Countries (OPEC), along with its allies, a group known as OPEC+, extended most of the oil output cuts into 2025. These cuts have led analysts to forecast a supply deficit in the third quarter as transportation and air conditioning needs during the summer deplete fuel inventories.

Gold Falls Over 1% as Risk Appetite Improves

Gold prices fell over 1%, vulnerable to a risk-on sentiment in equities and profit-taking by investors after surging in the previous session on expectations that the US Federal Reserve might cut interest rates as early as September.

Spot gold dropped 1.4% to $2,357.88 per ounce by 1804 GMT, after earlier climbing to its highest since May 22, 2024. US gold futures settled down 1.4% at $2,363.50.

Last week’s data indicated a sluggish labor market, prompting the US central bank to consider an early start to interest rate cuts. The market now anticipates a 71% chance of a Fed rate cut in September and another reduction in December.

Spot silver fell 1.7% to $30.68 per ounce, platinum dropped 2.4% to $1,001.75, and palladium declined 1.5% to $1,010.87.

Copper Falls as USD Strengthens, Chinese Demand Remains Weak

Copper prices declined as a stronger US dollar signaled persistent weak demand from China.

Three-month copper on the London Metal Exchange (LME) fell 0.2% to $9,920 per ton by 1610 GMT, after touching a three-week high on Friday. LME copper has dropped about 11% since reaching a record peak of $11,104.50 in May.

COMEX copper futures for delivery in July fell 0.7% to $4.62 per pound.

Investors are hopeful that additional stimulus measures will be announced at China’s upcoming key political gathering from July 15 to 18.

The subdued demand in China has led to inventory buildup, with on-warrant stocks—those not earmarked for delivery and available for investors—hovering near a four-year high reached last month.

A Shanghai Metals Market survey showed an unexpected drop in the operating rates of cable and wire manufacturers last week.

The most-traded August copper contract on the Shanghai Futures Exchange fell 0.3% to 79,930 yuan ($10,995.25) per ton.

The US dollar slipped after Friday’s data showed a slight slowdown in US job growth in June, while the unemployment rate edged up, fueling bets that the Federal Reserve might start cutting interest rates as soon as September.

On the LME, aluminum rose 0.2% to $2,530 a ton, zinc fell 1.5% to $2,955.50, lead was unchanged at $2,236, nickel climbed 0.6% to $17,440, and tin gained 0.7% to $34,125.

Iron Ore Falls on Weak Demand, High Inventories

Iron ore futures declined due to weak demand and high inventories in China, weighing on steel prices.

The September iron ore contract on the Dalian Commodity Exchange (DCE) in China closed 3.3% lower at 825.50 yuan ($113.56) per ton. The August iron ore contract on the Singapore Exchange fell 1.8% to $108.40 per ton.

This drop comes after weekly gains, supported by dovish comments from the US Federal Reserve and investors’ hopes for additional measures to boost the Chinese economy during the upcoming key meeting from July 15 to 18.

However, the actual supply and demand situation has not improved, making it challenging to sustain the higher price levels touched last week. Buying interest from steel mills is currently weaker, and port inventories are increasing.

Inventories at major ports in China rose to 150 million tons last Friday, up 25% from the start of the year and 18% higher than the same period last year, according to data from Mysteel.

On the Shanghai Futures Exchange, steel contracts tended to fall. Steel rebar declined 2.3%, hot-rolled coil fell 1.9%, wire rod dropped 2.3%, while stainless steel remained stable.

Soybeans, Corn, Wheat Fall Ahead of Expected Positive US Crop Report

Chicago soybean and corn futures dropped to four-year lows as traders awaited a report on the progress of US crops from the US Department of Agriculture (USDA). Traders anticipated damage to crops due to recent extreme weather events, including hail, heavy rains, and flooding in parts of the Western Corn Belt.

July and September corn futures both fell below the psychological mark of $4 per bushel, while the most active soybean contract dropped to its lowest since November 2020. Wheat futures also turned lower on expectations that the recent dry, hot weather would allow for good harvesting progress in the US.

Chicago wheat futures fell 20 cents to $5.70-1/2 per bushel. Corn futures ended the session down 16-1/4 cents at $4.07-3/4 per bushel, and soybean futures dropped 30-1/4 cents to $10.99-1/2 per bushel.

Coffee Surges on Tight Supplies

ICE robusta and arabica coffee futures rose sharply due to tight supplies resulting from slow exports from Vietnam and weather-related issues, while cocoa futures ended lower.

September robusta coffee rose $163, or 3.9%, to $4,348 per ton.

Agents reported that the pace of exports from Vietnam remained slow, with supplies expected to remain tight until the next harvest picks up in November. The robusta harvest in Indonesia is gradually gaining momentum, with a significant improvement expected over the previous season.

September arabica coffee rose 2.4% to $2,344 per lb.

Favorable weather conditions continue to support coffee production, with below-average rainfall in both Vietnam and Brazil.

London cocoa futures for September fell £154, or 2.4%, to £6,394 per ton, in a quiet session following gains of over 3% in the previous session. New York cocoa futures for September fell 1.8% to $7,705 per ton.

Sugar Edges Lower

Raw sugar for October delivery was unchanged at 20.13 cents per lb, while white sugar for August fell 2.5% to $560.70 per ton.

Agents noted that rain is expected in some areas of Brazil’s Center-South in the coming days, which could ease concerns about cane conditions in those regions.

Brazil’s state-owned oil company, Petrobras, announced a 7% increase in gasoline prices. This decision could boost profits for domestic ethanol, reducing sugar’s price advantage.

Japanese Rubber Hits 8-Week Low on Stronger Yen

Japanese rubber futures fell to their lowest in nearly eight weeks due to a stronger yen and weaker rubber prices in top producer Thailand, dampening market sentiment.

The December rubber contract closed down 7 yen, or 2.16%, at 317.1 yen ($1.97) per kg. September rubber futures on the Shanghai Futures Exchange closed down 115 yuan, or 0.78%, at 14,610 yuan ($2,009.77) per ton. Thai RSS3 rubber dropped 2.39% to 70.75 baht ($1.94), while block rubber fell 2.81% to 63 baht on Monday.

The August rubber contract on the Singapore Exchange last traded at 162.1 US cents per kg, down 0.9%.

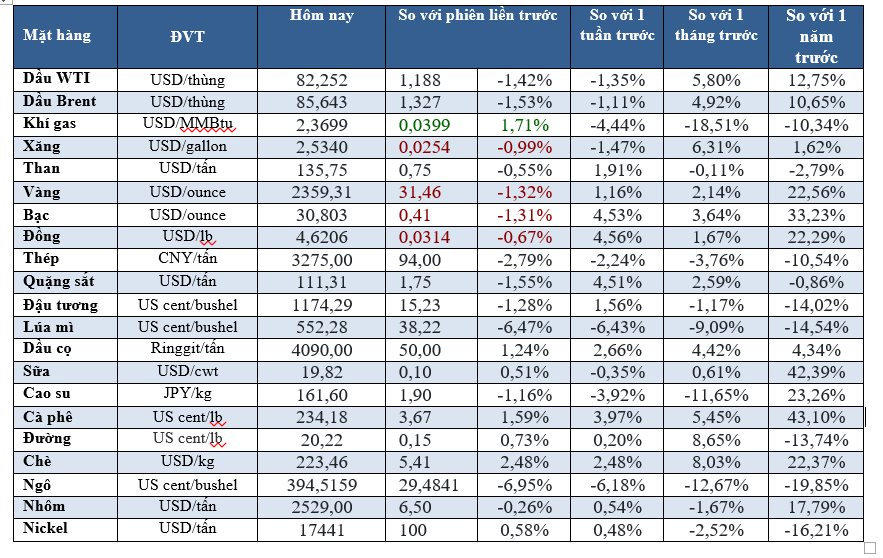

Prices of Key Commodities on July 09, 2024

Top Investment Channels for 2024: Safe and Profitable

2023 is a year full of volatility in the global financial market. Against this backdrop, many investors are interested in gold as a store of assets.

Market Update 02/07: Oil, Gold, Copper Rise while Iron Ore, Rubber Decline

Oil prices increased at the end of the trading session on June 2nd, with gold strengthening as the USD weakened. The currency experienced its first upward trend in 5 sessions, while iron ore and rubber declined.