The first trading session of the week was not easy for the VN-Index as large-cap stocks faced corrective pressure, causing the index to turn red. There was a moment when the benchmark dipped below the 1,280-point mark. The market witnessed a clear polarization, and the net selling pressure from foreign investors further challenged the market.

Foreign investors net sold nearly VND2.5 trillion.

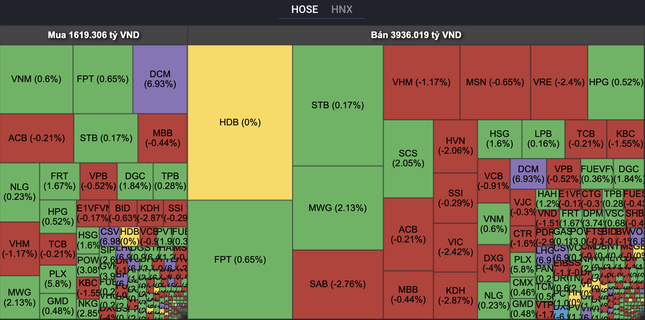

Today marks the 23rd consecutive session of strong foreign net selling across the market. The selling pressure was concentrated on several blue-chip stocks, including HDB, FPT, STB, ACV, and SAB. Among these, HDB witnessed a net sell-off of nearly VND500 billion. ACV, STB, and FPT also experienced net selling of over VND200 billion each. However, none of these four stocks declined in price. Domestic money flowed in to provide relatively strong support, with FPT gaining 0.65% and maintaining its position as the most liquid stock in the market with a trading value of VND815 billion.

The non-financial stocks, such as GVR, PLX, MWG, DCM, FPT, and POW, made the most positive contributions to the VN-Index. The energy sector witnessed a collective surge, with PLX, POW, BSR, PVD, PVS, and OIL all climbing higher.

Notably, fertilizer stocks raced to the ceiling prices, with DCM, BFC, PSW, and SFG hitting the upper limits. Many of these stocks belong to the Vietnam National Chemical Group (Vinachem), and this positive momentum comes amid the group’s recent announcement of impressive business results for the first six months of its subsidiaries, with significant increases compared to 2023 (DDV up 46 times, BFC up 5 times, and CSM doubling).

As a result, Vinachem’s estimated revenue for the first six months of the year reached VND29,595 billion, a 10% increase compared to the same period last year, fulfilling 52% of the annual plan. The group’s profit is estimated at VND815 billion.

On the flip side, the largest stocks, including VCB, VIC, SAB, VHM, and BID, weighed on the market. Despite their high capitalization and liquidity, the banking and real estate sectors not only failed to take on a leading role but also dragged the market down.

In the real estate sector, DXS plunged to the floor price after news broke of a complaint against Mr. Luong Tri Thin, Chairman of Dat Xanh Real Estate Service Joint Stock Company, and Mr. Do Van Manh, General Director of the company, alleging embezzlement of investors’ money related to the MNRCH2123001 bond lot.

In response to this information, Dat Xanh Group has sent a document to the Economic Police Department and the Economic Security Department of Ho Chi Minh City’s Public Security, requesting verification, investigation, and handling of the investor’s accusation regarding the purchase of Dat Xanh Service’s bonds – a subsidiary of Dat Xanh.

At the market close, the VN-Index rose 0.52 points (0.04%) to 1,283.56 points. The HNX-Index climbed 0.84 points (0.35%) to 243.15 points, while the UPCoM-Index gained 0.32 points (0.33%) to 98.58 points. Liquidity improved, with the matching value on HoSE reaching nearly VND17,300 billion. Foreign investors net sold nearly VND2.5 trillion.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.