A bank records a profit of VND 5,919 billion in the first half of the year

A Quick Overview of the Banking Sector’s Profitability in H1

According to the business trend survey conducted by the Forecasting and Statistics Department of the State Bank of Vietnam, the overall performance and pre-tax profits of the banking system in Q2 showed significant improvement. However, the overall picture of the banking sector did not live up to expectations and lacked clarity.

The banking sector’s profits are forecasted to slow down, growing at 12% year-on-year. This is a decrease from the 14% growth recorded in Q1 2024 compared to the same period last year. The main reason for this slowdown is the continued pressure on net interest margins as lending rates decreased per the State Bank’s requirements, while deposit rates increased slightly across most banks. Analysts from MBS Securities assessed that the industry’s net interest margin (NIM) would remain under pressure as lending rates are expected to drop further, while deposit rates have already inched up across most banks.

The bright spot in the Q2 picture was the credit growth, which quadrupled compared to Q1, reaching an estimated 4.17% compared to 0.26% at the end of Q1 2024. However, it still fell short of the same period last year, so net interest income couldn’t increase significantly.

Meanwhile, SSI Securities assessed that the profitability of the banking sector in Q2 showed a clear divergence. While some banks achieved impressive growth rates of up to 60% year-on-year, others reported single-digit increases or even faced setbacks during this quarter.

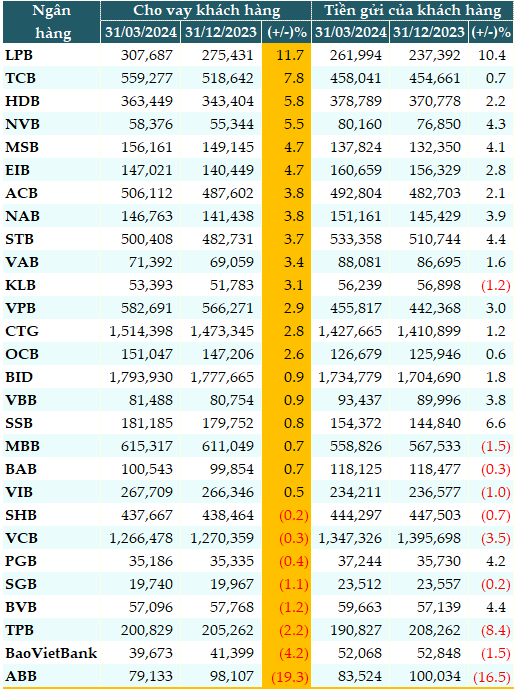

Overall, the after-tax profits of banks are not expected to grow significantly. Notable increases are forecasted for banks with strong credit growth, such as LPBank, VPBank, and HDBank. On the other hand, some banks are predicted to record negative profit growth due to high after-tax profits in the same period last year.

A Bright Spot in an Otherwise Gray Picture

Amidst the projections of stagnant or declining profits for many banks, analysts from MBS Securities commended LPBank’s impressive Q2 performance, attributing it to their remarkable growth. LPBank is the first bank to announce its financial results and, so far, the only bank to achieve a triple-digit growth rate in profits for this quarter.

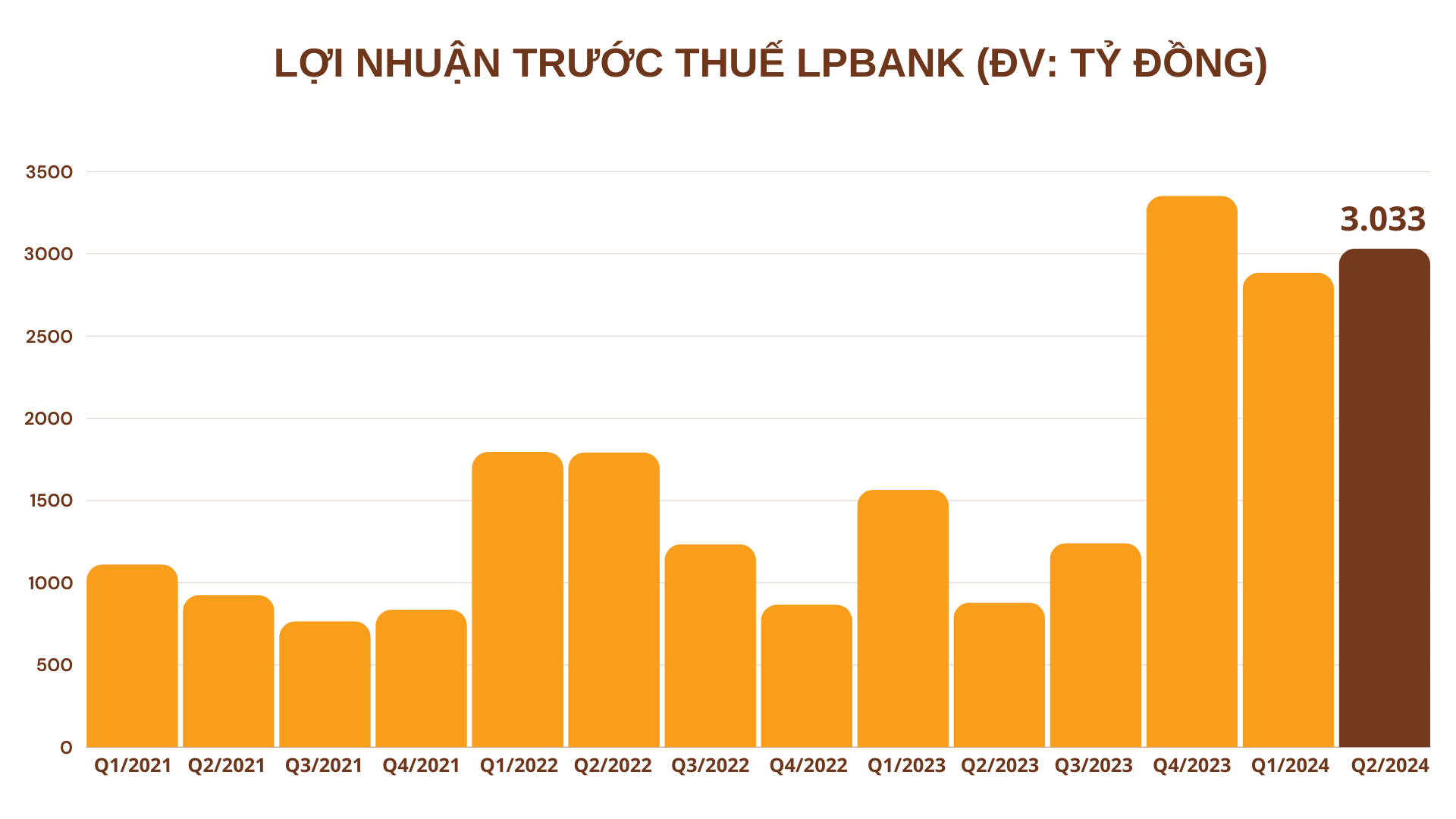

Specifically, LPBank reported a pre-tax profit of VND 5,919 billion for the first six months, reflecting a 142% year-on-year increase. In Q1 alone, the bank’s pre-tax profit exceeded VND 2,886 billion. With Q2 profits surpassing VND 3,033 billion, LPBank has achieved consecutive quarters of profit growth and nearly tripled its profits compared to the same period last year. MBS Securities recognized LPBank as one of the few banks that successfully overcame the challenges of the market in the first half of 2024.

Analysts attributed LPBank’s impressive performance to its aggressive credit growth strategy from the beginning of the year. Additionally, the bank focused on cross-selling various products and services, particularly in foreign exchange, remittances, and import-export businesses. Core income accounted for 77% of total operating income (TOI). Notably, LPBank’s efforts to diversify its revenue streams paid off, as the proportion of non-interest income increased significantly. Non-interest income contributed 22.63% to the total income structure, reaching VND 2,079 billion in the first six months.

Regarding capital mobilization, LPBank’s extensive network of over 1,200 transaction offices provided easy access to diverse customer segments with financial service needs. As a result, the bank successfully mobilized VND 336,978 billion in capital in the first six months. On the disbursement side, market 1 loans reached VND 317,417 billion, with a credit growth rate of 15.23% compared to the end of 2023.

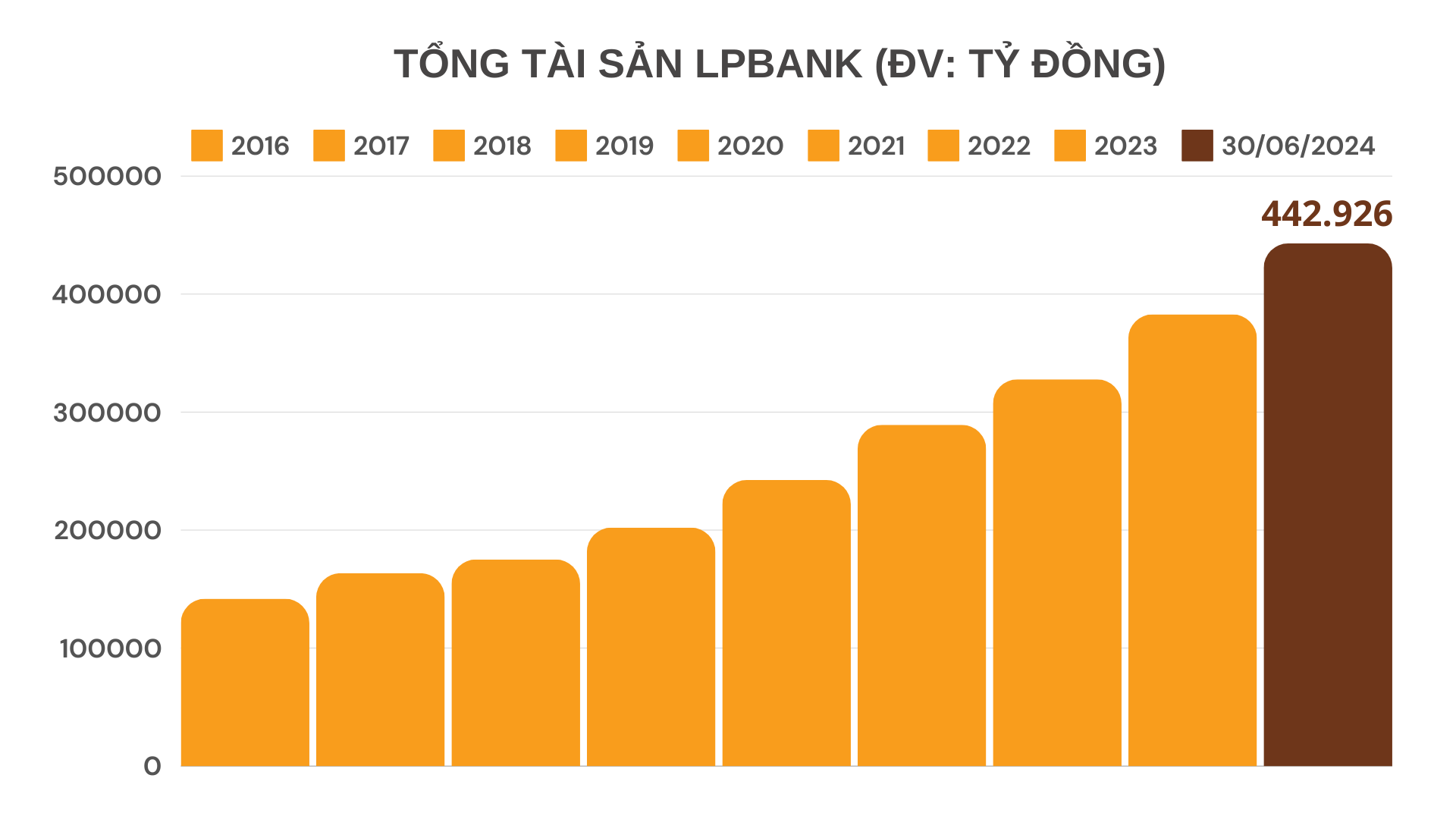

As of June 30, 2024, LPBank’s total assets amounted to VND 442,926 billion, representing a 16% expansion from the beginning of the year. The bank maintained a good growth rate in both credit and mobilization during this period.

In conclusion, the banking sector’s performance in the first half of the year exhibited some differentiation. Banks with robust business strategies, ample capital, and diverse fee income sources were better positioned to achieve growth and maintain healthy profits despite market pressures. Conversely, some banks will need to continue seeking restructuring solutions to overcome challenges, address non-performing loan issues, and navigate the narrowing profit margins.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.