The photo showcases Maxport Hai Hau, Nam Dinh – a prominent company with numerous green production solutions for sustainable growth.

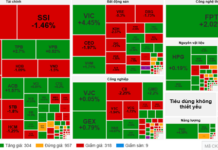

In the first half of 2024, textiles and garments ranked among Vietnam’s top export industries, generating 16.282 billion USD, a 3% increase from the previous year.

The Vietnamese textile and garment industry’s improvement can be attributed to successful inflation control in major markets like the US and Europe, boosting purchasing power. Brand inventories from 2023 decreased, and some textile and garment companies are now outsourcing production to smaller businesses through Vitas. Additionally, Vietnamese companies have proactively diversified their markets and customer base.

Mr. Cao Huu Hieu, CEO of the Vietnam Textile and Apparel Group, shared that most companies in the industry have secured production orders until the end of the third quarter of 2024 and are negotiating for the fourth quarter, the peak season for Christmas and New Year orders.

Mr. Hieu predicts an 8-10% increase in the industry’s export turnover in 2024 compared to 2023. He also foresees a more positive outlook for the market, especially in the fiber sector, with better-than-expected business results in the last six months of the year.

Mr. Vu Duc Giang acknowledges the recovery in textile and garment exports, with companies securing orders until the end of the third quarter and the end of 2024. However, producers also face new challenges due to changing customer requirements, such as smaller orders, lower quantities, shorter delivery times, and lower prices. Consumers are increasingly turning to e-commerce for their purchases, demanding a wider range of products.

Markets like the EU and the US have legally mandated and implemented synchronized requirements for green and sustainable production, encompassing raw materials, labor, equipment, energy, and transportation.

Consequently, the Vietnamese textile and garment industry is facing mounting pressure regarding its labor force. Currently, the sector is short of approximately 500,000 workers, particularly those with specialized skills, middle-level management, product design expertise, and more.

Triple your income in 3 days, businesses still struggle to hire security guards for Tet.

As Tet holiday approaches, the demand for recruitment in certain service-related industries continues to soar. Among them, the security service sector is facing a severe labor shortage at this time, even though the income could be three times higher than normal days…

Export Expectations for 2024 Look Promising with Positive Signals

The export turnover in 2024 is projected to be optimistic, based on positive factors of the global economy, increasing consumer demand, decreasing inventory levels, and the ability to leverage advantages from free trade agreements…